What if you could increase your wealth while saving on taxes, AND freeing up cash for other investments?

That’s what indirect amortization of your mortgage can enable you to do. If it’s done correctly!

What does indirect or direct amortization actually mean?

When purchasing your first home, you might plan to secure the best mortgage and repay the debt (along with the interest) directly each month until it’s fully paid off. This approach is known as direct amortization.

But there is an alternative where you put your mortgage repayments into a 3rd pillar. That’s what is called indirect amortization.

Reminder of the mortgage amortization rules in Switzerland

For a primary residence, Swiss banks typically finance up to 80% of the property’s total value.

All mortgages taken out for your main residence are divided into two levels:

- The 1st level of your mortgage corresponds to 65% maximum of the total property price. You can keep this 1st level mortgage for life, without ever paying it back (however, you pay interest on this debt for life as well).

- The 2nd level of your mortgage corresponds to 15% maximum of the total price of the property.

- You must repay this mortgage within a maximum period of 15 years OR before retirement age (depending on which comes first) if you choose direct amortization.

- However, if you choose indirect amortization you can only repay these debts when you are 65 (and not within 15 years).

The ideal mortgage amortization for a Mustachian (with a supporting example)

Another reminder: I’m assuming that you’re a Mustachian, and so you make all the money you save work for you — and that NO, you don’t spend it as quickly as possible.

Let’s imagine that you want to buy real estate worth CHF 720'000 in Switzerland (house or apartment, it doesn’t matter which).

Your financial plan might look something like this:

- 20% = CHF 144'000 of your own money as a deposit (to which will be added the notary fees which also have to come out of your own money)

- 65% = CHF 468'000 of 1st level mortgage

- 15% = CHF 108'000 of 2nd level mortgage

And concerning our other hypotheses:

- 2.5% mortgage interest rate

- CHF 7'200 of indirect amortization paid into your 3a pillar every year (I’m using CHF 7'200 in order to have a round number) ~ 1% of total mortgage amount

- 25% marginal tax rate (this is the tax percentage applied to every last franc earned)

- Approximately 5.5% tax on the amount withdrawn from the 3a to pay back the mortgage

- 8% annual stock market return, for the opportunity cost of tying up money in bricks and mortar by paying back directly (rather than putting this money into the stock market)

Three important points:

1/ I am not taking into account the growth of your 3a pillar portfolio that is invested 100% in stocks. After all, regardless of whether you’re doing direct or indirect amortization, you’re filling your 3a pillar to the maximum as a Mustachian.

2/ Similarly, I am not taking into account your 3a pillar tax deductions, as you’ll be entitled to this regardless as you fill it to the maximum whatever the type of amortization.

3/ I’m not taking into account the impact of direct amortization and the increase in tax on your wealth, as the latter has a minimal/negligeable impact on our calculations.

That therefore gives us these two scenarios, with a calculation over the next 15 years:

| Direct amortization (bank) | Indirect amortization (3rd pillar A) | |

|---|---|---|

| 2nd level tranche | 108'000 | 108'000 |

| Mortgage interest (2.5%) [1] | 21'600 | 40'500 |

| Tax savings via deduction of mortgage interest [1] | -5'400 | -10'125 |

| Tax on withdrawal of 3a capital | 0 | 7'000 |

| Missed opportunity cost (cash tied up in stone vs. 8% annual return on the stock market) [2] | 211'146 | 0 |

| Total costs | 335'346 | 145'375 |

| Advantage of indirect amortization | 189'971 |

Comparison of direct or indirect amortization of a mortgage (table above)

