I often get the question: which trading platform should I choose (as a Swiss investor) between DEGIRO and Interactive Brokers?

Which one is the better online broker?

Which broker should I choose if I am a Mustachian like you (aka on the road to financial independence)?

After sharing my opinion by email and answering the same question over and over again, I decided to share my opinion in a dedicated article :)

REMINDER: I am addressing investors resident in Switzerland in this article. Each country had its own financial regulation and tax rules, so what I write below is certainly not applicable in Germany or France.

DEGIRO vs Interactive Brokers: a quick overview

If you’re looking for a quick answer, and want to have your online broker based in the US, then choose Interactive Brokers.

Interactive Brokers (aka IBKR) is simply better overall for your investment portfolio — better rates, better selection of available stocks, better tax optimisation for the Swiss and the company is much better secured and stable. Basically, everything you could want from an online broker, Interactive Brokers offers.

But then, why would anybody choose DEGIRO?

The main reason is to have your online broker based in Europe. And also, because some of the ETFs offered by DEGIRO are with extremely low transaction fees on orders.

So if you are just starting to invest in the stock market…

And if you just want to test to see…

And if you really feel comfortable having your online broker based in Europe…

Then DEGIRO could be a good choice.

But as usual, we have to go through the details thoroughly. So let’s go with the more in-depth comparison of Interactive Brokers vs. DEGIRO.

As I know there are new readers coming to this page regularly, I’m just adding three paragraphs for context. If you already know all this, you can just skip to the fourth paragraph below.

Why should you invest in the stock market?

Investing in the stock market is the way to make your savings grow. And it allows you to live off the returns when you are FIRE (Financial Independence, Retire Early). Important clarification: investing in the stock market for a Mustachian means “buying and holding”, not trading daily.

How do I buy an ETF on the stock market?

In order to invest in the stock market, you have to use an online broker. The broker can be your bank. BCV and ZKB offer these services for example. And there are also online brokers specialising in this area, such as DEGIRO or Interactive Brokers.

DEGIRO web interface to buy an ETF (e.g. Vanguard's VWRL global ETF accessible as a European investor)

Why Interactive Brokers or DEGIRO?

As a Swiss investor myself, I spent a multitude of hours comparing the available brokerage solutions. And I discovered that the two most important points when choosing an online broker were: the fees and the products available on the platform.

Obviously, the brokerage platform must also be available to us in Switzerland (this is the case for DEGIRO and Interactive Brokers). And of course, it has to be a secure financial entity that can stand up to the test (again, both Interactive Brokers and DEGIRO are secure).

In short, this comparison of online brokers has led me to a top 3 that has remained the same for a few years:

- Interactive Brokers, aka IBKR (based in the USA)

- DEGIRO (based in the Netherlands and Germany)

- Saxo Bank (<= CHF 200 brokerage fee refunded using this link) (based in Switzerland)

In this article, I’m going to focus on the top 2, as Saxo Bank is really a step behind for clients like us (i.e. long term investors). But I still wanted to include the best Swiss-based online broker in my latest comparisons.

DEGIRO vs Interactive Brokers: which is cheaper in 2024?

Interactive Brokers is the cheapest for a Swiss Mustachian investor. This is, an investor who buys one ETF per quarter (1x global and 1x Swiss alternating) and holds them over the long term.

As a reminder: brokerage fees are an important element for an investor.

Indeed, these can significantly reduce your returns if you don’t pay attention to them.

For example, some banks charge 1 or even 2% annually on their clients’ assets!!!

Imagine if you have CHF 100'000 invested in the stock market, with an online broker like Interactive Brokers or DEGIRO, you pay zero custody fees. On the other hand, with other “big banks” you will pay between CHF 1'000 and CHF 2'000. Per year!

For me, I recommend choosing an online broker that aims for maximum fee optimisation, and focuses its business model on being the best service provider and making money on the total amount of clients it gets.

What criteria should you use to choose your online broker?

Very concretely, I use the following filter criteria to choose my online broker, especially when choosing between Interactive Brokers or DEGIRO:

- Account maintenance fee: CHF 0

- Inactivity fee: CHF 0

- Custody fee: CHF 0

- Transaction fees for stock market orders: less than CHF 1

- Transaction fees for ETF orders: ideally free of charge via a list with the best ETFs (which usually contains my favourite ETF!)

