What if investing in the stock market after they turn 18 could be as natural for my children as getting up in the morning for school?

That’s what I said to myself recently, when I was recalculating my financial independence date with our FI Planner prototype that’s currently in progress.

Because if I’d started investing half of all my income from the age of 18, I’d have already been FI for several years!

That’s the hard work I wish for my children :)

A single DEGIRO account (for our two children) until now…

We chose DEGIRO at the time because we knew that we wouldn’t exceed CHF 100'000 of investment.

It was the best broker for this profile. But meanwhile, Interactive Brokers (IBKR) has removed all its inactive account fees, and so it’s THE best broker. Period.

Also, until now, we’d opened one single brokerage account for investing our two children’s savings, out of simplicity.

However, with the children growing up, I would really like each of them to be able to see their own portfolio clearly. To be able to understand what they will have “just for them” rather than having to do complex mental math every time they look at DEGIRO.

So I had the idea of creating an Interactive Brokers account for each of them and giving them access, so that every month/quarter, they can buy our favorite VT ETF themselves! 1

Interactive Brokers for children: Which account?

There is no Interactive Brokers children’s account as such (in Switzerland, in any case, see the FAQ at the bottom of this article).

So I was delighted to analyze the Interactive Brokers sub accounts, and even the Interactive Brokers family account.

Except that… I want each of my children to be able to log into their IBKR account by themselves, and get in the habit of buying ETFs like a grown-up.

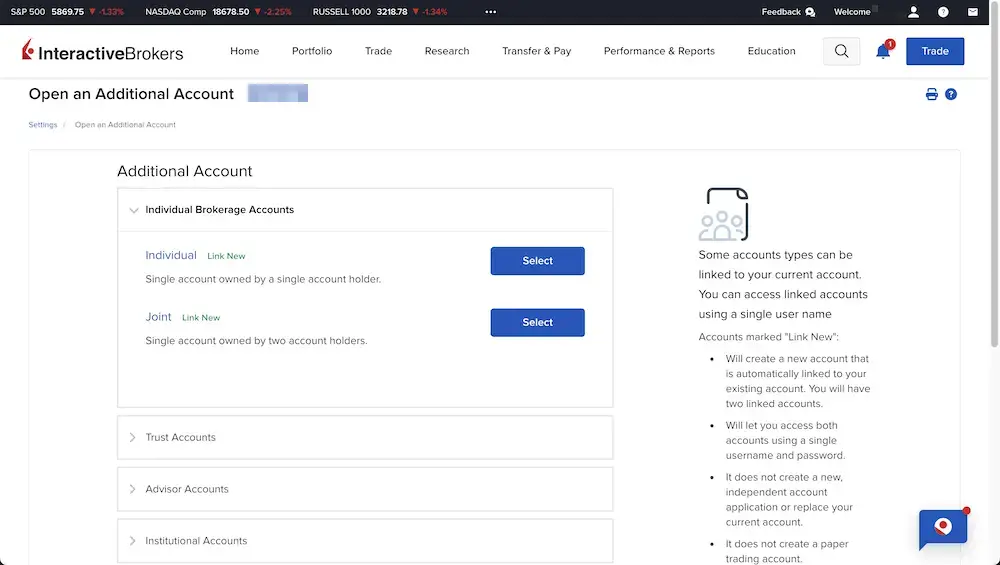

Why didn’t we open an Interactive Brokers sub-account?

I’d have really liked to create an IBKR sub-account, but the problem (which is an advantage normally) is that I would have had only one account (my current one) still with just one access.

And we don’t want our children to be able to see all our investments on IBKR, and that’s not even the worst thing, as what we absolutely don’t want is for them to click on the wrong button and sell all our ETFs or something like that.

