UPDATE 22.08.2025

The development of FI Planner (our FIRE planning tool specially designed for Switzerland) is progressing well.

If you would like to receive news about the tool and be notified first when it is officially launched, sign up for the waitlist on our FI Planner website.

What if I could simply enter my personal finance data into a software tool, and get my financial independence date in return?

That’s the tool I’ve dreamed of creating since I made a serious start on my journey towards FIRE (financial independence, retire early) in Switzerland… a tool that could tell me at any given time what my predicted FI date is, based on my figures.

And even better if such a tool could tell me how much more I would need to earn per month (quantified targets) if the date of financial freedom that it gave me wasn’t to my liking…!

My financial independence planning journey

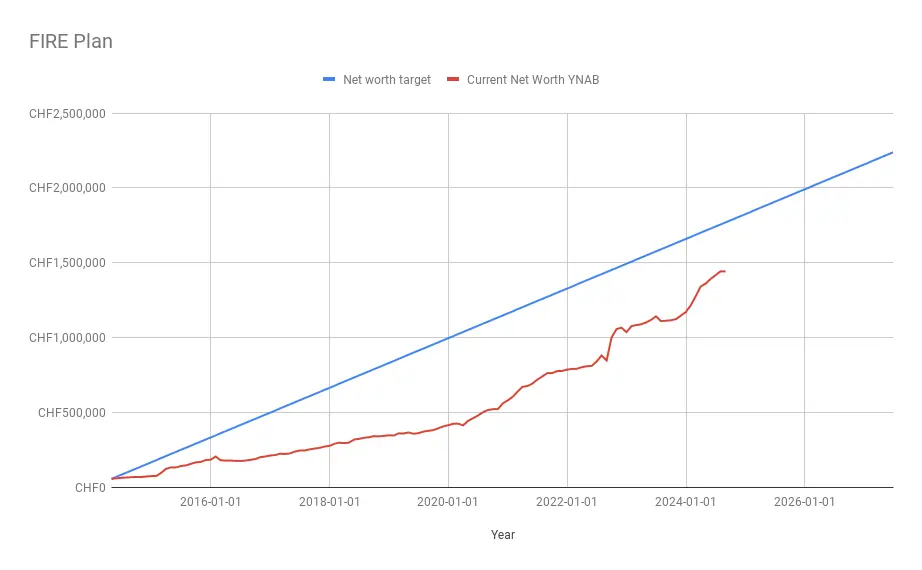

When I first set out on my path towards financial freedom in 2013, I used the standard 4% rule to find out the amount I would need to achieve in order to become FIRE.

Then I created my own graph by computing my FI date to see how many years it would take me to get there:

Except that, while it’s pretty accurate and indicative as an estimate, the 4% rule doesn’t consider the plethora of particularities and choices related to Switzerland (pillar system: social security (AVS), 2nd and 3rd pillars, and other factors such as taxation).

So I sought out a financial advisor who would be independent and capable of making these kinds of calculations about my financial independence.

Suffice to say that it was a real uphill struggle as, in Switzerland in any case, it’s really challenging to combine independence and financial advice…

After a range of conversations, I found what I was looking for with the company VZ (and their Lausanne branch) as a guide. As I mention in my book, they gave me a funny look when I told them I wanted to retire early at the age of… 40 :D

Unrealistic according to them… according to the “norm”…

I really had to convince them that yes, that was my goal, and that yes, I wanted to pay them to check it.