- Lowest currency exchange fees

- No minimum amount to open an online trading account

- Possibility to have an IBAN account in CHF in order to send my savings directly from my Swiss bank account neon (no additional currency conversion fees)

Examples of Swiss investor scenarios: DEGIRO and Interactive Brokers fees

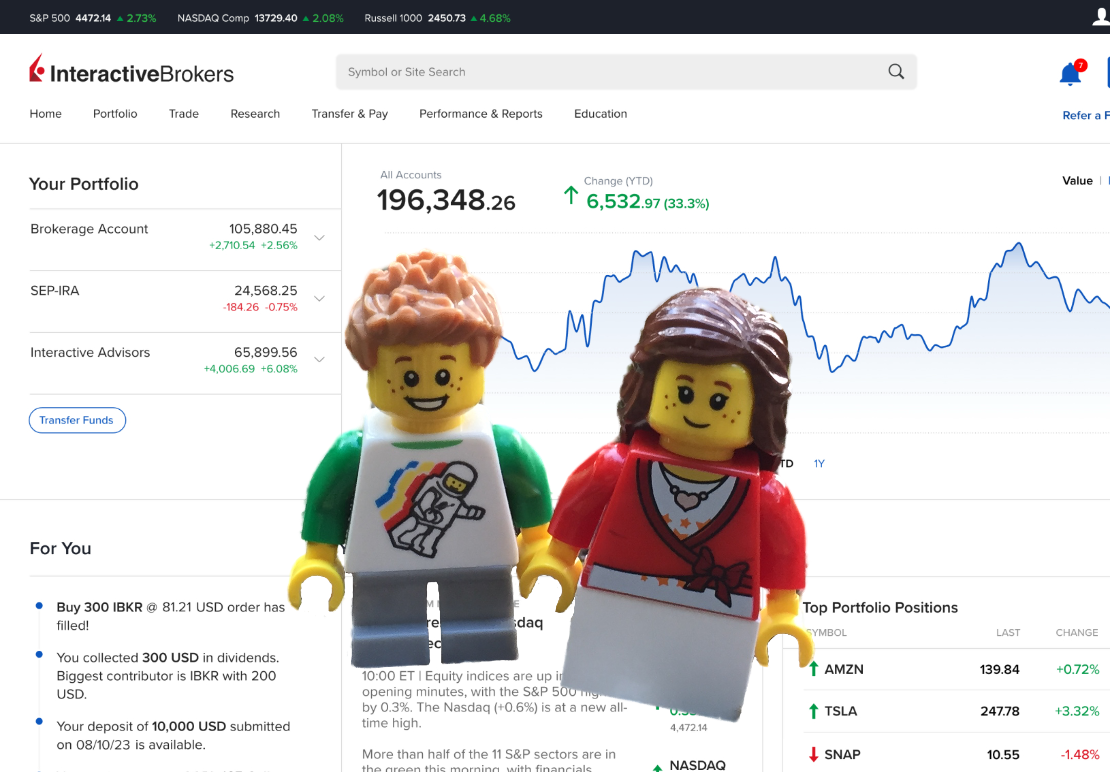

As always, I use Melanie and Adrian as representative characters for the readers of the blog.

Both of these investors are “buy and hold” investors.

They buy 1x global ETF and 1x Swiss ETF alternately, every quarter.

Their goal with this investment strategy is to have an investment portfolio that takes maximum advantage of the potential of global companies, while keeping a slightly safer portion in their own currency, the Swiss franc.

And the idea of buying one ETF each quater (not both at the same time) is to minimise the transaction costs of your orders as much as possible.

The only two things that differentiate Melanie and Adrian are: the amount of money they can invest each month (Adrian is starting his career on a low salary), and their starting wealth (Melanie is older and therefore has more basic savings).

I’m deliberately letting you with the other top brokers (after Interactive Brokers and DEGIRO) so that you can see how quickly the fees increase. And that’s as soon as you get beyond the top 3.

Examples of fees for trading and administration of your DEGIRO or Interactive Brokers account

But first, here are the fees charged by the best online brokers for an investor residing in Switzerland:

Then, here are Adrian and Melanie’s 6 scenarios based on the amount invested each month, and their wealth invested in the stock market to begin with:

Summary of brokerage fees

So, in the summary table already discussed below, here’s how DEGIRO and Interactive brokers rank:

The result is indisputable: Interactive Brokers is THE cheapest brokerage platform for a Swiss investor.

Interactive Brokers is between 23x and 48x cheaper than the most expensive of the 7 online brokers compared here.

Imagine if I included all the cantonal banks and other banking behemoths with the red logo :)

DEGIRO is also very well ranked, since the next most expensive online broker (Saxo Bank) is already between 1.5x and 9.5x more expensive than DEGIRO!