Therefore, no Interactive Brokers sub account…

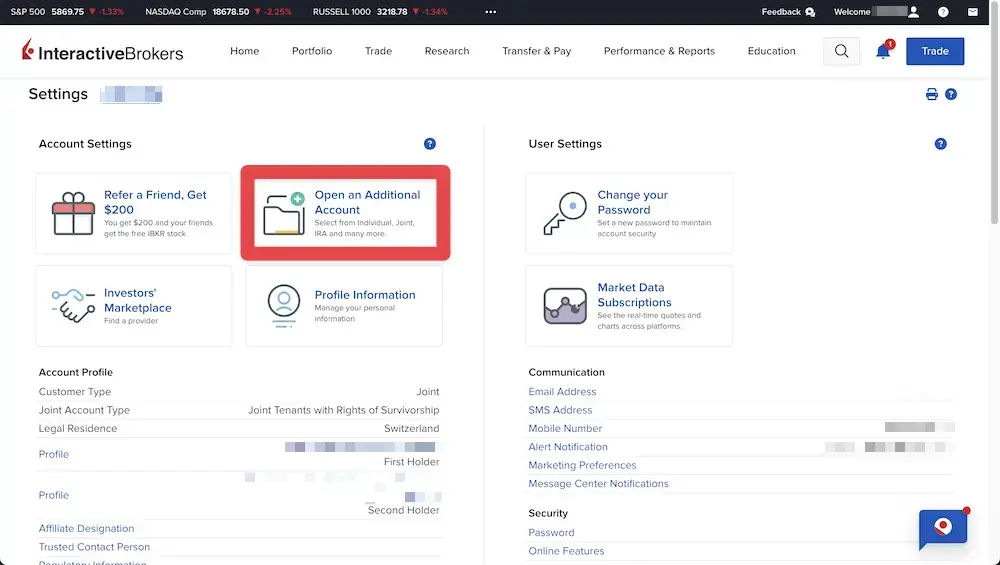

How to create an Interactive Brokers sub account: you can easily create it through this section in the settings of your Interactive Brokers account

