Last updated: December 9, 2024

Saxo Bank 2024 referral code

Use the button below when signing up to Saxo Bank.

You'll get CHF 200 of broker fees refunded (and you'll contribute to supporting the blog at the same time, thank you!)

Since the start of the 2020s, we’ve been fortunate to have healthy competition between online brokers in Switzerland. This benefits investors in ETFs like you and me, as it means we get the best conditions in terms of fees.

It’s no longer the case that you only have a choice of solutions from the last century.

Swissquote and its high fees? Or your canton’s bank and its adviser, who tries to flog you its own investment products?

No thanks :)

Saxo Bank Switzerland overview

Here’s my brief opinion on the online broker Saxo Bank Switzerland Ltd., starting with its advantages:

What I like about Saxo’s services

- The lowest fees in the market if you’re looking for an online broker based in Switzerland. It’s THE cheapest online broker with offices in Switzerland (in Zürich).

- Open an account with CHF 0. I’m mentioning this because many other brokers require you to invest an initial amount of CHF 2'000 or similar. With Saxo Bank Schweiz AG, you can start investing in a single stock or ETF with only CHF 100.

- Offers US ETFs! It is the only (or one of the very few) brokers in Switzerland, and indeed in Europe, to have made the effort to translate the KIID for its customers. This effort makes it possible to provide access to all global ETFs (that are documented only in English or another language) to which Swiss brokers don’t usually give access due to regulation (of having to provide information in the language of the country where the broker operates).

What could Saxo improve in the future?

- Make their user interface more user-friendly, as even though it’s simple, it gives the impression of being complicated with lots of information provided at the same time. But as I often say, as you’re going to buy ETFs once a month or quarter, it’s not that big an issue. Especially as I’m going to show you how to do that (it’s a piece of cake).

MP recommendation

Looking back to when I got my first pay packet, AND assuming that I’d have known about investing at that time, I’d have loved Saxo Switzerland to have been around then.

I don’t think I’d have been prepared to choose an American broker due to a lack of knowledge (such as Interactive Brokers).

So I recommend you use them as a broker if you absolutely want a Swiss broker (and not European or American, which could be more attractive).

What actually is Saxo?

The Saxo Group is a Swiss online broker.

You’re new to the world of personal finance, and you’re wondering: “what’s a broker?”

In essence, an online broker is like a virtual supermarket for stocks and investments: you can buy and sell shares in companies and other financial products directly from your computer, without needing to go anywhere or talk to an intermediary.

All these virtual supermarkets sell their products at the same price. However, they have selling fees which they pass on to you in addition to the share price.

As a Mustachian, you want to choose THE supermarket with the lowest recurring fees possible. Since you’re going to be investing over several decades, it’ll soon start costing you a lot of money if you don’t pay attention to this.

And above all, what you don’t want is one of the big traditional banks (which can also act as a virtual supermarket for buying stocks) which take advantage of you with their huge fees in order to fund Porsches (via their end-of-year bonuses!) as well as football club sponsorship campaigns…

So the Saxo Group is one of these virtual supermarkets, based in Switzerland.

The objective of such a broker is to help you build up a nice pot of money with your investments, without seeing your returns get eaten away by exorbitant fees.

Generally, the next question that comes up is: what’s so special about the Saxo Group compared to competitor solutions?

Why is Saxo Bank THE best trading platform (based in Switzerland)?

This online broker is THE best in Switzerland for an investor who wants to invest in the stock market. Their streamlined fees enable you to keep the maximum return in your pocket. You can use their web app (via a standard navigator) and mobile app to buy your ETFs.

