Great news: we’ve invested in our second real estate property in Switzerland!

The second “big” piece of news, for us anyway, is that this time we’ve bought to sell on.

Suffice to say, that means plenty of new things for us, but only good things :D

New real estate investment project in Switzerland: buy to sell

Until now, we’ve only bought real estate as a rental property.

We look for a good property, we buy it, rent it, and voilà :) The rental income comes in, the property goes up in value, and life is good! In both France and Switzerland, we’re aiming for between 10-20% expected returns on equity with this type of real estate investment.

But this time, my network led me to another opportunity: buy to sell!

To be more specific: buy without a building permit (!), create a development project, obtain a building permit, put it up for sale with a turnkey general contractor contract, and exit the project with added value.

Not being in the real estate profession myself, I went into this project with a partner from the sector. It’s fascinating as I’m in “rookie” mode with everything to learn.

I love it!

How we set up our investors partnership

Previously, I had thought that if I were to partner with someone to invest in real estate, I would set up a Swiss limited company.

But that is for an investment for a limited period of 12 to 24 months maximum.

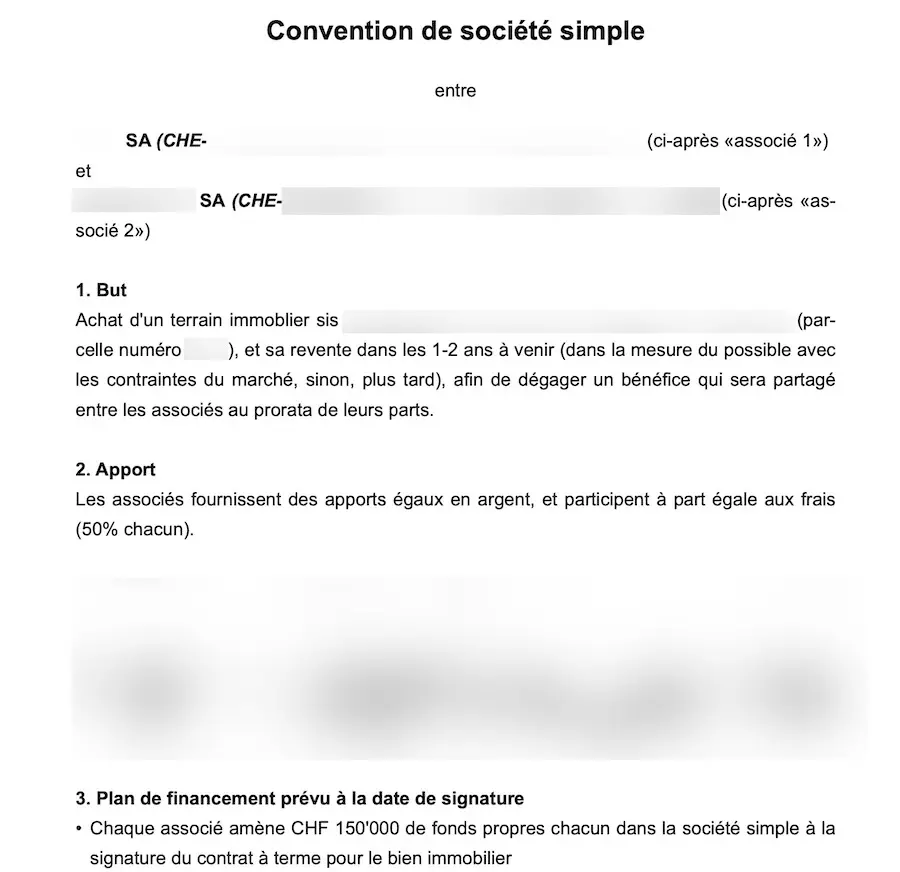

So we went for a simple solution: a simple partnership.

Simple partnership

Here’s a brief lesson in Swiss law:

A simple partnership in Switzerland is a form of contract between two or more people for the purpose of undertaking a joint economic activity without necessarily having to constitute a distinct legal entity. It is based on a verbal or written agreement between the partners, with no registration formalities on the company register. The partners are jointly responsible for the debts of the partnership.