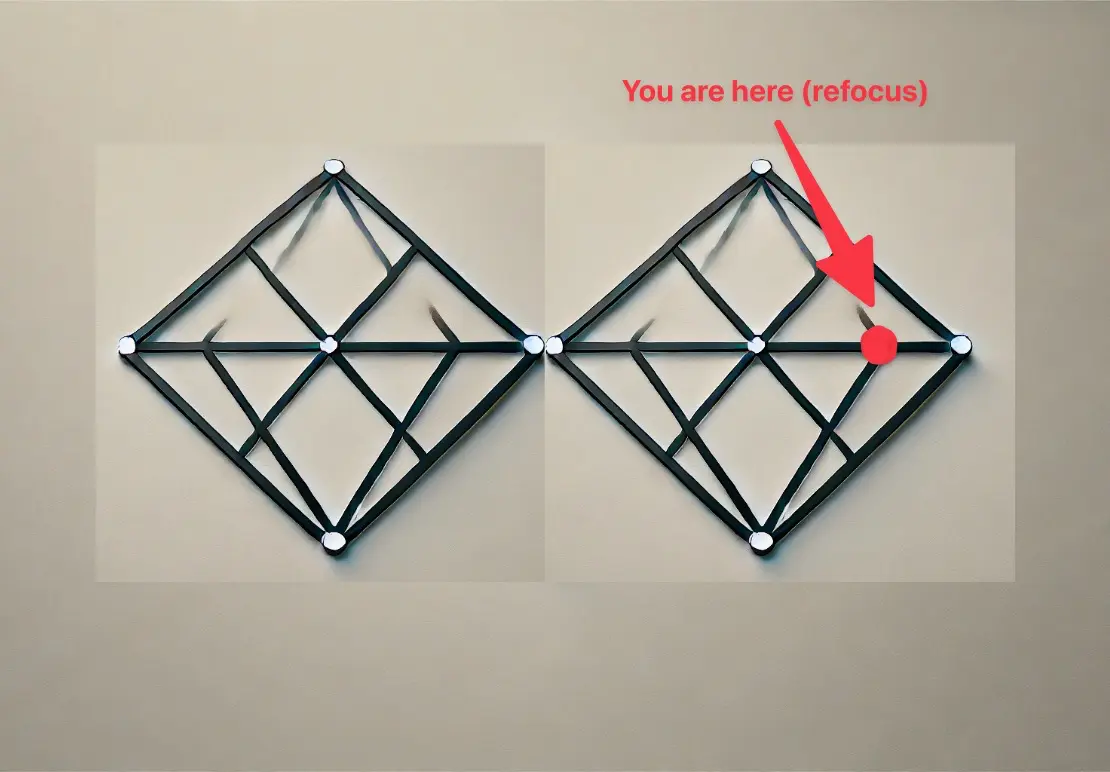

In choosing indirect amortization, you’re ticking two boxes at the same time: you’re paying back your mortgage AND you’re filling your 3a pillar. And therefore you’re not tying up savings in property unnecessarily. And so you can put this cash into the stock market.

Direct or indirect amortization: Here is what the cash flow looks like:

- Direct amortization

- 7'200.- in bricks and mortar every year (direct repayment)

- 7'200.- to fill up your 3a

- Money (if any left) invested in the stock market

- Indirect amortization

- 7'200.- to fill up your 3a AND pay back the property later

- 7'200.- that you can invest in the stock market at 8%

- And any other money (if there’s any left) is also invested in the stock market

Indirect amortization of a main residence mortgage is therefore the preferred option for any self-respecting Mustachian.

Which 3a pillar should I choose for indirect amortization?

I’ve set out which is the best 3rd pillar for a Swiss Mustachian in this article. In sum, you want to choose the 3rd pillar where you can invest the maximum amount of money in stocks (99%, as 1% is always reserved for liquid funds in order to pay the service charges), and with the minimum fees. Currently, there are two main 3a pillars like this on the market which are the best. But the competition is furious about this, which is positive for us consumers.

So therefore, you’re going to want to do indirect amortization of your mortgage in Switzerland through such a 3a pillar invested 100% in stocks, in order to maximize your returns. Not all banks accept finance via such a product, but some do. Please read my full article on the best mortgage in order to get the most up-to-date information.

And a reminder: NEVER take out a 3rd pillar linked to life insurance, unless you want to lose several tens of thousands of Swiss francs like me…

Conclusion

Indirect amortization of a mortgage in Swizterland enables you to use a lever effect by only putting the absolute minimum into bricks and mortar, and investing the maximum into the stock market at the same time.

We’re talking there about the potential to gain several hundreds of thousands of Swiss francs over 15-20 years. Therefore, indirect amortization of your main residence is the obvious choice for a Mustachian. Because, every reader of this blog is looking to achieve financial independence one day, and is therefore going to invest their money so that it makes more money ;)

Note that this theory is correct as long as you invest everything in the stock market that you’re not putting into bricks and mortar through direct amortization. Otherwise, direct amortization can make sense (see the FAQ below).

And what about you, are you paying back your mortgage via direct amortization or indirect amortization?

Mortage Amortization: FAQ

Which type of amortization is best if you’re not a Mustachian?

If you stumbled upon this blog and your goal is to minimize costs so you can spend the rest of your money as you wish, the calculation becomes less straightforward: the choice between direct and indirect amortization of your mortgage will depend on the mortgage rate and the return on your 3a investments.