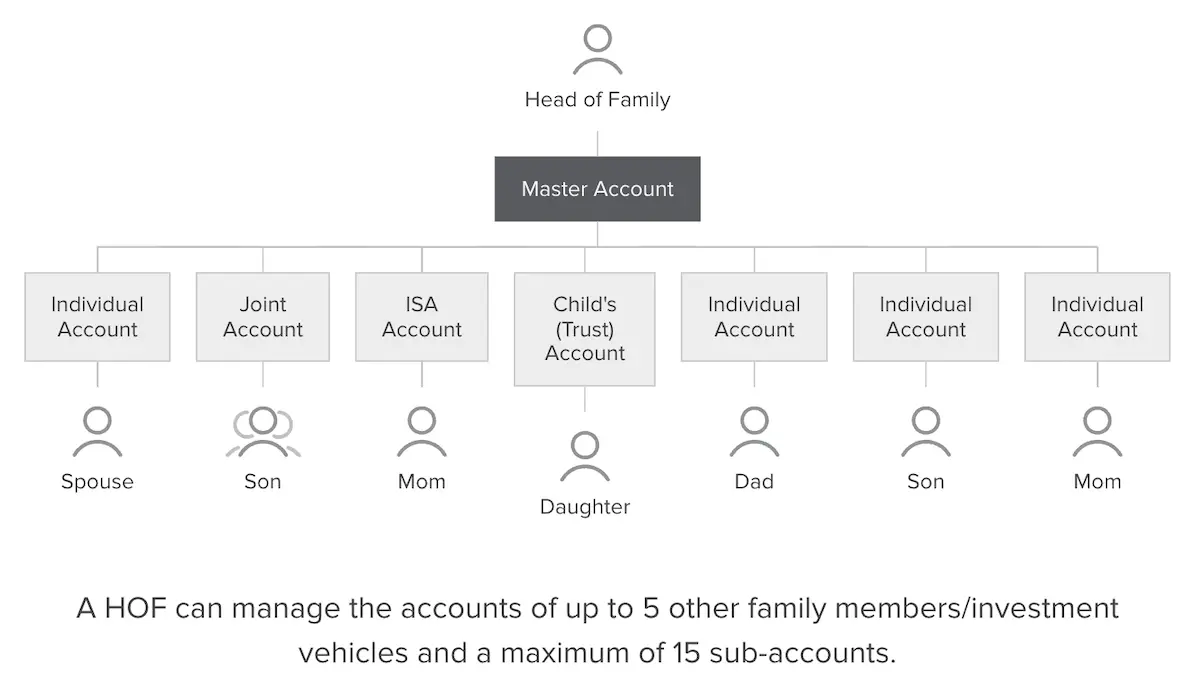

Why didn’t we open an Interactive Brokers family account?

Then I discovered the Interactive Brokers family account:

I saw two main problems with this:

- I don’t want to create a IBKR trust account for my children, as I want to be 100% free with what I do with these savings that we are putting aside for them (see what happened with the BCV here)

- I don’t actually need a centralized IBKR account (and I imagine new Interactive Brokers login details… this point needs checking)

As a result, we went with an even simpler solution.

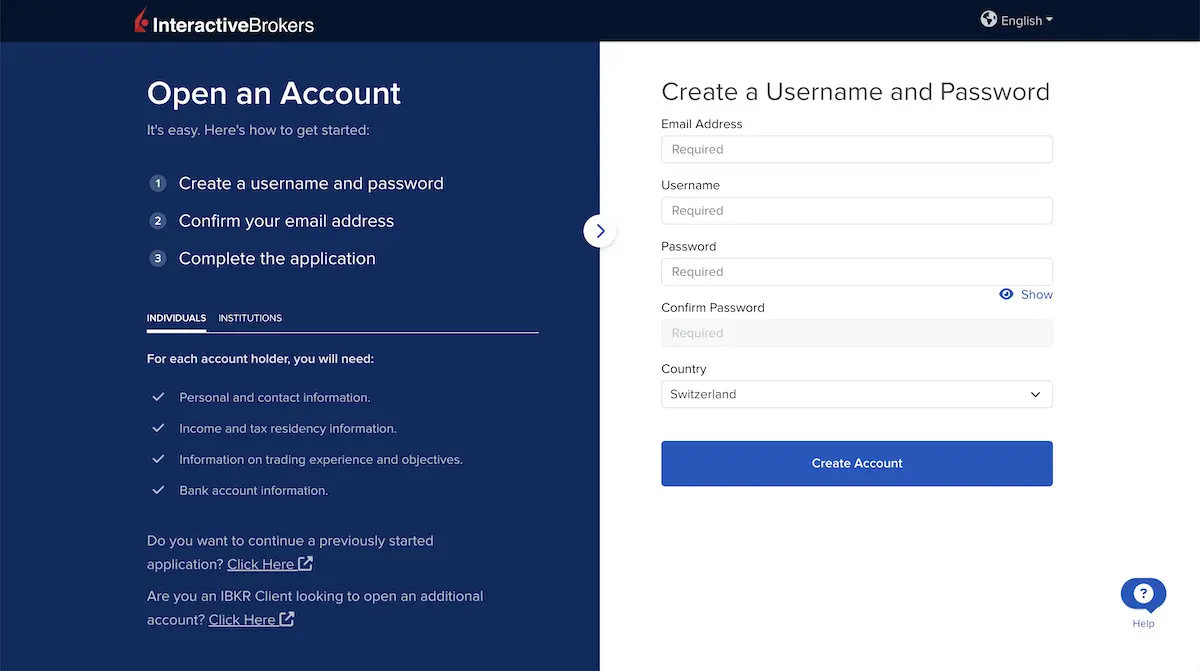

Opening two additional IBKR joint accounts

So we decided to open a “standard” IB joint account to virtually represent each of our children’s accounts in IBKR.

Technically, and it’s interesting to know, you can create as many Interactive Brokers accounts as you want in the same name.

That way, we’ll be able to give separate access to the IBKR Client Portal and IBKR GlobalTrader to each of our children.