For example: if you grow vegetables with a friend in a garden that you both own, and you sell these vegetables together on the local market, then you automatically form a simple partnership in the eyes of the law.

It’s the same principle for my partner and me. We decided to choose this format so then you don’t pay anything when you dissolve it.

To ensure that everything was in order between us, we signed what is called a simple partnership contract (also known as an agreement) where we set out everything we planned to do together related to our joint real estate project.

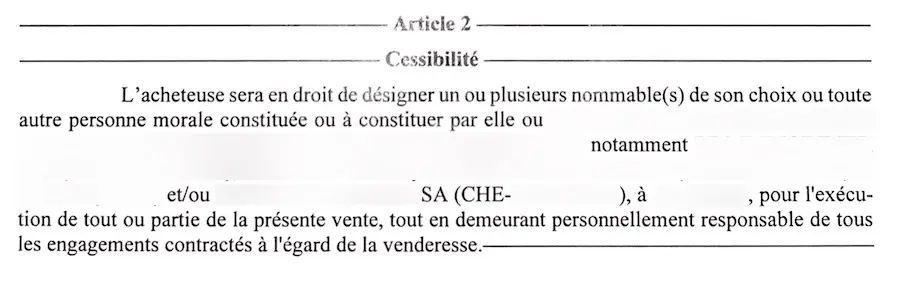

Listed as a named party

In parallel with the discussions about setting up our simple partnership, my partner had to sign the deal quickly so we didn’t lose out.

As I was unable to go to the notary with him on that day, he opted to put my limited company as a named party in the forward sale agreement.

He could actually have put me on the first page as 50-50%, but as we hadn’t signed the agreement, he didn’t want to take that risk (which I totally understand!)

Instead, he put my limited company as a named party. That means that on the day of the final sale, I will have an irrevocable right to purchase the real estate property with him. Without my limited company being specified in the named parties, we would have to pay additional notary fees to add me to the transaction, as it is already “in progress”.

I’m telling you all this as, even though it’s dedious, it’s still interesting to know how it all happens behind the scenes step by step ;)

The details of this second Swiss real estate project

I can’t tell you the exact location of the real estate project we decided to invest in, as the final sale will take place during the first half of this year (you can never be too careful!)

Nevertheless, I can tell you that the future buyers will have a view of Lake Geneva! 🤩

Here are the figures:

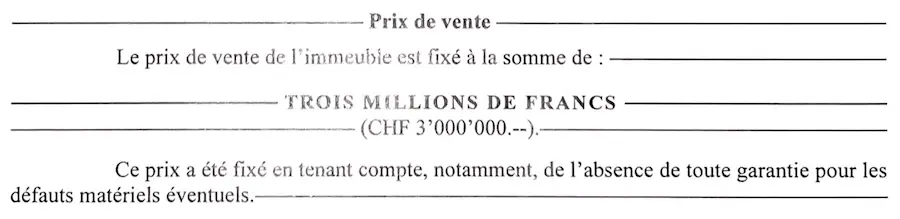

- Purchase price + notary + fees: CHF 3,200,000

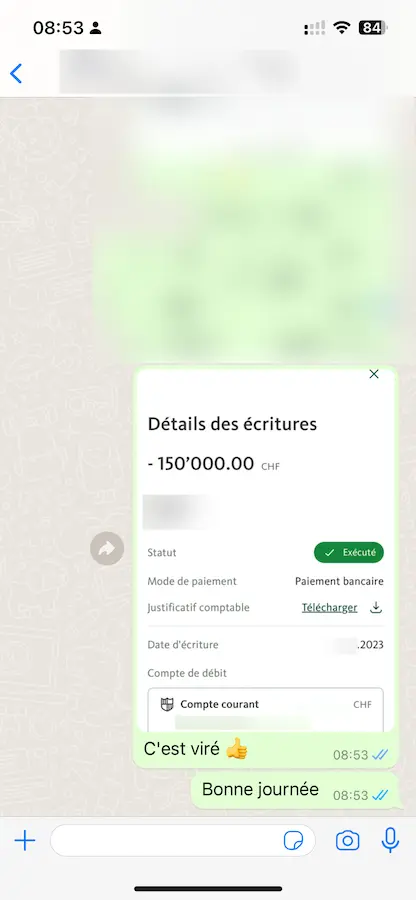

- Deposit for forward purchase agreement: CHF 300,000 (10% of the purchase price)