Mustachian criteria for selecting your Swiss online broker

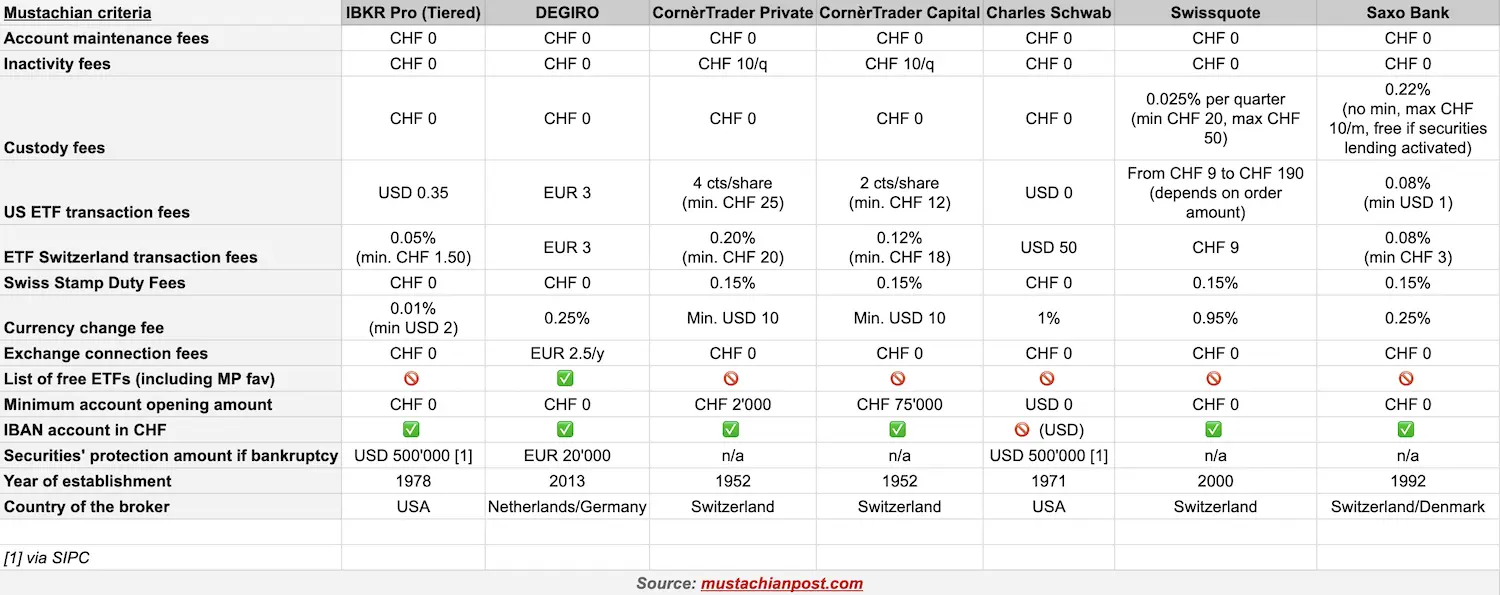

As a reminder, here are our Mustachian criteria for choosing our trading platform in Switzerland:

Criteria 1: the lowest trading platform fees

We want to avoid, at all costs, those online brokers who line their own pockets with exorbitant fees (I’ll add in brackets what we’re aiming for):

- Account management fees (CHF 0)

- Inactivity fees (CHF 0)

- Custodial fees (CHF 0)

- Transaction fees (< 1 CHF per transaction)

- Currency exchange fees (the lowest possible)

Especially given that some of these fees should no longer exist with digitalization…

On the contrary, we want an online broker who wants to be THE best in the market by making their money through the volume of clients that come to them as they’re so good.

You don't pay custody fees if you activate the Saxo securities lending feature.

Given that stockpickers tend to choose stocks like Tesla or Apple for their bets, your ETFs are unlikely to be lent out (see my personal experience).

BUT, if you don't like this idea, and still want to take advantage of Saxo's free custody fees, I recommend you use the following official trick: open a Saxo sub-account, buy a single Tesla or Apple or whatever share, then activate securities lending only on that sub-account, and BOOM! Your entire Saxo Bank account is exempt from custody fees (Saxo documents this tip officially in its FAQ here).

Criteria 2: solid governance and financial stability of the broker

You’re going to place your hard-earned savings with this online broker.

We’re talking about several thousands, even tens of thousands of Swiss francs.

Therefore, although there is a Swiss deposit guarantee that protects your assets up to CHF 100'000, you want your assets to have maximum protection instead of an unnecessary high risk of losing, so we’re looking for a trading platform backed by a reliable company of a certain size to reduce our risks as much as possible.

The Saxo Group has been around since 1992, and survived the “dotcom” bubble (and all the other financial crises up to now). They have been present on the Swiss market since 2008 and have held a Swiss banking license since 2013. Their equity ratio was 27.5% at the end of 2023, compared to the regulatory minimum of 10.5%. Their S&P Global Ratings credit rating in 2024 was “A-”. Finally, they have been classified as a Systemically Important Financial Institution (SIFI) since 2023, with 1.2 million private investors and institutional clients globally.

I’m reassured :)

Criteria 3: trading platform with an IBAN account held in CHF

Some brokers based in Europe only offer an IBAN in euros.

You may think to yourself that it doesn’t matter, as they’re “only” taking 1% or 1.5% in currency exchange fees.

But on CHF 1'000 or CHF 10'000, that equates to CHF 10 or CHF 100…

So we definitely want an online broker with an account held in CHF.

