I’m anxious for you. Don’t take me wrong, I’m glad that you managed to find a financial agreement with the seller, but still… I’m anxious for you when I think of all the remaining steps until you can enter your home.

Many contractual details remain to be discussed and signed. I went through this already, and I wish someone hold my hand, and told me what to do.

I want to be this person for you.

Definitive choice of your mortgage

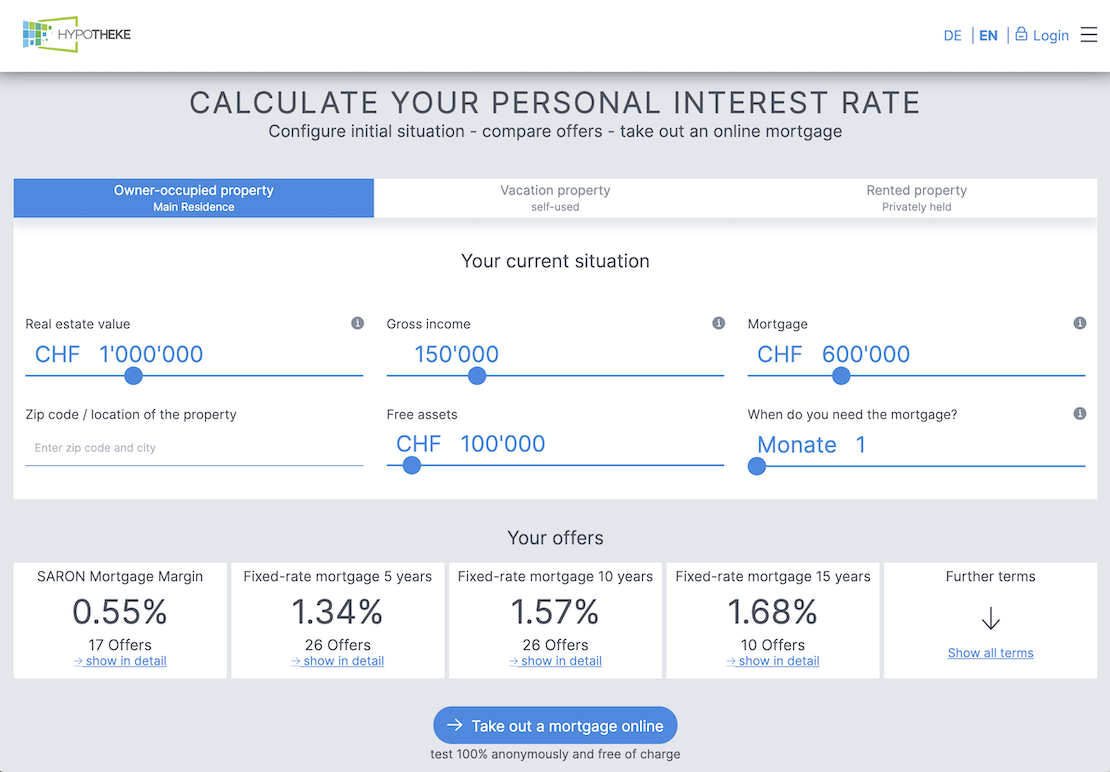

Now is the time to call back the money man that offered you the best mortgage rate.

This is a critical step. You’re about to sign for what will be your rent during the next five to fifteen years. You need to choose your mortgage based upon three key factors.

Key factor #1: Mortage type

There exists three types of mortgage in Switzerland: fix-rate, variable-rate and LIBOR-based rate.

The fix rate one is the most used these days as interest rates are very low, and people like the security feeling of knowing their rent budget on the next ten years.

Historically, it is nevertheless not the best option for two reasons:

- 1/ If you need to sell your home for whatever reason, you may need to pay up to several tens of thousands CHF to break your mortgage contract (the amount correspond to the difference between what the bank would make if they had invested your loan into the stock market, and what they get from your interests — in case the amount is positive, don’t dream, they don’t reimburse you the difference)

- 2/ You don’t know at which rates you will end up in ten years, when you have to renew your mortgage contract

Variable rate mortgages are not used a lot anymore as they are more expensive in this low rates period. The idea of this type is to follow mortgage market trends: if it goes up, your interests goes up; if it goes down, your interestes goes down. The bank where you have the mortgage is the only one who decide about the rate — i.e. there is no central authority who defines it.

