Hooray! You made it to the fifth step!

First, it means that you got out of the damn loop. And second, that the gem matching to your criteria wasn’t only perfect on the classified ads, but also in reality!

You now have a concrete usecase to present to the money men. Are you ready to dive into the sharks’ pool?

Your moment of glory!

Before finding a concrete property, I went to see banks and insurances, with barely the 25% cash needed.

The goal was to know until which amount they’d follow me, and under which conditions.

As it was all hypothetical, these meetings were kept short by the salesmen and I was out after 30 minutes of meeting with a “Contact me as soon as you found your future home”.

The day I brought back a real case study, it was a whole different story.

Even though it may sound like a cliché, it is actually the reality: I got welcomed with the red carpet now that I was a potential client.

It is your moment of glory. And in the same time, I remember the apointment with one of the selected banks; when I entered the salesman’s office, I read in the banker evil smile: “Look at this fresh and young meat, it’s gonna be an easy and highly profitable contract with the highest rates and conditions one could ever get. Yearly bonus, here I come!”

Nevertheless, you must be confident.

I repeat it: it is your moment of glory, not theirs.

You’ve got the power to say no in the end.

The hardest thing is to be rational and avoid any emotional decision based on “That’s my dream home, I want it no matter what!” — easier said than done, I know…

That is also why to have the 25% or more in cash is so important: it brings you so much confidence and avoids you to sell your case too short.

The behavior I recommend you is the following: play the competition game by giving them valid reasons why you are coming here.

For instance, tell your current bank A that you checked the company B as one of your friend works there — and not that “You wanted some competition to happen”.

Or claim to company B that you come to meet them as they are famous for their low rates, and because your current bank A didn’t manage to satisfy you with their conditions.

The 3 red signs that should make you leave the bank/insurance office right away

1/ Hard pressure from the salesman

Remember the banker with the evil smile? After our meeting for the mortgage, he sent me his proposal.

With it, he informed us that he already opened a third pillar account where we’d need to transfer the cash from our actual one.

He even provided the account internal number as well as the IBAN.

This can stress you out if you aren’t confident with laws: I didn’t sign any damn paper so I just ignored the underlying pressure of a potential “No” from my side — it was his problem if he’d need to close this account.

I still wonder if a third pillar transfer of cash — even without any contract signed — would imply an implicit agreement that locks you down…

Bad practice anyway. Stay away from this kind of people. They don’t play it fair.

2/ Upselling overdose

When for a “standard” mortgage, one proposes you — with no alternative solution — no less than three new third pillars, just run! Even if this is the house that you dream about since years!

The guy was such a “good” salesman: he took his time for the meeting even though it was later than 7pm (rather unusual in Switzerland). He even took the time to bring me back home — faking that it’d be faster than my bus. The guy was nice, starting a small talk along the way about family, job, etc.

This should be an alert when you get the combo “Huge upselling+uber nice person”.

Don’t get me wrong, I know how sales work and I do appreciate that someone takes time for me; it’s just the other part of the combo that made this case insane!

Sidenote: it’s quite usual that companies push for a third pillar opening at their company when you come for a new mortgage. One is OK, three is crazy!

3/ High mortgage rate and third pillar enforced, for no added value

Back in July 2015, Swiss mortgage rate average was between 1.8% and 2% for a fixed one on 10 years.

The evil smile guy — him again! — dared to propose me a rate of 2.25% as well as a new third pillar. All that for what added value compared to others: none!

As a Mustachian, you must get that a fixed mortgage is a thing you setup and forget afterwards — there is no added value to be in this bank or this insurance, except their numbers.

You don’t need a super customer care team nor an uber nice sales contact person. You won’t see them before the end of the fixed period, ever!

What you will see is only the regular mortgage interest bills. That’s it. So, better if they’re as low as possible!

And keep in mind: bankers are here to sell you their highest rates, and insurances their third pillars based on life insurance. Definitely they aren’t here to make your life cheaper!

Some numbers (yeah!)