And that enables us to keep 100% control of these assets until we officially transfer them at age 18 (or 25 for more wisdom?! Big discussion in progress with Mrs MP haha).

DEGIRO migration process to Interactive Brokers

Here is the DEGIRO account migration process to Interactive Brokers that we used:

- Open 2 separate IBKR accounts (one per child) in 10 minutes (per account), in the form of joint accounts (in both mine and Mrs MP’s names in case one of us passes away)

- Transfer CHF 5 into each new IBKR account (good to know: a deposit can speed up the opening of the Interactive Brokers account)

- Wait 1-2 days for confirmation that the two IBKR accounts are open

- Calculate how much is due to each child

- Sell all the VWRL ETFs in DEGIRO (see below to find out how much profit we made)

- Deposit this amount into our neon joint account

- Transfer each child’s amount into their respective Interactive Brokers account

- Buy VT ETF with all the money available in each account

- Update the recipient for our automatic payment from our Neon Duo account to the individual IBKR accounts of each of our children.

- We also decided to transfer the “Savings” part of their pocket money directly into IBKR (rather than into their BCV savings account)

- Done! ✔️

And the transfer strategy for these assets (when they’re adults)?

When the moment comes (age 18 or 25), we’re going to have to transfer these assets to our children so they are legally and officially the new holders.

Regarding taxes, I looked into it, and we can make a parent-to-child gift of up to CHF 50'000 per calendar year per child tax-free (in the canton of Vaud). Everything is fine.

Mrs. MP and I are still in discussions about how to allocate this money. Initially, we plan to proceed as follows:

- You can only use the dividends to buy things that are (genuinely) worthwhile, but you’ll never sell your capital in order to experiment with the power of compound interest yourself.

- If you really have a big plan (like buying your main home, investing in real estate, or setting up a business), then we can talk again… around age 30-40… so that you’ve really had the time to see the power of compound interest.

How much have our children made on the stock market so far?