It can be useful if you need flexibility though. For instance if you plan to make multiple reimbursements when you sell your property.

The last type is the LIBOR-based mortgage. It states for London Inter Bank Offered Rate — i.e. the average rate at which world leading banks exchange money between themselves.

Banks use it as an index for mortgage. Contract duration is usually of three years and the rate is updated every three months.

It’s quite recommended by independant advisors as it’s the most transparent and has the best past performance amongst all three types. They often say that it is for people that can handle the market peaks — which sounds like us, Mustachians.

Key factor #2: Mortgage tranches

Banks and insurances want one thing above all when it comes to mortgages. They want to lock you down within their firm for the next thirty years. To do so, they use mortgage tranches.

But this powerful money-making tool can be used in a way that it benefits you, not the bank.

The devil example: you sign for a fix-rate mortgage split into two tranches of respectively five and eight years.

What happens after the first five years? You are locked with your current institution. A transfer of an ongoing mortgage is either impossible or costly (with mortgage exit fee, and mortgage note to transfer to the new financial institution). The best you can do in this situation is to renew this tranche for only three years (to match the eight years of the other tranche). But the bank is free to propose you only “bad deals” for a three-years period. You end up choosing a longer duration to have not-too-bad-interests-rate. You are stuck with them. Bye bye competitors with your cheap mortgages.

Rinse, repeat, and pay expensive interests for the rest of your life.

The Mustachian example: you use tranches to your advantage. The first one is a LIBOR on three years; the second one is a fix-rate on six or nine years. This way you enjoy the security of low interest rates (like in this actual period), and you leverage LIBOR opportunities.

In a situation where you’re sure to live in the same home for 20-30y, a full LIBOR mortgage could be interesting if you look at historical rates. This advice takes into account that you’re a Mustachian who can handle peaks with no worries, thanks to your high savings rate.

As you understand it, the choice of duration and split percentage depends on your personal situation, and also on the market period.

The important point with tranches is to make sure to not be locked into one particular organization for decades. You want flexibility. You want the ability to choose the lowest rate on the market.