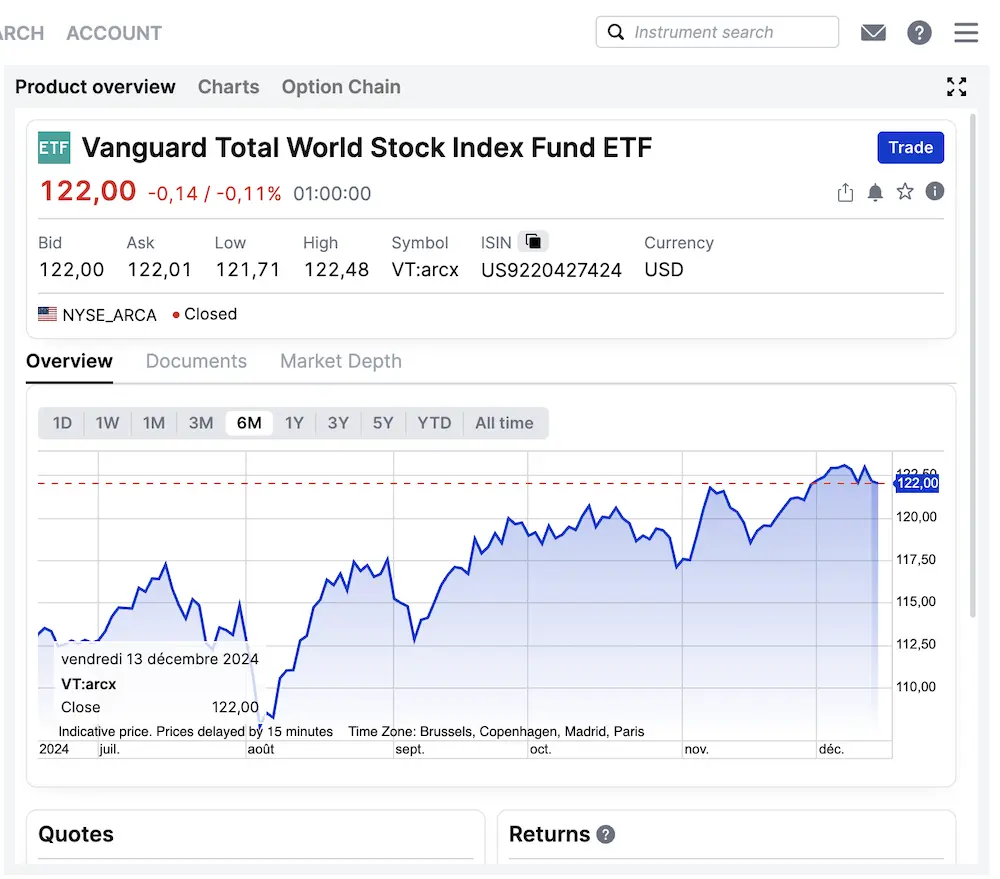

Criteria 4: access to the best ETFs

You want to be able to buy the ETFs with the lowest fees (the well-known TER: Total Expense Ratio) and which are diversified to the maximum extent in a range of companies spread around the world.

The big news came in 2024, when Saxo expanded the range of ETFs available to its customers. For us Swiss Mustachians, this means we can now buy our favorite VT ETF via Saxo Switzerland!

✅ The online broker Saxo fulfills these four criteria.

As a reminder for this article, we’re going on the basis that you absolutely want an online broker based in Switzerland.

In this case, Saxo is THE best choice.

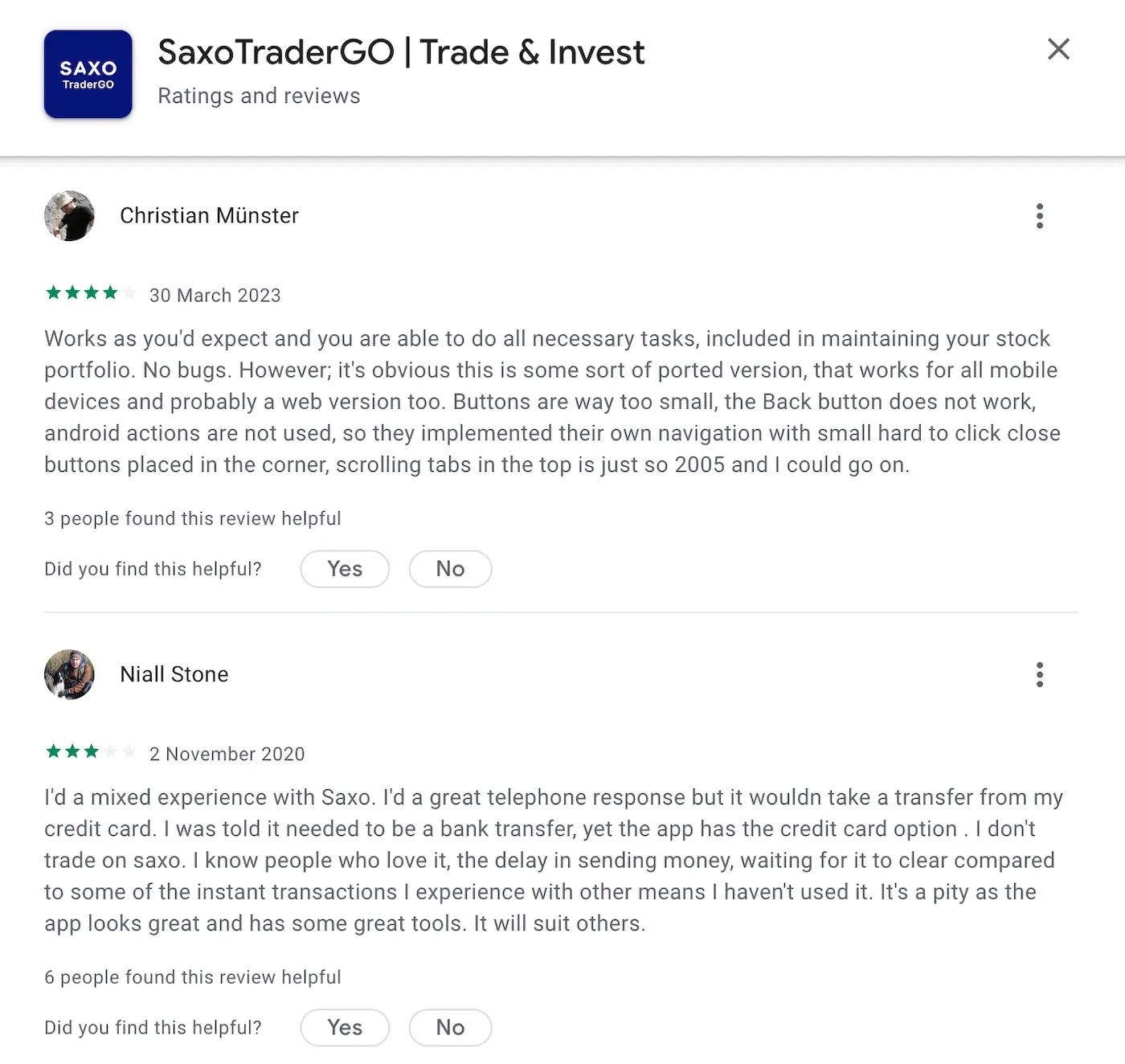

Saxo Bank user reviews

I like to take a brief look at the ratings of users of the financial services that I use, particularly if the company has a mobile app.

