We have bought our first rental property in Switzerland!!!

Here’s to the new passive income stream in CHF :D

What an adventure packed with surprises… I have to admit!

Context on our real estate investment strategy

My goal last year was to acquire a rental property in Switzerland.

We couldn’t afford it until a few years ago, so we looked at other alternatives. Especially on the other side of the Jura border.

As you already know, we bought a French rental property in 2019. And we did exactly the same when presented with the possibility of purchasing a second (investment property with an IRR of 21% !)

But as I explained to you in a previous article, France is great with its 100% or even 110% mortgage possibilities.

On the other hand, there are also disadvantages such as taxes which tend to increase after every presidential election. The same goes for the taxation in Switzerland, with some ugly clouds approaching in the canton of Vaud…

Generally, French tenants are much less respectful (from our personal experience anyway), and the system is rather disadvantageous for homeowners by default.

In short, I’ve always figured:

As soon as we can financially buy real estate in Switzerland, we will refocus on our country, as France is too unstable fiscally and has a political system that is too disadvantageous for homeowners

Spring of 2022: the start of our search for a rental property in Switzerland

So, 2022 was chosen to be the year we were going to buy our first rental property in Switzerland.

We had the funds (thanks in particular to our mortgage switch, which you can read here).

We had also done our research and acquired the necessary knowledge of rental properties..

And above all, we had started to create our network of owners and investors in French-speaking Switzerland (a critical step in the real estate investment process, as I describe in my program).

So we started to visit a lot of different properties.

It was a bit of an emotional rollercoaster.

Because even though I have a process with very clear metrics for decision making, the excitement of buying my first Swiss rental property meant that my decision making was sometimes clouded by my emotions.

As soon as the first property met the performance requirements of my Excel file, I thought it was THE one! ^^

Fortunately, I decided to work with a business partner for this first property purchase.

So, when I was too focused on a property because it was so well located, my partner reminded me of our approach.

The same goes for me when he saw the potential for improvement (via work that he likes to do), I reminded him of our 4.5% minimum gross yield rule!

Summer of 2022: a great investment opportunity… that went down the drain

We visited 4-5 properties in total before finding THE right rental investment project.

In order to be able to quickly calculate the rental potential every time, we focused on the regions we knew.

In other words, the regions of the distric of Morges, Gros-de-Vaud and the Jura Nord Vaudois.

A great opportunity even made us leave our comfort zone and go to… Fribourg.

The profitability was great on paper. But in the end the investment opportunity was unclear and shady when we started asking questions about the history of the construction, rents, etc… The deal was dodgy!

Next!!

Having engaged my French-speaking real estate network like crazy during spring, a first opportunity popped up in June 2022.

There was some work to be done (clearly not a turnkey deal where you buy and receive the rent directly), but we were interested.

My partner and I agreed to hand in an offer on afternoon in July. Then… the seller had a problem with the building permit for the works… we tried to find solutions, but nothing helped (and I am not talking about the added value on the construction part…)

Back to square one.

Autumn of 2022: Mustachian perserverance pays off!

Connections, connections, connections. There is no other way, it is a key element of success in rental investment from what I saw in my recent experience as a real estate investor.

Because it was via connections that we got back on the saddle quickly in August with a new potential rental property.

At first, we validated that the rental property had a sufficient return according to our strict selection process. It was close, but it passed: Check!

Then we went to visit the property. No bad surprises there either.

This was followed by several follow-up visits to discuss technical points.

And then we entered the negotiation phase.

Even though it was my first rental investment, the price was rather high and I didn’t want to rush and lose an opportunity for a higher return.

The key was that the owners had very few viewings as they told us in informal discussions.

Long story short: the real negotiation actually started after the summer holidays once everyone had returned from their holidays.

We came up with a much better performance figure around November.

Then we started with the paperwork: bank meetings to prepare the mortgage project, creation of a Swiss SA, meetings with the notary, etc.

You should know that the end-of-year period was very busy due to my other acquisition of my rental property in France!

The deal was therefore concluded in 2022 and the notary signing took place at the very beginning of 2023.

We are now officially owners of a rental property in Switzerland!!!

Numbers, we want numbers!

I know you guys well, since I’m the same way: “We want numbers, numbers, MP!!”

How much did this Swiss rental building cost?

1.6 million CHF.

And how much gross rental income will you get from it?

CHF 108'000 per year.

Note that I am working with a partner on this project, so the earnings and expenses are divided by two. But since we also split the funds in half, the return calculations are also split in two.