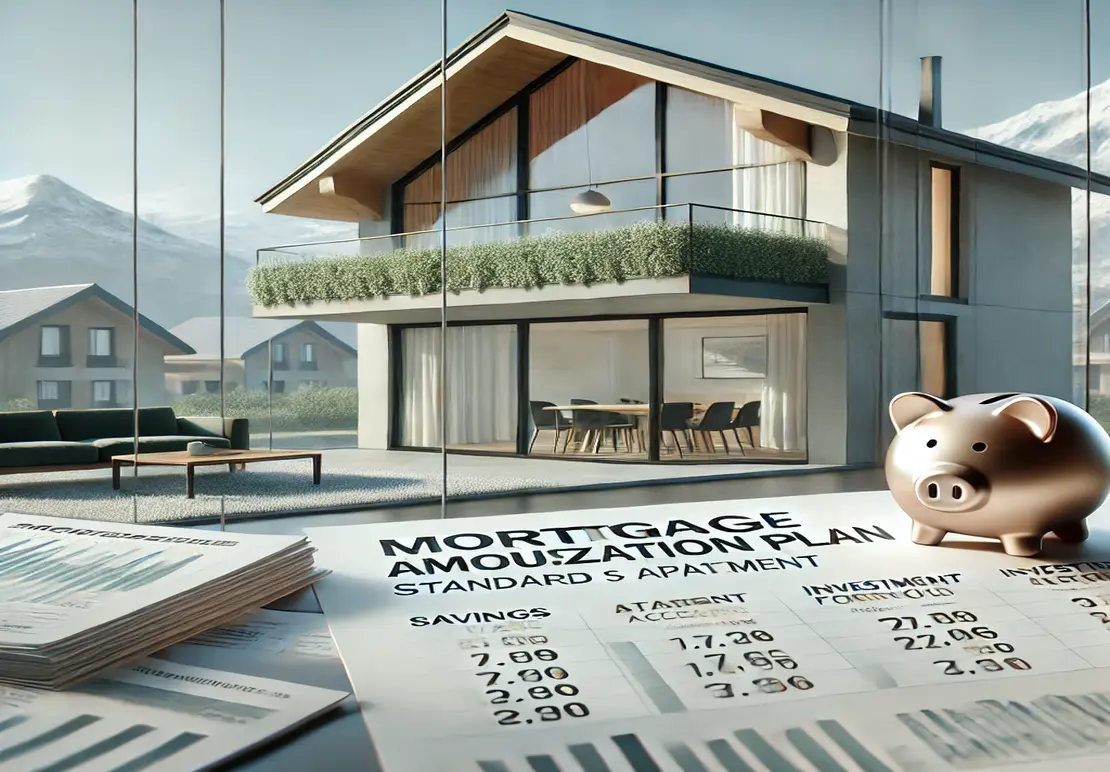

Key factor #3: Direct or indirect amortization

This factor might be the most stupid one. Which country could favor people to keep debt as long as possible in order to lower their taxes…

In Switzerland, you can choose to either reimburse your mortgage every month (i.e. direct amortization), or to open a 3a pillar and use it as an indirect amortization tool (i.e. the insurance part of the 3a is pledged by the bank).

The actual regulations say that the more real estate debt you have, the less taxes you pay. Also, if you have a 3a pillar, you can claim the corresponding tax deductions. Double-win to keep your debt the longest possible.

Current interest rates are so low that it’s really appealing to pay them, and to invest all the savings made on rent and taxes.

I’ll write a dedicated post on this topic with more numbers and examples as it can be confusing for newcomers.

MP mortgage definitive choice

We went all-in for this purchase, left with a cash cushion close to CHF 0.

In such a situation, we had to take a safety measure. We chose a ten years fix-rate mortgage. We could have taken a shorter period, but interest rates were so low historically that we felt better to lock it down for a long period.

You may wonder why we didn’t choose some LIBOR tranche neither? Well, even though our savings rate could allow such a decision, one of us could still be fired, and with two kids, we preferred to secure our budget while we rebuild our emergency fund. We’ll clearly have a different approach when we renew in ten years.

As for the amortization, we went for the indirect one.

In the event we didn’t touch to our emergency cushion, we would’ve go with two thirds of LIBOR to leverage the (very) low rates, and one third of fix-rate to keep a safety margin.

Side note about the “forward” rate

There is often a delay between the time you visit your money man and the actual notary signature. Mortgage offers are usually valid for thirty days, and if your transaction last more time, you will have to get a new proposal with an updated rate — which might be higher or lower than the initial one.

A solution banks and insurances provide to lock a fix-rate is called the forward rate.

I saw two types of “forward rate” during my journey.

The first one: companies claim it is free, but in fact they start the fix-rate duration at contract issuance. This means that if you get your five years fix-rate contract signed on the 1st of July, and start the mortgage at notary signature on the next 1st of January, you will end up with a contract duration of four and a half year.

The second type is that you pay to lock the rate (either a fee, or a slightly-raised interest rate).

We chose the first type of “forward rate”. Hence we have a shorter mortgage contract (~9.5 years instead of 10). At the time, I was disappointed to lose half a year of very low interests. Now, I see it as an opportunity to switch to a LIBOR mortgage sooner than expected.

The pillars’ game

New 3a pillars to open

When you want to go with an “indirect repayment strategy”, you often get enforced to choose a third pillar from your lender.

Their conditions are far from optimal — compared to the best third pillar out there — but they nevertheless propose third pillars invested in stocks.

When I went to negotiate with the money man back in July last year, he offered three third-pillar options. I told him that I would like the one with the less fees and the most invested in stocks, to which he answered that it should be fine.

He was convincing with his suit and paternalistic tone. He told me to not stress out. I should focus on my mortgage and apartment negotiation, he said, and that we still had until November to finalize it all to be on time to leverage tax optimizations.