If a mobile app has a rating of 4/5 or higher on app stores (AND the app has more than 20-40 reviews), then I’m pretty reassured.

So here are the average ratings of the SaxoTraderGo apps on the iOS and Android app stores:

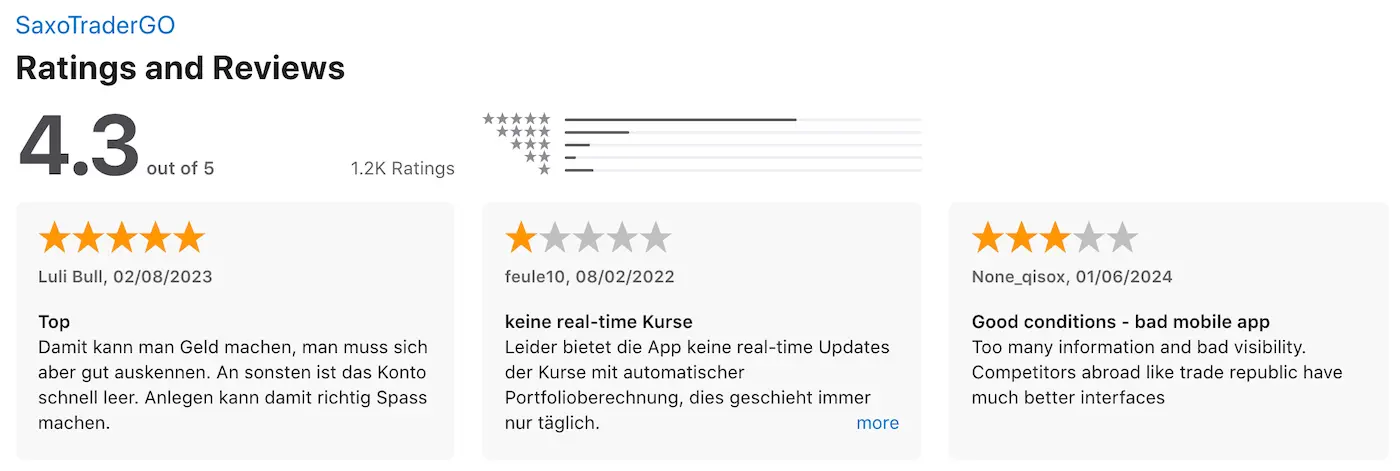

That’s all fine.

You can see some of the comments about SaxoTraderGo in the screenshot below:

While the average ratings are good (4.3 on iOS and 4.0 on Android), some of the reviews… not so much.

Fortunately, the Saxo Group has been in business since the last century; otherwise I might have hesitated to mention it here…

As I’ve already said, their user interface has some considerable room for improvement. Also, their customer service could be quicker to respond to questions from their clients (the ransom of success when you make a price cut, like in early 2024).

In the end, what reassures me is that we’re not frenzied traders, so making a few transactions per year to place purchase orders for our 1-2 favorite ETFs, it does the job.

You can also go and form your own opinion via these links to the most recent reviews of the SaxoTraderGO iOS app and the SaxoTraderGO Android app, depending on your smartphone type.

Alternative solutions to Saxo Bank — and a comparison of them

Saxo vs Cornèrtrader

Saxo is THE best broker based in Switzerland, when you use the official trick of activating the securities lending feature of a single stock to obtain an exemption from custody fees (see box in criteria 1 above). Indeed, the broker fees are lower with Saxo than with Cornèrtrader.

Saxo vs DEGIRO

My fee comparison shows that DEGIRO is more attractive than Saxo. But, DEGIRO is an online broker based in the Netherlands and Germany. So if you want a broker in Switzerland, Saxo remains your first choice. If, however, you don’t mind having a European broker, then DEGIRO is the best alternative.

Saxo vs Interactive Brokers

The best way to invest for a Swiss Mustachian is using Interactive Brokers (in terms of fees). I’ve been using it since 2016. But I know that some readers consider it essential to have a broker in Switzerland. In this case, Saxo is THE best alternative for you.

Saxo vs Swissquote

Ah, good old Swissquote… I began using this Swiss broker when I started out. Partly because there weren’t many other choices, and partly because they were very aggressive with their marketing. But don’t fall for this: Swissquote is on average twice as expensive as Saxo when it comes to fees.

Saxo vs neon invest

I really like neon. It’s my main bank in Switzerland. However, their investment solution, “neon invest” is not as good as Saxo’s. neon invest is practical because it’s integrated into the same app as neon bank. But when it comes to fees, Saxo is half the price of neon for transaction fees.

So if you’re looking for a Swiss broker, I recommend Saxo.