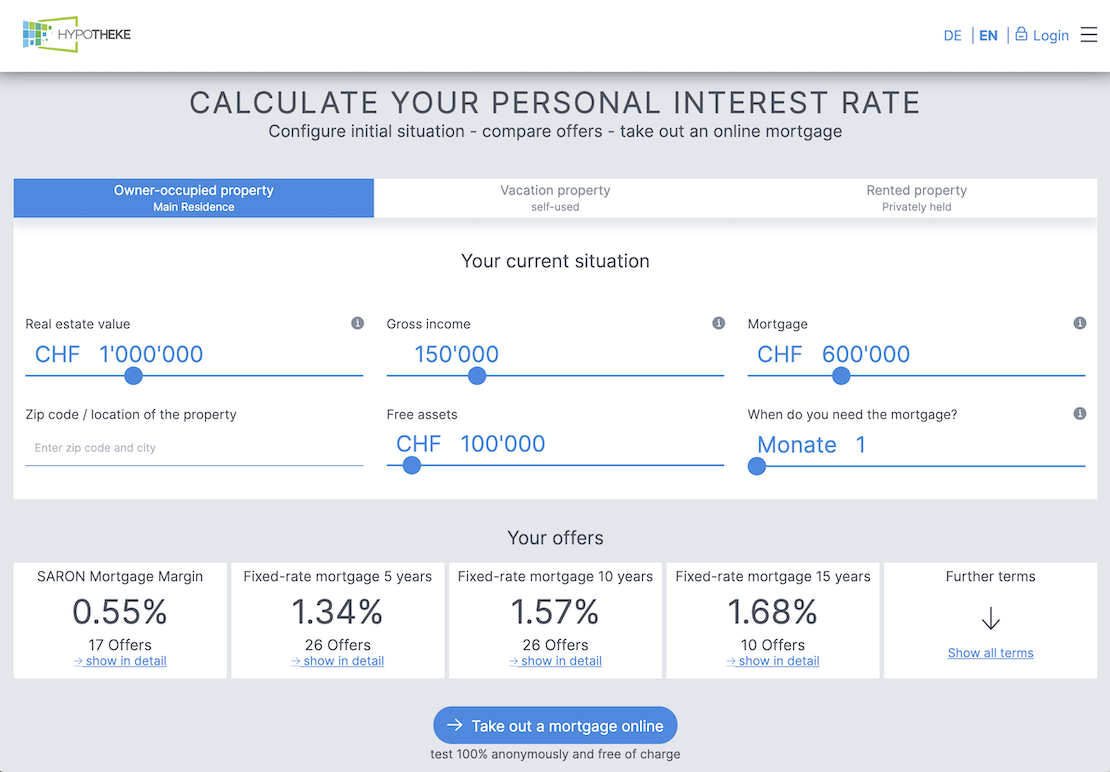

As a reference, I want to share the rates proposed to me last year (for a 10y fixed mortgage). Notice that I’d only the 20% bare minimum cash in bank — vs. someone who’d have more negotitation power with more %.

Even if the comparison list below is a good representation of company rates’ ranking, don’t take for granted that this is the cheapest company, and that is the most expensive: this is only my experience and you’d go check by yourself. For instance, some banks offer special mortgage rates when they open a new office; I’d feel bad if you miss a nice deal because of one blogpost!

Cheapest first:

- Helvetia: 1.69%

- Crédit Agricole Financements: 1.74%

- Migros Bank: 1.75%

- Vaudoise: 1.75%

- BCV: between 2.22% and 2.25%

- Raiffeisen: between 2.22% and 2.25%

- AXA: n/a - they don’t deliver mortgages when the second and/or third pillar need to be withdrawn, hence they redirected me to Vaudoise

As a reminder that one can’t predict any market: I thought “less than 2%” was crazy at the time, but as of today (i.e. August 2016), rates are lower than 1.5%!

Two weeks marathon

Thankfully, I wasn’t overbooked at work when we decided to go for our future home.

Visiting your money men is like a marathon.

In less than two weeks, I had all these seven meetings plus all the homework, as well as the online research to try to find a better deal and more detailed infos about mortgages.

This is the required time to invest to not lose your opportunity.

My advice to you if you’re close to find your property: arrange your work and personal schedule for the next two weeks to one month in order to have enough margin. This will help you to step back and keep a clear mind for such an important and emotional decision.

About financing the 5% transaction fees

You probably heard the open secret that some companies still finance the extra 5% of transaction fees. I heard it too but still wasn’t sure as no bank nor insurance really confirmed it during the first step of this quest.

The answer is: yes, some banks and insurances still finance these 5% of fees.

Insurances seem more free to do it (from a legal point of view), and banks play the “you’ll have to go through a special committee” motto.

Although it is far from ideal to be in this situation as your negotiation power gets reduced, it is still good to know it.

We were somehow in between as when we signed for our home, we didn’t have all the 25% cash, but the 6 months between the transaction and the final signature allowed us to get it all, right on time.

d-l.ch, an alternative?

We discussed this d-l.ch in our first article of this serie.

As a reminder, you basically pay them CHF 900 and their job is to find you the best mortgage rate out there.

As a brokerage firm, their model is based on preferred partners like insurances and often Credit Suisse it seems. There is still the risk that they make money via commissions on life insurance sales.

Nevertheless, from what a friend in the financial field told me, the real estate financing file they provide is good, at an “affordable” price.

All in all, I think it can be a good service to use as you can save so much on the mortgage interests in exchange of a one-time low fee.

At worst you lose CHF 900 if you found a better deal than them…

If I had to do it again, I would 1/ ask a friend to look for a mortgage with my numbers to the companies I’d like to check, and 2/ go to DL to check if their deals are better. The reason of this strategy is that it’d avoid DL to ask one company you already checked — both the company and DL would feel like doing the work twice, something that no one likes.

If one of you, dear readers, already used their services, please share with us your feedback about this company.

UPDATE 01.12.2022: D-L (now called MoneyPark) is not necessarily to be recommended, according to these mixed reviews from some blog readers.

UPDATE 28.11.2024: I’ve written a comprehensive article to help you find the best mortgage in Switzerland.

Next step: Negotiate

Here we are: the step I find the most interesting!

Now that you found your best mortgage option, meaning you’re backed up by a bank/insurance contract proposal, it’s time for you to negotiate the final price of the property and the conditions of the deal!

We’ll list the different negotiation phases in which you can be during a transaction, so that you know how to get the best price no matter when your purchase happens.

I’ll also reveal you the single book I recommend to lead any negotiation (including the discussions with money men): life changing!

If you’re on your way to home ownership (or already a home owner), let us know your strategy on how to deal with money men.

I will update this blogpost based on your comments.

Show me your numbers! Interview with J. Money from …

I stopped to invest into the stock market. It...

Last updated: August 22, 2016