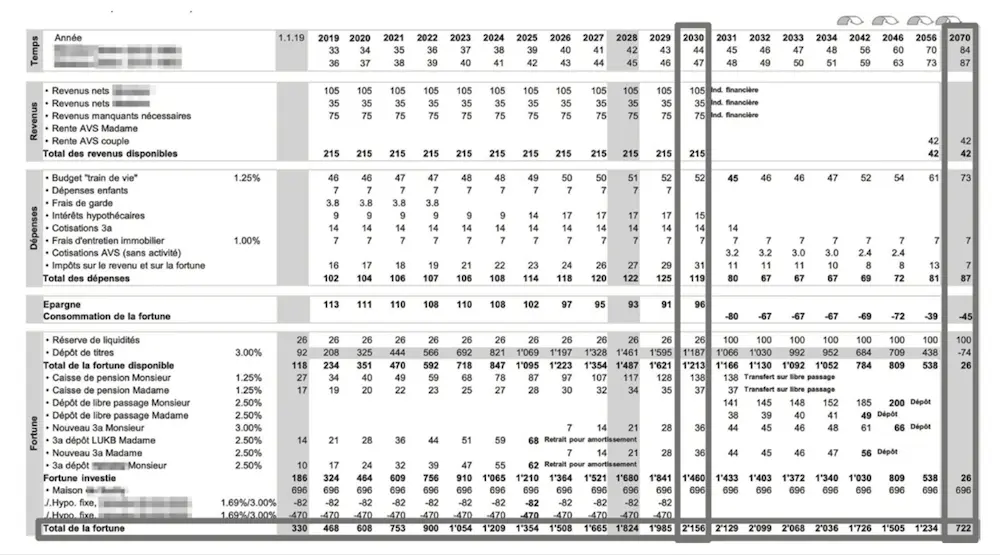

Two appointments and 10 financial consulting hours later, I had my precious graph that set out my future of financial autonomy:

My FIRE goal in a table, with the figure that I was looking for: at what amount and on which date could I be FIRE?! (source: 'Free by 40 in Switzerland')

Without forgetting the CHF 2'376 of charges later, haha!

And of course, if I wanted to update my figures, I’d have to get my wallet out again…

A Swiss FIRE calculator?

Since that day, I’ve dreamed of creating a SaaS service which, like YNAB does for my budget, would provide me with a clear overview of my financial independence goal.

The dream of a tool that computes the FI date remained just an idea for quite a while; it was filed as a project among my long list of projects to explore one day.

Then, in 2023, I met a long-time reader.

We chatted about investing, our respective FIRE plans, as well as our real estate projects. He told me about a “financial independence calculator” on which he was spending some of his free time, in order to model if and when he could no longer have to work for money… I told him that I also had an idea like this…

…and that we’d chat about it again…

Some time later…

“FI Planner” prototype in progress…

This arrived some time later, in spring 2024.

As I was expecting some large incoming payments (mainly with our Swiss real estate development), I was looking to update my financial independence projections.

So I got back in contact with Patrik, who kindly agreed to run my financial data through his tool.

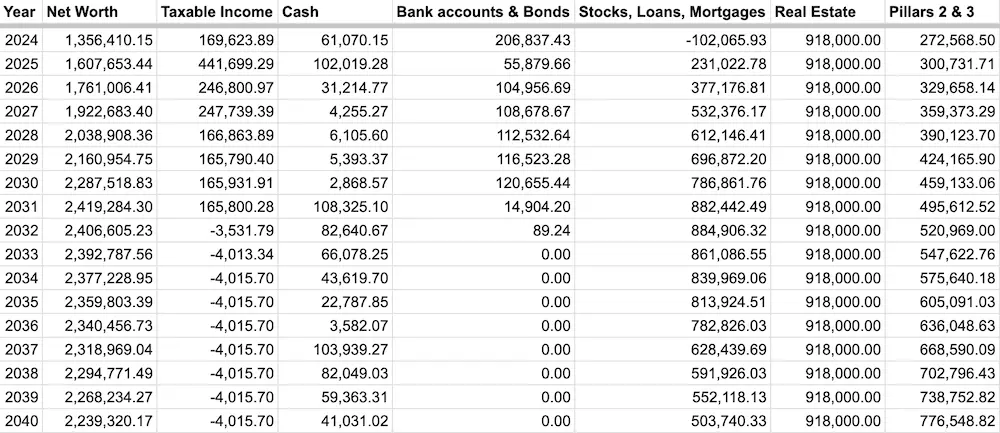

Date of financial freedom for the MP family: 2031 (age 44)?!

I completed more than an A4 page of data to be input into his software.

It includes standard details about salary, 1st pillar, 2nd pillar and 3rd pillar, as well as all my stock market investment accounts and our various mortgages (main home and investment properties).

The result: I’ll be FIRE at the age of 44… ouch! Is there a bug in your simulation Patrik?! What a letdown… especially for someone who’s written a book with a big “40” on the cover haha!…

We discussed the results of my FIRE planning, and in fact, we’d done it in very conservative mode:

- I’m going to die at the age of 83 (while the average life expectancy for a man is 81)

- We only considered the returns (rent vs. charges) from my various real estate assets, and did not include any real estate gains

- We based it on a lifestyle costing CHF 100'000 per year, yet it’ll be much lower once the children have left home… but of course, we don’t know when they’ll move out or what kind of studies they’ll do

My initial conclusion

At the latest, and being mega conservative, I’m going to retire at age 44. There are worse scenarios.

My second conclusion

There’s no way!

I’ll make the move to financial freedom at age 40, and that will give me a further boost to increase our income (as you must have noticed, I’m focusing on real estate and digital entrepreneurship to achieve this rather than my salary — if you’re interested in this, please let me know and I’ll write an article on it).