How to open a Saxo account

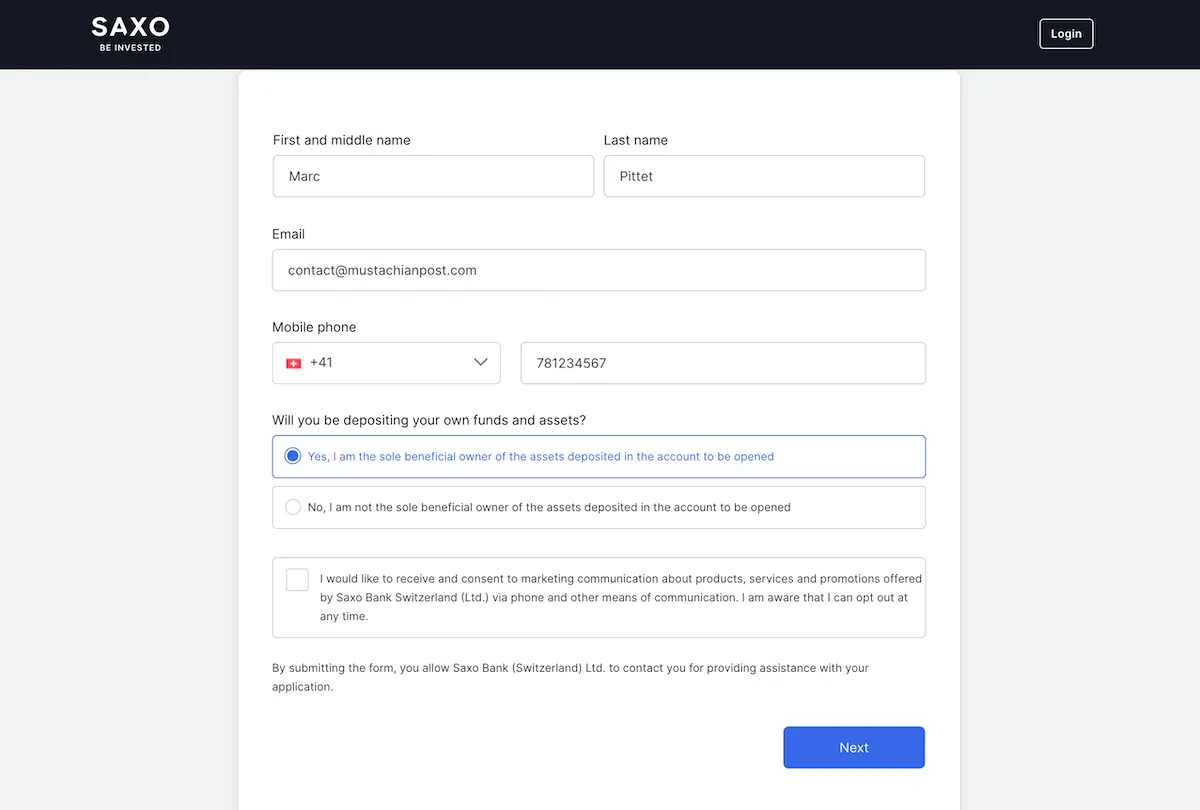

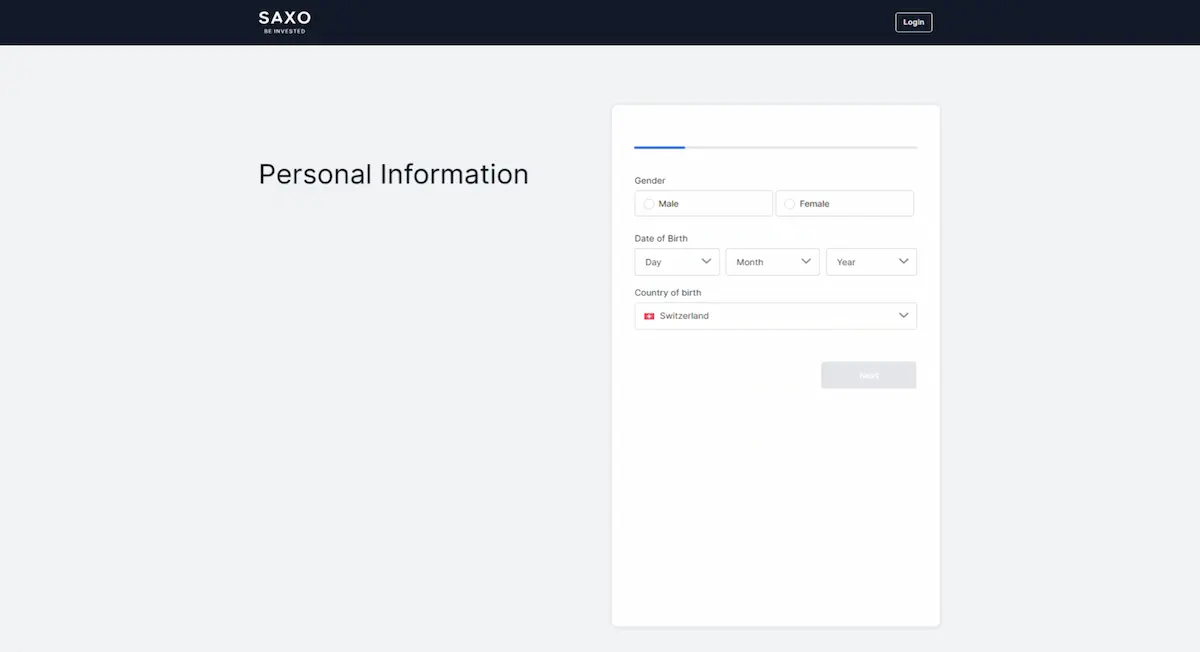