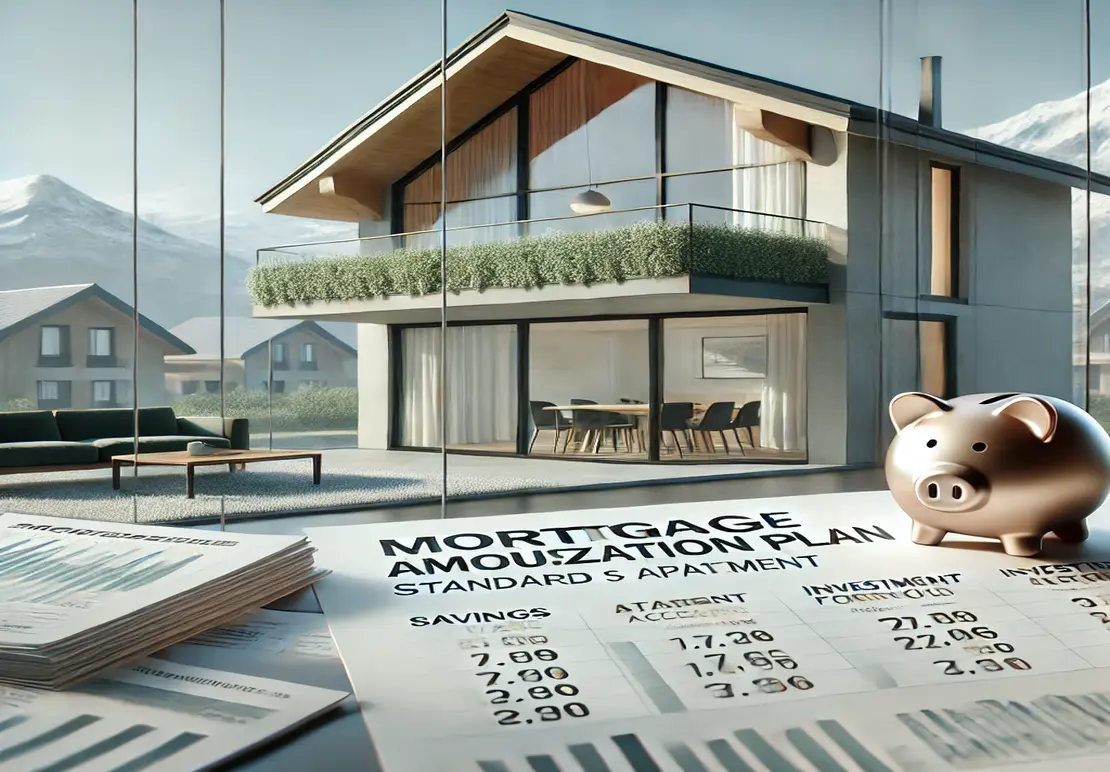

So what about the return on equity (net, after taxes and expenses)?

9% net cash flow return on equity!! This means that I don’t count the rent that is used to pay back the mortgage (in other words, this money stays in my assets, but in stone, not in cash).

And if we calculate the gain including the amortization of the mortgage, we result in a 12.7% return on equity. NET!

What about recurring costs for the rental property in Switzerland?

Can you please give us all the recurring charges you will have to pay in total?

With pleasure:

- PPE charges (heating and electricity for communal areas)

- Management fees

- Maintenance costs

- Risk of vacancy

- Mortgage interests

- Taxes on rental income

- Total in CHF ~ CHF 52'000

I would also like to point out that you should not forget the one-off charges such as:

- Notary fees at the time of purchase (5% in canton Vaud)

- Incorporation costs of the Swiss SA that owns the property (notary, capital deposit account, etc…) = around CHF 2'000