Whenever it may be, 2027 or 2031, you’ll be the first to know when I announce my financial independence :)

Our lessons learned and tips gained from our experiment

On discussing my figures and scenarios with Patrik, we learned, realized and confirmed quite a lot about the subtleties of a FIRE calculation.

Your life expectancy has a big impact on your FIRE plan

By testing different life expectancy parameters (end of life at age 90 and 83), we were able to see that it made a big change to the date at which you can be FI.

It’s obvious when said like that, but much more so when using the figures.

For now, we’re using the standard value of end-of-life being age 83 for any simulation that we do.

The magic of compound interest

Patrik was telling me how he’s constantly impressed by assets invested in the stock market even if only for a few extra years… and the disproportionate increase that it has on your total wealth.

We can never repeat it enough: the best time to start investing was yesterday. The second-best time is today!

A small change with a big impact

Likewise, by doing financial independence simulations with my situation, we noticed that a “small” change like “taking early retirement in year X vs. year X+1” significantly affects all the rest of the simulation.

In particular, “retiring a year earlier” doesn’t just mean “1 year less of income”, It has many other consequences for your future figures.

I loved this analogy from Patrik:

I think that retirement planning is like ballistics: a tiny change in the firing angle can lead to a huge difference in distance. And then there’s the nice case where you shoot so hard that the shot never comes down (meaning when the money increases faster than you can spend it).

The Swiss tax system and pillars system = not so bad

When testing his software on “standard” Swiss profiles, Patrik realized that many had their investments in Swiss stocks (vs. global, like us Mustachians).

With this kind of portfolio, you can expect less than a 4% return (in relation to the 4% rule). But in fact, the tax system and pillars help.

Firstly, the Swiss tax system is very favorable to investors, as there are no capital gains taxes.

Then, Swiss social security (AVS, also known under the name of “1st pillar”) compensates a bit, because even stopping early, people with 30 years of contributions can easily receive more than 20'000 Swiss francs per year (more than 30'000 Swiss francs for couples). And the second pillar also represents quite a substantial amount of money.

The 4% rule is really not so bad

On analyzing the results of our FIRE planner, I couldn’t help but think:

In fact, CHF 100'000 x25 equals CHF 2'500'000. And our FI Planner is targeting total net assets of… CHF 2'419'284.30! So why bother creating a FIRE planning service?!

So, in effect, I could just stick with that.

But when it means giving up my job, I can’t see myself just being content to use the simple 4% rule.

I know that I’m freaked out by the idea of no longer having a salary, so I had planned to go to VZ to recheck all my figures anyway.

So that’s why we’re going ahead with this Swiss FIRE planner (who said “And global one day!?” :D)

26 cantons, 26x more complications, and opportunities…

For the moment, we’ve modeled 4 cantons out of the 26. So we’ve been able to get an insight into the differences in terms of taxation…

What we’ve also realized (again) is that Mrs MP and I could be FIRE even earlier if we moved. And learned Swiss German! Those are two pretty big constraints, but it’s good to know haha!

Well no, but alternatively, rather than Swiss German, how about true freedom in a boreal forest in Finland, OK!? (photo credit: pexels.com)

Project objectives and next steps

We’ve decided to do some of the journey with Patrik, by joining forces for this project. Without any pressure. We’ll see where it takes us.

We’re going to stay in R&D mode for the next few months, but our idea of a future SaaS is taking shape.

Our primary objective is to have an automated tool that works for the most standard cases. One of our challenges is adapting the tax calculations for each canton, but it’s in progress (it’s just really onerous having to work through the documentation in the usual barely understandable jargon…)

During this time, I’d like for us to be able to set a price at around a quarter of what I paid to VZ.

Ultimately, we aim for a more affordable SaaS system where users only need to enter their data once. When there is a salary change or an inheritance, updates can be made seamlessly, similar to how the YNAB budget functions.

Interested?

We’re still looking for some early adopters (paying customers), with a “standard” profile (read: not a finance expert with a thousand complex investments).

So, if this project appeals to you and you want to be one of the first to test this tool (still in manual mode, before it becomes a SaaS), let me know by email (by responding to any of my newsletters)!

PS: following my interview with JL Collins, I increasingly use the term FI (Financial Independence) rather than FIRE (Financial Independence Retire Early), as I’m still waiting to meet someone who is capable of not dying from boredom after spending several days sipping cocktails on a beach. We need meaning, purpose, and connections. Not retirement per se.

Last updated: November 7, 2024