- CHF 150,000 from me, same for my partner

- Resale price: CHF 6,500,000

- Construction cost: CHF 2,410,000

- Optimistic margin: CHF 890,000 (so CHF 445,000 per partner)

- Pessimistic margin: CHF 700,000 (so CHF 350,000 per partner)

- We subtracted 20% from the optimistic margin to get the pessimistic margin

There is a minimal chance in terms of schedule (see below) that we’ll resell even before having signed the definitive sale agreement. This would mean that we don’t even need to take out a mortgage!

But let’s not get carried away… and so we’ll be conservative.

So we’re assuming that we’ll be taking out a mortgage to fund the purchase of the land:

- Purchase price: CHF 3,000,000

- Own funds: CHF 750,000

- 25% of the purchase price, as it is a real estate investment project, and not the 20% required for a main residence

- Notary fees and other expenses: CHF 200,000

- To be paid out of our own pockets: CHF 950,000 (so CHF 475,000 per partner)

Expected return for our real estate investment in Switzerland

We’re giving ourselves between 3 months and 1.5 years to have sold all the lots in the project.

To make my life easier when it comes to calculations, I’m going to start from the hypothesis that everything will be sold within 1 year.

With equity of CHF 475,000, I hope to obtain an annualized return of:

- Optimistic: 93.7% (= ((475,000 + 445,000)-475,000)/475,000 x 100)

- Conservative: 73.7% (= ((475,000 +3 50,000)-475,000)/475,000 x 100)

To curb the WOW effect, remember that maybe:

- We won’t get our real estate building permit on the first go, which will tie up our funds (a lot) longer than envisaged

- We won’t manage to sell straight away, and will have to lower our prices more than planned for in the conservative margin

- We’ll have a nasty surprise, due to some unknown new global crisis, where we have to pay higher work and/or construction materials costs, which will reduce the profit more than the 20% safety margin that we’d set

But, as a cautious optimist, I firmly believe in my second real estate investment in Switzerland. And I’m grateful to my partner for having me onboard, ready to weather whatever storm may come along, together.

“Have you won the lottery, MP with all this money!?”

Or the other reaction I can foresee: “Did you sell all your shares on the stock market or what?”

Well no, nothing like that!

So, as I was saying, indeed, you can’t just magic CHF 475,000 out of thin air.

Nope, in fact, I used leverage. This mechanism is as powerful as it can be “dangerous” when it comes to the impact it can have on your total assets.

Effectively, I could have sold all my shares on the stock market and invested in this real estate project with my own cash.

But instead of that, I borrowed part of the 475k through P2P (peer-to-peer) lending so that I hardly had to take out anything from my stock market investments.

This means that I keep the stock market gains (from dividends and share price increases), while benefiting from the added value on the real estate side.

Is the bank OK with giving me a mortgage based on funds that come from third parties?

The answer is: it doesn’t need to know. Legally, it does. But it is not false to say that the money you’re giving it from your own funds is yours, and the money you have in the stock market (from your P2P loans) is nothing to do with it.

I am only sharing my experience here, and you are responsible for your own actions, as usual :)

How to use leverage by taking (well) calculated risks

Just like with my Interactive Brokers margin account, I am very cautious with leverage. It can become addictive as it’s such easy money, and you can quickly get your fingers burnt.

It’s the same with real estate and P2P lending.

I therefore calculated all the liquid assets within my total assets, by which I mean those that I can access within a couple of days, such as:

- The money we have in (personal) reserve

- The cash reserves in the accounts of our different Swiss companies

- Our cryptocurrency “casino” account, which I divide by two (or even four or ten if I had more than CHF 10-50k ^^), as it’s so volatile

- All our stock market investments (personal and company accounts), which I divide by four to be very conservative (and because the amount is much larger than the cryptos) in case of a worldwide collapse (though we’d have other problems rather than repaying P2P loans if that actually happened)

And it’s therefore the amount equivalent to the sum of all these assets that I am OK with taking in P2P loans to use leverage to invest in real estate in Switzerland.