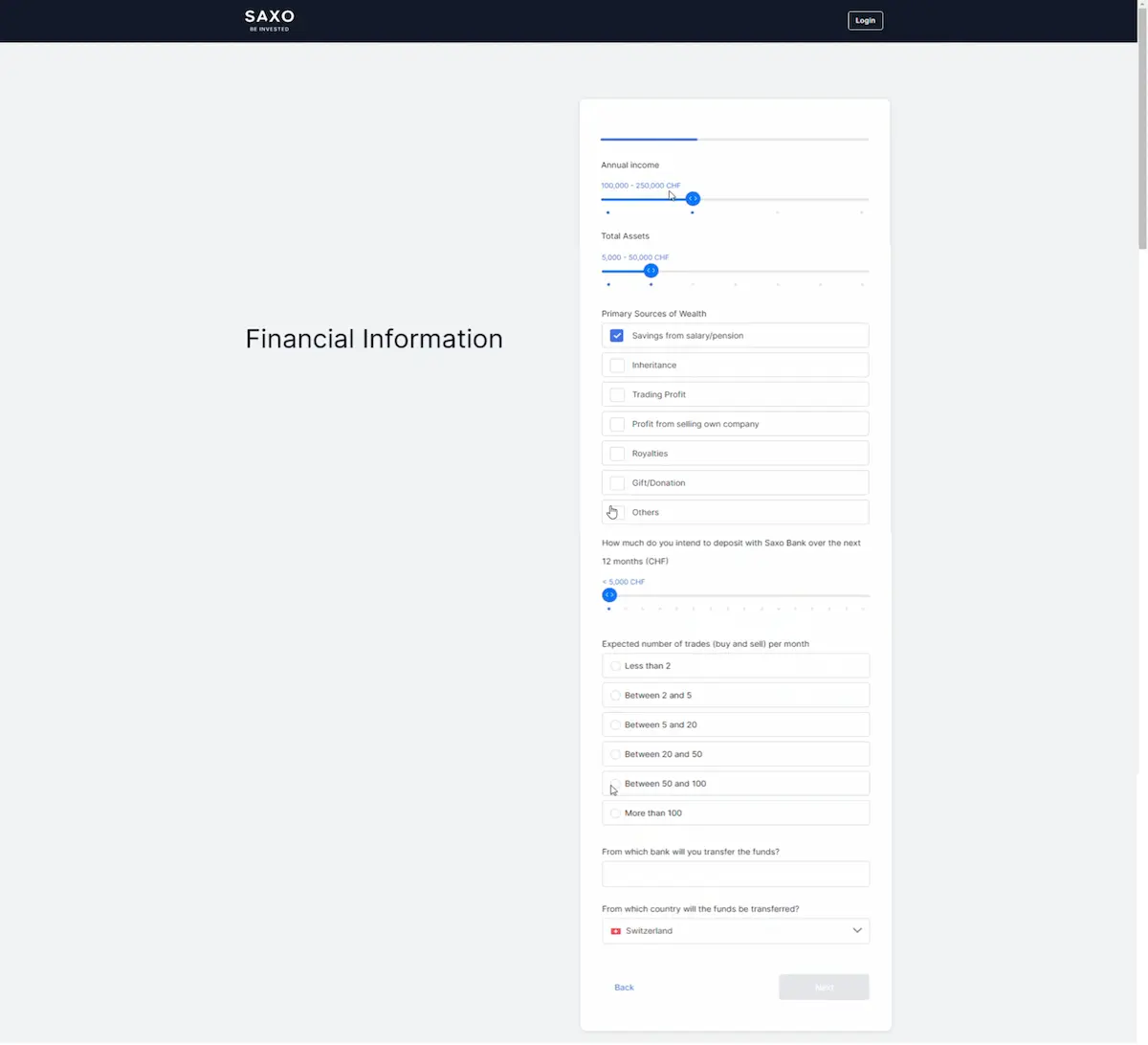

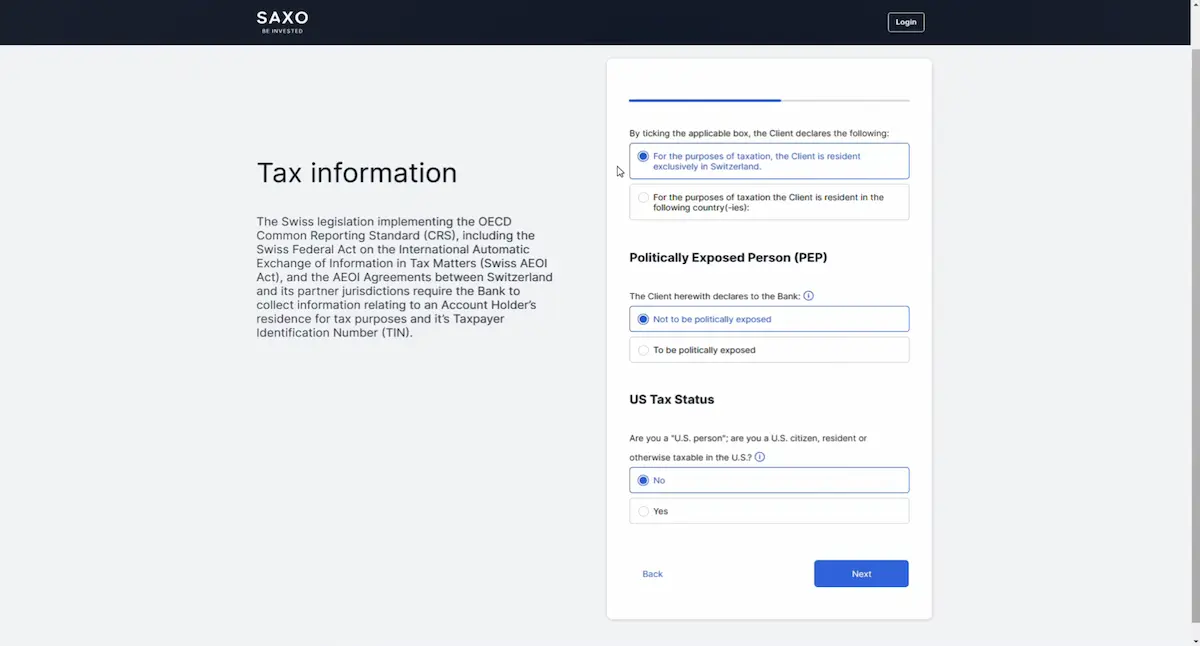