Here are two examples of different calculations when it comes to the level of interest of the loan and the return of the 3rd pillar:

Low mortgage interest rate, “high” 3a interest rate

| Direct amortization (bank) | Indirect amortization (3rd pillar A) | |

|---|---|---|

| 2nd level tranche | 108'000 | 108'000 |

| Mortgage interest (1.5%) | 12'960 | 24'300 |

| Tax saving via deduction of mortgage interest | -3'240 | -6'075 |

| Interest on 3a (2%) | 0 | -19'010 |

| Tax saving via deduction of payments into 3a pillar | 0 | -27'000 |

| Tax on withdrawing 3a capital | 0 | 7'000 |

| Total costs | 117'720 | 87'215 |

| Advantage of indirect amortization | 30'505 |

High mortgage interest rate, low 3a interest rate

| Direct amortization (bank) | Indirect amortization (3rd pillar A) | |

|---|---|---|

| 2nd level tranche | 108'000 | 108'000 |

| Mortgage interest (4.5%) | 38'880 | 72'900 |

| Tax saving via deduction of mortgage interest | -9'720 | -18'225 |

| Interest on 3a (0.2%) | 0 | -1'753 |

| Tax saving via deduction of payments into 3a pillar | 0 | -27'000 |

| Tax on withdrawing 3a capital | 0 | 6'000 |

| Total costs | 137'160 | 139'922 |

| Advantage of direct amortization | 2'762 |

In summary, for a spender, the more the mortgage rate increases, the more direct amortization becomes interesting compared to indirect amortization.

But then, why does the advice of Swiss bankers always lean towards indirect amortization being always better for you? Because they have a huge conflict of interest in selling you this amortization:

- The longer you stay with the banks, the longer you’re going to be paying interest to them

- By selling you indirect amortization, these banks have the opportunity to sell you one of their 3rd pillars, which increases their profits further

Is it possible to have one mortgage tranche with one bank and the second with another?

I have rarely (never?) heard of a bank agreeing to share a mortgage with another financial institution. So the answer is no.

If you have another experience, email it to me.

Calculation details

[1] Mortgage interest and tax savings through mortgage interest deduction

Direct amortization:

| Year | Remaining mortgage | Interests | Tax deduction |

|---|---|---|---|

| 1 | 108'000 | 2'700 | 675 |

| 2 | 100'800 | 2'520 | 630 |

| 3 | 93'600 | 2'340 | 585 |

| 4 | 86'400 | 2'160 | 540 |

| 5 | 79'200 | 1'980 | 495 |

| 6 | 72'000 | 1'800 | 450 |

| 7 | 64'800 | 1'620 | 405 |

| 8 | 57'600 | 1'440 | 360 |

| 9 | 50'400 | 1'260 | 315 |

| 10 | 43'200 | 1'080 | 270 |

| 11 | 36'000 | 900 | 225 |

| 12 | 28'800 | 720 | 180 |

| 13 | 21'600 | 540 | 135 |

| 14 | 14'400 | 360 | 90 |

| 15 | 7'200 | 180 | 45 |

| Total | 21'600 | 5400 |

Indirect amortization:

| Year | Remaining mortgage | Interests | Tax deduction |

|---|---|---|---|

| 1 | 108'000 | 2'700 | 675 |

| 2 | 108'000 | 2'700 | 675 |

| 3 | 108'000 | 2'700 | 675 |

| 4 | 108'000 | 2'700 | 675 |

| 5 | 108'000 | 2'700 | 675 |

| 6 | 108'000 | 2'700 | 675 |

| 7 | 108'000 | 2'700 | 675 |

| 8 | 108'000 | 2'700 | 675 |

| 9 | 108'000 | 2'700 | 675 |

| 10 | 108'000 | 2'700 | 675 |

| 11 | 108'000 | 2'700 | 675 |

| 12 | 108'000 | 2'700 | 675 |

| 13 | 108'000 | 2'700 | 675 |

| 14 | 108'000 | 2'700 | 675 |

| 15 | 108'000 | 2'700 | 675 |

| Total | 40'500 | 10'125 |

[2] Compound interest calculation of CHF 7'200 invested in the stock market (8% annual return)

| Year | Total savings | 8% annual yield (compound interest) |

|---|---|---|

| 1 | 7'200 | 7'776 |

| 2 | 14'976 | 16'175 |

| 3 | 23'375 | 25'245 |

| 4 | 32'445 | 35'041 |

| 5 | 42'241 | 45'621 |

| 6 | 52'821 | 57'047 |

| 7 | 64'247 | 69'387 |

| 8 | 76'587 | 82'714 |

| 9 | 89'914 | 97'108 |

| 10 | 104'308 | 112'653 |

| 11 | 119'853 | 129'442 |

| 12 | 136'642 | 147'574 |

| 13 | 154'774 | 167'156 |

| 14 | 174'356 | 188'305 |

| 15 | 195'505 | 211'146 |