In this period, my focus was to get everything in order to sign the real estate forward-sale contract, lock the transaction, and breath again. I listened to my lender. I did not worry about the third pillar opening.

Fast forward in November. I contacted my money man so that we meet. I went there well prepared about what I wanted. Prepared about the worst third pillar my lender would try to sell me. But not prepared to the “I understood what you want, but I’m worried that my mortgage department may impose another one.”

One day later, he emailed me. I was enforced to take one of the two least interesting options due to our borderline 20% financial situation. And he went on to propose to split it into one for my wife, and one for myself. I asked for another meeting.

I went there again. After one hour of negotiation, we found an agreement that I accept his third pillar, but that I take it all under my name. I wanted to keep the possibility to choose a Swisscanto product for my wife.

You may ask at this point why I didn’t step back and claim that I would not take his mortgage if I couldn’t choose my third pillar? Well, remember that the mortgage contract was signed since July, and that we were in November finalizing the side contracts.

You’re right if you feel he cheated on me. I felt it too. Still today actually.

The lesson I learnt is dead simple, yet we overlook it when under time or trust pressure. The lesson is: get important and implicit agreement written down. That’s it!

I won’t mention the first contract draft he sent me, which was containing the worst third pillar option. I politely told him about the mistake. The correction — as well as excuses — were made in the next 24h. Was it a sales strategy or not, I will never know. What I know is that the trust is broken. I consider him as yet-another-money-man, versus someone to whom I will ask other services.

Existing 2nd or 3rd pillars to withdraw or to pledge

As a confident (stupid?) poker player would do, my home purchase looks like an “all-in” strategy. Still, I felt confident. I used my second and third pillar money, and my wife pledged her second.

I convinced myself that we never know which laws will be invented in the next three decades about the rights that we have on our personal pillars. Hence that it was better to put this cash at work for now, and not let it sleep into a low interests pension fund.

If you play this withdrawal and pledging game too, the thing to do is to get the cash out of your pillars on two different fiscal years.

This simple rule is also valid when you will reach the legal retirement date.

The law dictates that the percentage of taxes increases the more you withdraw. Why would a Mustachian refuse himself to save several thousands!

We saved around CHF 1'000 by doing so.

You can find one concrete example with numbers in this VZ article (DE here, FR there).

Taxes and fees

I presented the taxes we had to pay on our second and third pillars’ withdrawals in the first article of this serie.

But there are more. More debits to your hard earned money!

For my second pillar withdrawal, we had a CHF 500 fee to pay.

And for the pledge of my wife’s one, we got a nice CHF 200 invoice…

I can’t wait for fintech to fix these non-sense fees!

It is worth to check your contracts to see if the amount of fees is worth the withdrawal.

Should I proceed with my mortgage contract before signing at the notary?

I remember to be lost in a vicious circle during this contract step. I needed to backup my financial engagement with a mortgage before signing at the notary (that’s a legal requirement), but I also needed to have locked the real estate transaction before signing a mortgage contract.

Be reassured! My lender confirmed that if the deal was cancelled, the mortgage contract would be voided as well.

Nobody will fight for you, except yourself

Be really careful that financial people don’t cheat on you as it happened to me.

Be strong. Be rude if needed. You won’t see their face for years, and they will have changed company in between anyway!

Focus on numbers and contract details. Don’t worry about how you look with your picky questions on the fine print of the contract. Dare to ask for a written confirmation of what was said in a meeting.

You got to fight for what you want. No one else will do it for you.

Next step: Signature and Champagne

If you’re still alive after this more-than-two-thousand-words post, it means you made it!

Next step is notary signature. And a bath of Champagne — just because you deserve it.

But don’t think you’re all set… You gotta show off the real cash now!

There are interesting details to know. When to hand the suitcase? How much money goes to whom during a real estate transaction (although you might only care about what goes out of your pocket)? What Champagne brand does MP recommend to celebrate such an event?!?

If you’re on your way to home ownership (or already a home owner), let us know about contractual details you faced, or ones that apply to different types of real estate transaction.

Last updated: November 8, 2016