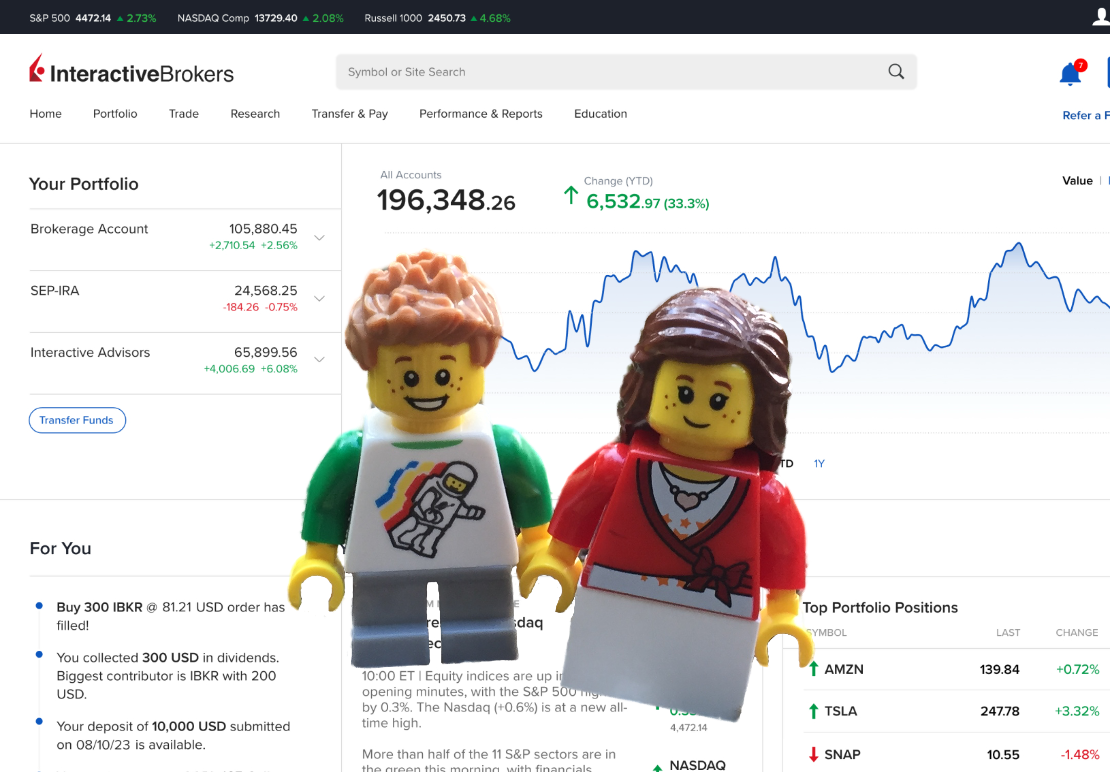

Well, here’s an interesting point for those (nosy? :D) people who follow this blog haha.

As a reminder, we’ve put aside CHF 50/month/child since their second birthday. And we’ve also added the money that some grandparents have given them for birthdays and Christmas.

In total, we’ve invested the amount of CHF 16'364.99 in the stock market.

And at the time we sold their ETFs in DEGIRO in November 2024, we got back CHF 23'124.78, which is a net profit of CHF 6'759.79 after tax!!

Amount invested: CHF 16'364.99

Amount withdrawn with gains made: CHF 23'124.78

Net gains made after tax: CHF 6'759.79 💰

Which has made us a net annualized return after tax of around 6%.

Conclusion

If you choose the strategy of putting money aside for your children, I currently recommend that you create an Interactive Brokers account for your children in your name, and invest their savings in our favorite VT ETF (we used the VWRL ETF before, as the VT isn’t available through DEGIRO).

Then, as they grow up, let them buy this ETF themselves so that investing in the stock market becomes a habit like brushing their teeth or going to school.

Once the children reach adulthood, you can transfer these stocks to them as an inter vivos gift (check that your canton doesn’t impose tax on this gift, that would be unfortunate!)

And how about you, how do you invest your children’s money?

FAQ

Do you use the same email address for all 3 accounts?

Short answer: no.

Long answer: since I use Gmail, I used an address like marc.pittet+firstname1@gmail.com and marc.pittet+firstname2@gmail.com. They are therefore different accounts in the eyes of IBKR, but all emails arrive on the same Gmail account :)

When can Interactive Brokers sub accounts be useful?

The main use for Interactive Brokers sub accounts, in my opinion, is if you want to separate your portfolio types.

For example, in my case, if I’d known they existed before, I’d have used:

- My main IBKR joint account with Mrs MP to hold our favorite VT ETF

- A Interactive Brokers subaccount to hold the value stocks of our Daubasses portfolio

That would enable me to monitor the performance of my respective portfolios more easily.

I’m not going to set this up as I’m currently thinking about stopping my Daubasses investments to put my full focus on real estate. An article on this subject will be coming out soon.

I’ve noticed that there’s a type of Interactive Brokers children’s account. Is this true?

That’s right, an Interactive Brokers child account does exist, more commonly called UGMA/UTMA in the USA (for “Uniform Transfers to Minors Act” and “Uniform Gifts to Minors Act” respectively). These are custodial accounts for minors, but IBKR accounts are exclusively available to U.S. residents.

IBKR Sub-account and SIPC?

The SIPC protection considers sub accounts as one single person (as those IBKR sub accounts belong to the same person). Hence, increasing your number of Interactive Brokers sub accounts won’t increase your SIPC protection.

Only when my kids will be 18, then their investments will be protected by SIPC for themselves, as I will have transferred “my” assets (saved for them) to their newly created IBKR account.

While writing this, I’ve realized that I was thinking of automatically investing the children’s savings with Interactive Brokers, but actually, I’m now thinking of letting them do it manually so that they get in the habit (and explaining some basic concepts of the stock market to them at the same time) ↩︎