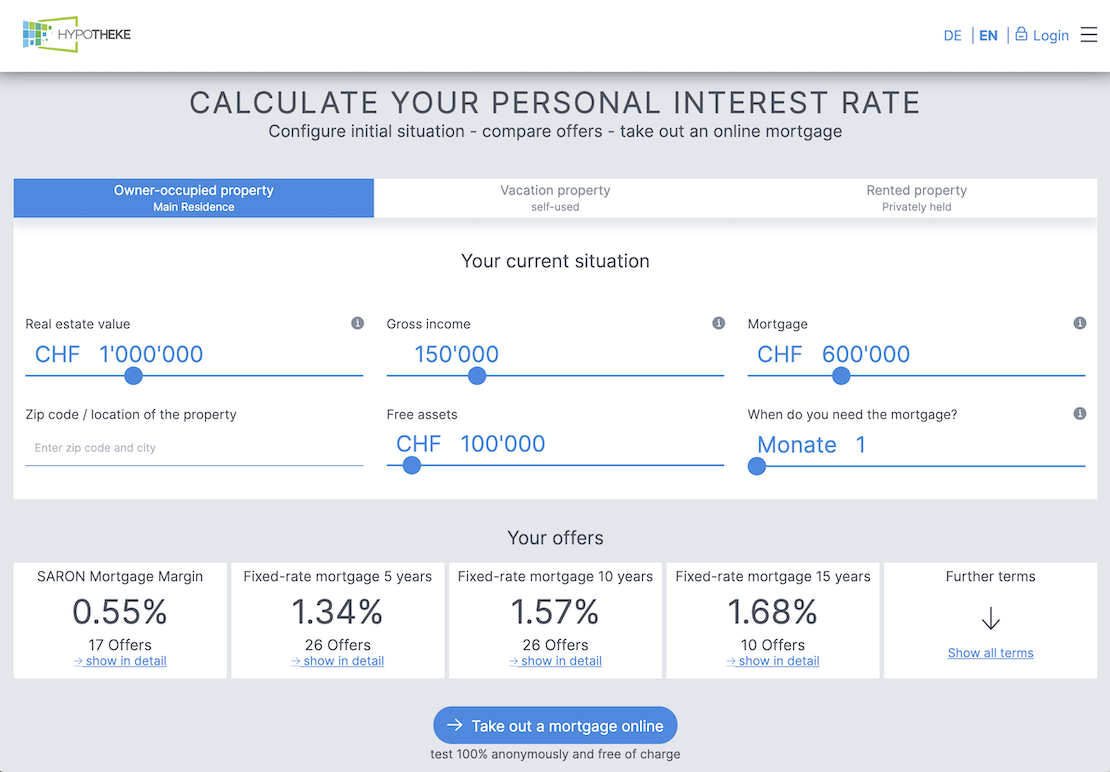

What about the interest rate on your mortgage?

Luckily for us, the previous owner had a 10-year fixed rate mortgage a few years ago. So we benefit from an interest rate of 1.35% for the foreseeable future :)

This helps with the profitability of this investment regarding the mortgage rates which have been rising over the past few months.

Are all the apartments rented out?

Yes, and this has always been the case for several decades.

This is one of my real estate investment criteria: I wanted proof (rental leases and bank account transaction history) that each and every flat was rented out for the last 6-8 years. At minimum.

Conclusion

Rental investment is likely to become a second pillar of our FIRE (Financial Independence, Retire Early) strategy. Thanks to the leverage effect of mortgages, investing in a building allows you to increase your return on equity in exchange for a little more work than the stock market. (it’s obvious that rental investment needs more time than investing in the stock market!)

The stock market will nevertheless remain the major cash allocation for MP for at least the next few years.

Potentially, in the medium to long term, the share of real estate will increase among our investments on our way to financial independance in Switzerland.

I say “likely” and “potentially”, since this is the first real estate investment I made in Switzerland.

And we will have to see if this investment is actually “passive” since we are imagining a system where the property manager will take care of everything from top to bottom.

But I thinks it’s unlikely that it wouldn’t work, knowing that in France we only have someone to deal with the incoming and outgoing payments, and that it’s us who manages the rent payments, the reminders and the services of craftsmen (electrician, plumber, etc…) if necessary. And it’s working out quite well, even if it takes up too much of our time for my taste.

Anyway, I raise a toast to the beauty of passive income. Cheers!

I will of course keep you posted on the progress of this first project (especially the rents that drop ;)).

Our next step: a second rental investment in Switzerland

Now that we have put our clear and defined process into practice, we are looking for a second rental property.

So if you find anything in the canton of Vaud that exceeds the 5% ROE (gross), you know where to find me :)

How about you, have you invested in rental properties? Did you succeed? In which canton?

Do you want to get into real estate in Switzerland?

Would you like to join the world of real estate investors?

But you lack a clear and concise procedure on how to get there?

Then my Swiss rental investment program will be a perfect match for you.

It’s in “simplified” mode.

No blah, blah, blah.

No “I’m selling you an unattainable dream” or marketing crap.

Only the essentials.

Only sharing experiences.

My goal is simple: to offer you a path to knowledge rather than you having to go through all the dead ends and running in circles just like I did before reaching a process that works for any first Swiss real estate purchase.

Because once you buy one, you’ve basically done the hard part.

And you can repeat the same exact process as many times you want to become financially free (FIRE) in Switzerland.

After all, the way to financial independence isn’t only just the stock market. There are countless ways to increase your passive income. More effort will transform into more returns. It’s up to you to select the path that works best for you.

You can find all the information on my Swiss real estate program dedicated page.

Last updated: March 30, 2023