A side note on Swiss stamp duty: What is it and who has to pay it??

Swiss stamp duty is a tax due by any Swiss investor who buys securities (ETFs, shares, etc…) via an online broker based in Switzerland. The amount of this tax is 0.075% of the transaction amount for a Swiss security, and 0.15% for a foreign security.

One of the advantages of choosing a broker such as Interactive Brokers or DEGIRO (both based outside of Switzerland, but doing business in our beautiful country nonetheless) is that you do not need to pay this stamp duty :)

You can learn more by reading my guide to tax optimisation for Swiss investors.

Interactive Brokers vs DEGIRO: who is more reliable?

Now that we’ve covered the fees aspect, let’s talk about security.

Until 2022, my view was this:

Interactive Brokers is more secure and reliable than DEGIRO, as IBKR has been around since 1978 compared to DEGIRO which was created in 2013. This difference of 35 years of experience allows Interactive Brokers to have gone through several global stock market crises, still being active to this day.

DEGIRO and BaFin since the end of 2022: Should I be afraid as an investor?

Then came December 2022.

DEGIRO got caught by the German financial authorities (BaFin, the equivalent of our FINMA in Switzerland).

In DEGIRO’s own words at the end of November 2022: "[BaFin] has identified shortcomings in certain business practices and corporate governance"

The press release goes on to explain its actions following this BaFin audit:

- Appointment of a new Chief Risk Officer to stengthen its governance

- Allocation of 50 million euros of additional capital

It should be noted that BaFin is very careful with this kind of follow-up, as they have had a case of bankruptcy of a financial operator and do nt want it to happen again.

However, DEGIRO itself has grown enormously in recent years. And the fact that we have to slow down a bit to make sure that everything is 200% under control is a good thing for us small European investors.

It makes me personally feel better, because it proves that BaFin is doing its job.

Furthermore, DEGIRO has been assigned a special representative of BaFin at the end of February 2023. His mandate is to ensure close monitoring of the implementation of the projects to implement the measures recommended by BaFin.

As a small gift to the representative… a fine of 1'050'000€ for recklessness.

In short, as a client of DEGIRO for my children’s investment portfolio, I am not worried by this news. I keep my savings there

In detail: I think it will play out for DEGIRO. These imposed regulatory measures just show that their maturity is still being built. After that, when you compare them with Interactive Brokers founded in 1978, and with its founder still at the head of the ship, there’s no contest in my opinion!

DEGIRO vs Interactive Brokers: which ETFs are available?

Both brokers offer a long list of ETFs. But there is a key difference between their offer: not all US ETFs are available at DEGIRO

Indeed, there are European regulations (but not yet applicable in Switzerland) that require more effort to make US ETFs available to all European investors.

Except that these regulations for Europe are not applicable in Switzerland.

But DEGIRO has made life easier by putting everyone on the same regime, including the Swiss. As a result, we no longer have access to the world’s best ETF, the VT ETF (whose ISIN number is “US9220427424”), also known as “Vanguard Total World Stock ETF”.

Interactive Brokers, on the other hand, continues to differentiate between each jurisdiction. So as a Swiss investor, we still have access to this famous VT ETF.

Next, DEGIRO still offers the excellent Irish VWRL ETF (ISIN IE00B3RBWM25).

But the VT ETF is better than the VWRL ETF for three reasons:

- The VT ETF has a total expense ratio of 0.07%, compared to 0.22% for the VWRL ETF (aka Vanguard FTSE All-World UCITS ETF Distributing)

- The VT ETF is more diversified (with 9'518 companies) than the VWRL ETF (with “only” 3'732 companies)

- Finally, the VT ETF is more interesting from a tax point of view than the VWRL ETF for reclaiming withholding taxes (see this article to understand why)

So, if you are a Swiss investor in “buy and hold for the long term” mode, then Interactive Brokers is better with its more complete selection of US ETFs.

Deposit protection: Difference between Interactive Brokers and DEGIRO

Another important point to consider when choosing between DEGIRO and Interactive brokers is deposit protection.

In this case, it is the country in which your broker is based that will dictate which reglations it follows in the event of bankruptcy.

The parent company Interactive Brokers is based in the United States. The company is a member of the SIPC (“Securities Investor Protection Corporation”). The SIPC is a non-profit corporation that has been protecting investors for over 50 years. Their mission is to return investors’ cash and securities when their brokerage firm fails.

As a result of IBKR’s membership of the SIPC, all investors using Interactive Brokers have their assets protected up to $500'000 USD, with a limit of $250'000 USD in cash.