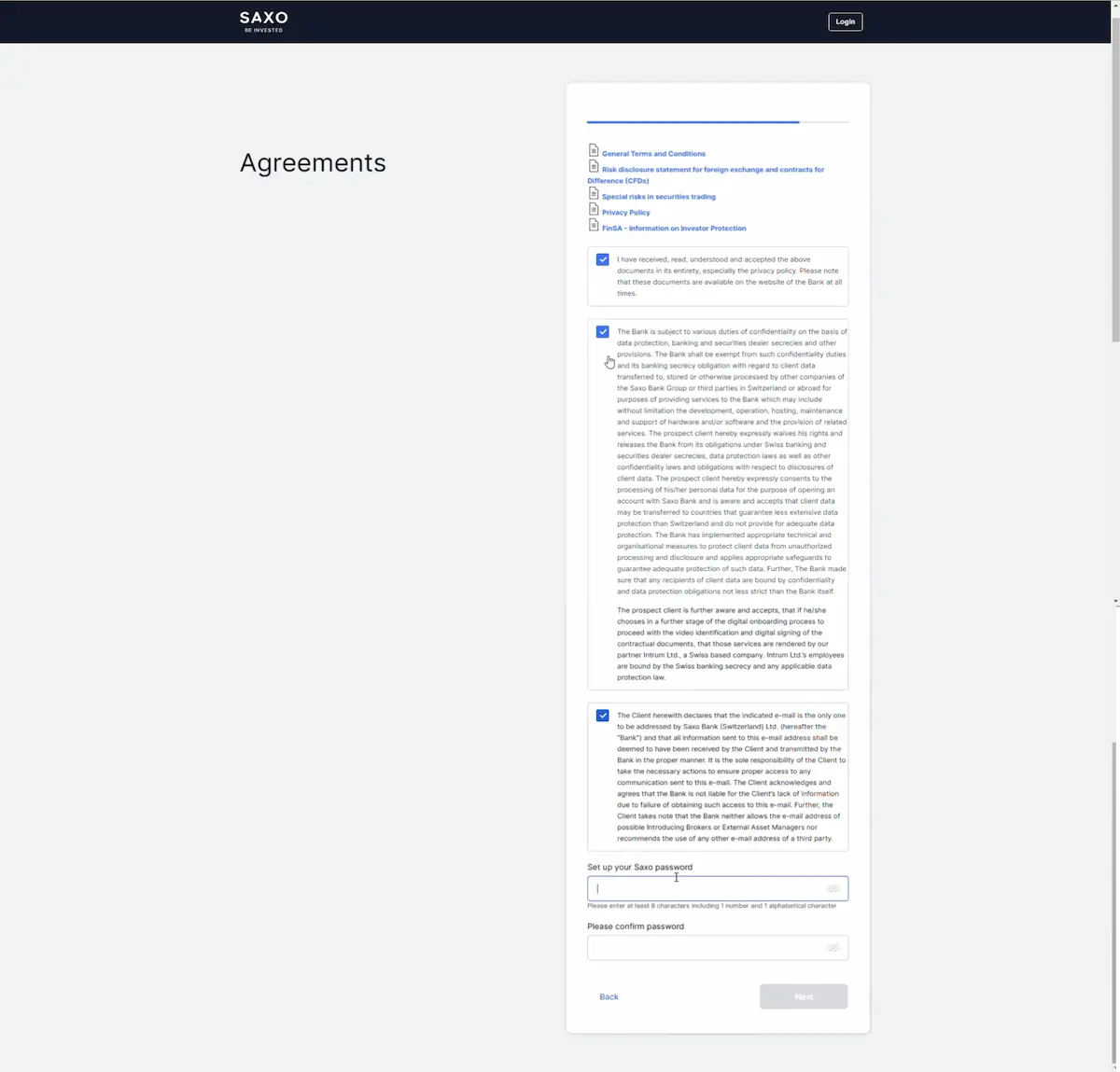

Opening a Saxo trading account is done entirely online.