The guiding principle is: PRUDENCE!

The next stages of my Swiss real estate project

This is what we’ll need to do over the next few months, in order:

1. Submit plans for approval

We’ll follow the necessary steps and undertake surveys in order to submit our plans to the local authority for approval. Ideally, we’ll obtain our building permit just after the contract of sale is completed and signed at the notary’s.

2. Take out a mortgage

We’ll also need to take out a mortgage, as we’re not going to tie up several million Swiss francs ;)

For this, with our respective experience and extensive networks, I have no concerns about finding one easily and at a decent interest rate.

3. Sign the final contract at the notary’s

Then we’ll sign the final contract in order to officially become owners of the real estate property (expected during the first half of this year, 2024).

For info: we agreed with the vendor in the forward sale agreement that we could undertake our surveys in preparation for submitting plans for approval.

It’s important to state this, as my partner has already been prevented from doing this on another project. Basically, this clause wasn’t included, and the vendor stopped him from going onto his land to undertake surveys. My partner was therefore only able to start his preparations for submitting for approval once the final sale had been signed. Because of this, he lost several months “for nothing”.

4. Create the PPE

In any Swiss real estate project where you have several lots, it’s now common to set up a PPE (“ownership by floor”) before selling.

Basically, you don’t want to sell to 6 co-owners by telling them “I’ll leave you to sort out setting up a PPE and struggle to establish the policies for administration, use of the communal areas, exclusive rights of use etc. 🤪”

On the contrary, you want to lay the foundations, that way the future buyers will be purchasing something that is clear and specific for everyone.

and, just in case, I’m bragging with everything I’m telling you above, but I learned it only yesterday myself :D)

5. Put it up for sale / Real estate marketing

We’ll move onto this stage once we’ve got the building permit.

My partner usually uses the common platforms (homegate.ch, immoscout24.ch, immobilier.ch, etc.)

But we’ll see, as with our networks, maybe we’ll be able to sell it all just through word of mouth!

6. Negotiate and draw up the general contractor agreement

A general contractor is the sole point of contact for someone who is having something built. This contractor will manage the construction of the property from A-Z, and give the keys to the buyer once the job is finished. Normally, the general contractor guarantees an all-inclusive price so that we can confirm a fixed price to our buyers.

This stage will be done in parallel with the real estate marketing.

We will agree a construction contract with a general contractor. The aim is to finalize and lock in the quotes for the planned building work.

7. Complete the final sale with buyers

And lastly, we’ll sign the contracts at the notary’s, receive our money and then crack open the champagne :)

Overall, our main aim is to reduce the length of our involvement during each of the stages as much as possible to get back our initial investment quickly, as well as reap the additional profits (in order to reinvest them in another real estate investment in Switzerland!)

Conclusion

As you can imagine, I’m thrilled about investing in real estate in Switzerland, which is going to increase the value of our assets.

I’ll keep you up to date with the progress, either during the process, or once it’s completed with the final figures and returns, to compare them with my initial expectations. Or maybe both, depending on how it’s going ;)

Whatever happens, I can tell you that my strategy of developing a network of contacts in the real estate sector (described in my Swiss real estate program) has worked and continues to work.

It’s certainly not by googling invest real estate Switzerland that you’ll come across such opportunities… It’s clearly by persevering and being patient (and genuine and honest!!), but in the medium to long term, that it pays off.

To finish off, I’ve got three questions for you:

- What other information would you like to know about this real estate investment project in Switzerland?

- If you’ve already undertaken a similar project of purchasing real estate to sell on via marketing, I’d be interested to know more about your experience and learnings (either in the comments below or by email to me)

- How do you use leverage for your real estate investments (what safety margin)?

PS: some of you asked me why I don’t invest in real estate investment trusts or other real estate ETFs. The reasoning is simple: for anything ETF, I favor diversification to no lose time picking the right real estate funds. And for real estate assets as such, I favor direct investment as the Return On Investment is really worth the efforts.

PS2: as said above, I was at first solely focusing on rental property (that could include or not commercial real estate). But the more I dig into it, the more I become open to other types of real estate projects, such as this “buy to sell” model :)