On the other hand, DEGIRO is part of the German bank flatexDEGIRO Bank AG. Each client therefore benefits from a protection of up to €100'000 of non-invested cash (thanks to the German deposit guarantee scheme).

Now, you have to understand that the securities you buy in your name are very often stored in a securities account in your name, AND especially separate from your broker’s accounts. So if there is a bankruptcy, you don’t risk losing these securities.

IBKR and DEGIRO both practice the separation of assets for their clients.

As far as cash is concerned, the advantage of IBKR is that it protect your liquidity up to 250'000 US dollars, as opposed to “only” 100'000€ for DEGIRO.

Languages available: is there a significant difference?

The last point that you might not think about is the languages supported by DEGIRO and Interactive Brokers.

Knowing that in Switzerland there are many people who speak English more easily than our four official languages, this is a criterion that can become decisive for many readers.

DEGIRO is available in 4 languages for the Swiss market: German, English, French and Italian.

It’s a pity that DEGIRO doesn’t use its presence in many other countries (and therefore languages) such as Portugal or Finnland. But still, I understand them because each text is actually specific for each market. So it would be a lot of extra work for a few clients in the end.

IB offers its services in 11 languages: English, German, Spanish, French, Italian, Russian, Chinese (2 variants), Japanese, Arabic and Hebrew.

The 11 languages supported by the Interactive Brokers Switzerland trading platform: English, German, Spanish, French, Italian, Russian, Chinese (2 variants), Japanese, Arabic and Hebrew

If you speak another language like German, French, or Italian, then Interactive Brokers may be a better fit for you than DEGIRO since it supports more languages.

Other features and functions offered by Interactive brokers and DEGIRO

Apart from the key elements discussed above, there are 3 other points I want to go into detail with you.

DEGIRO vs Interactive Brokers user interfaces

As you know, we do not trade stocks everyday.

We buy our ETFs within 30 minutes once a quarter.

And then we lock up our laptop to go back to other much more rewarding occupations :)

So, whether the interface is nice or not, or a bit too complex: we don’t care!

Well then, with the advent of user experience in the digital world, we have seen online brokers increasingly offer user-friendly interfaces that are easy to use even for a newbie.

IB and DEGIRO are no exception.

Whether it’s their mobile app or their web trading platform, these two brokers are on par with their online brokerage user interface.

Investment portfolio report: is Interactive Brokers or DEGIRO better?

One of the other important features as a stock market investor is the investment portfolio reports.

First of all, for performance monitoring purposes (to know how your portfolio is performing).

And secondly - and this is certainly where it’s more useful - when you do your taxes, having an efficient reporting tool is key (so you don’t waste hours clicking and exporting PDFs).

From my experience as an investor in US ETFs (like my favourite VT ETF), Interactive Brokers is much more advanced in terms of reporting.

It’s much easier to find, for example, all your foreign dividends and their associated withholding taxes. And that’s because everything is centralised in the same unique and ultra comprehensive report.

Zooming in on my dividends list and corresponding withholding taxes in my Interactive brokers report

Whereas on DEGIRO, you have to do plenty of digging.

Some parts like transactions are available in the web interface with a filter while other information is only available for download (PDF or CSV).

All in all, Interactive Brokers does much better than DEGIRO regarding the portfolio reporting functionality.

DEGIRO and Interactive Brokers mobile and web application

Another practical feature is the availability of a mobile app and an online trading web application.

Such tools allow you to make your quarterly purchases from the comfort of your bed, via the IBKR or DEGIRO mobile app.

And when Febrary comes around with the Swiss taxes, you pull out your laptop with the web app to be able to fill in your tax return with ease.

On this specific point, Interactive Brokers and DEGIRO are also on par as they both offer good mobile and web applications.

Conclusion: Comparison between Interactive brokers or DEGIRO?

DEGIRO is a good choice if you are just starting to invest in the stock market AND you want a European based online broker. Its brokerage fees are very low and it’s trading platforms (mobile app and web) are easy to use for a beginner investor.

When you are ready, change to Interactive Brokers if you’re into long-term stock market investing: the lowest trading fees on the market, a company that’s been around for more than 45 years (!) and was a pioneer in online brokerage. It has access to the best possible US ETFs for Mustachians.

And if you absolutely want an online broker based in Switzerland, then I always recommend, Saxo Bank (<= CHF 200 brokerage fee refunded using this link) which is awarded the bronze medal in my top 3 best broker for investing in the sstock market in Switzerland.

How about you, which trading platform did you choose between Interactive Brokers and DEGIRO?