These are the main steps:

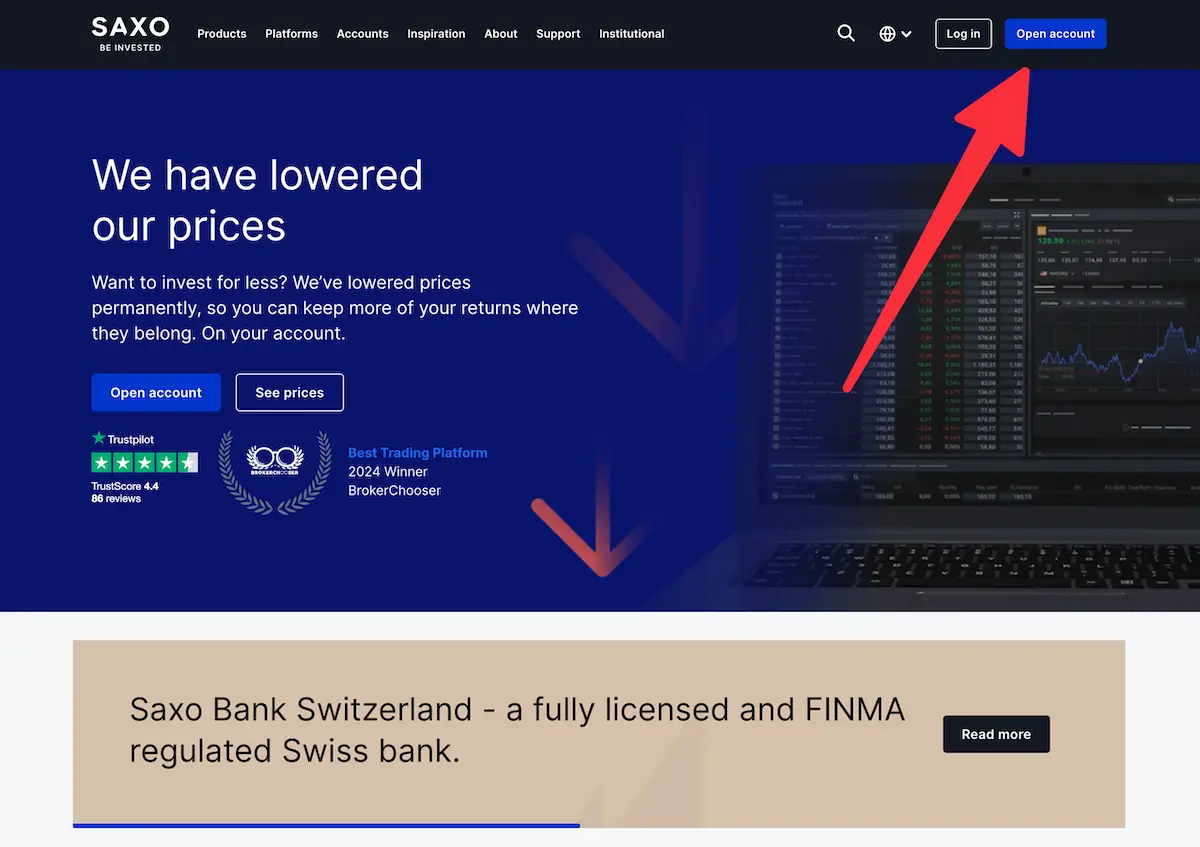

- Go onto the Saxo homepage

- Create your Saxo account

- Go through the identification process to formally confirm who you are

Once your Saxo trading account has been created via this link, you’ll be refunded CHF 200 of broker fees.

And that’s it :)

Now all you need to do is make your first deposit into your Saxo account in order to make your savings grow!

FAQ about Saxo

Who created Saxo?

The Saxo Group was founded in 1992 in Copenhagen (in Denmark) by Lars Seier Christensen, Kim Fournais and Marc Hauschildt. One of the Saxo Bank group companies is their subsidiary in Switzerland, which is an approved bank and securities trader authorized by FINMA (the Swiss Financial Market Supervisory Authority).

Where is the head office of Saxo in Switzerland?

The company Saxo Bank (Switzerland) Ltd. is a limited company registered on the Zürich commercial register (their offices are located at the Circle in Zurich).

Are my assets protected up to CHF 100'000 in Saxo?

Yes, as a Swiss bank, Saxo is able to provide its clients with a deposit (cash) guarantee up to a maximum amount of 100'000 Swiss francs in the event of Saxo going bankrupt. Stocks are always in the client’s name, and remain so even if Saxo goes bankrupt. However, trading losses are not insured, obviously.

Why does “Saxo Banque” appear sometimes?

Saxo Banque France is the French subsidiary of Saxo, which is where this French spelling comes from :)

Conclusion

Saxo Bank Switzerland is THE best online broker based in Switzerland to buy ETFs.

In sum, their fees are the lowest in the market for this investor profile.

Click on the link below when you're signing up to Saxo.

You'll be refunded CHF 200 of broker fees (and you'll contribute to supporting the blog by doing so; thank you!)

Open a Saxo Bank Switzerland account >