neon referral code 2025

Use the promotional code "neonMustachian" when you register on bank neon's app.

You'll get the neon Debit Mastercard for free (instead of CHF 20) and a 10 CHF credit as a welcome bonus on your neon free bank account (and you'll also help to support the blog, thanks!)

(N.B. the app may not reflect the bonus directly, but it'll be taken into account, I checked with their support)

What if we were to “legalize” our joint bank account situation in Switzerland? Or should I say “formalize” or even “simplify”…

A joint bank account in one of our two names…

Since we moved to the 100% online bank neon, we’ve only ever had a single bank account in one of our two names.

We each paid our salary into this bank account, with which we paid all our outgoings. Simple. Efficient.

However, we did receive a few questions from one of our two employers, who quickly accepted the situation after verifying that the bank account was indeed registered under the spouse’s name.

Except that… if you read the small print of the bank neon’s account properly, only money destined for the beneficial owner (i.e. the one who has the business relationship with bank neon) can go into the neon bank account.

I wasn’t too concerned about this up until now, as we’re married, and the HBL legal side didn’t say much…

Then came problems with transferring money…

Then, one of us started making large transfers for business purposes. To verify our legitimacy, we had to provide the relevant contracts. That’s when we had our first wake-up call — incoming and outgoing transactions were only allowed if they were in the name of the account holder.

Once, twice, and that was enough to raise the question of salaries. Not OK!

If we wanted to continue, we would have had to complete a form for each deposit to prove that the money coming in definitely belonged to the bank account holder (to absolve the bank of all responsibility) … that’s going to be a lot of paperwork!

So, it was time (and reasonable, I admit) for us to properly formalize our situation.

But then, a subsidiary question…

Alternative Swiss accounts for couples (and a comparison of them)

I will put together a dedicated article for you comparing every available Swiss joint account, and setting out which is the best.

To give you a quick overview, meanwhile, here is my Swiss joint account comparison in three points:

- BCV (and other cantonal and traditional banks): they offer things like “free Swiss joint account if you maintain a minimum account balance of CHF 15'000 at all times, otherwise CHF 15/month”

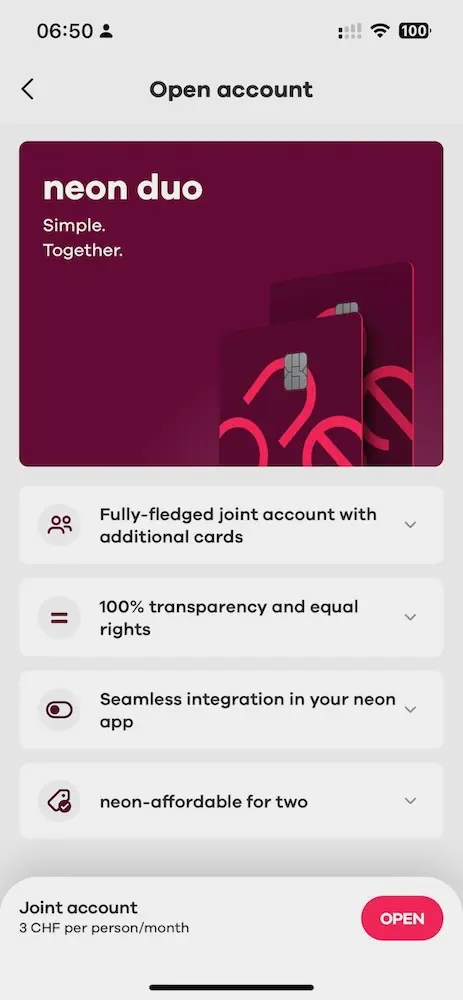

- neon duo: then there’s neon and its 100% online joint account, for CHF 6/month

- Bank WIR: and there’s the new “Bankpaket top” from Bank WIR at CHF 0/month, even for a joint account!

My reasoning was first simple, and then a dilemma.

Ruling out BCV was easy — I have no interest in letting CHF 15'000 sit idly in a bank account just so they can profit from my money. Investing that same 15k CHF in the stock market, even at a modest 6% return, would generate CHF 900 instead.

After that, came a dilemma: on one side bank neon with its neon duo account for couples option, but CHF 6/month (as CHF 3/month/partner) … and on the other side, the Bankpaket top by Bank WIR.

I was on the verge of ditching bank neon and going with Bank WIR…

But on thinking about it again, I thought:

- neon needs to be the best and most competitive with the quality of their products, because they don’t (yet) have any mortgages or other products that would enable them to maintain working capital with the risk of resting on their laurels

- Whereas Bank WIR’s mobile app is quite outdated, and doesn’t really get developed

- Some examples: the integration of Wise into neon, the onboarding user experience (incl. on neon duo) is really great

Another reason for my hesitation in using WIR Bank’s joint bank account is that my mortgage is already with them. I’ve always aimed to avoid being entirely dependent on one banking institution to maintain my negotiating leverage. In the end, I transferred my VIAC mortgage to them without any negotiations. But anyway…

Also, as we’ve seen with several banks in the past, they launch an attractive product, then after a while, they change the conditions. While with bank neon, at least, I know that there’s an account fee right from the start.

On this point, I’m now waiting to see if WIR Bank will play fair over the long term.

But… CHF 6 per month for a joint bank account in Switzerland feels steep when you’re trying to be frugal.

Despite this, I decided to test out the neon duo joint account over 12 months, and then I’ll re-evaluate the situation.

Meanwhile, I view these CHF 72 as support for the development of neon bank (for now, anyway haha), who I’ve really liked ever since they started out.

UPDATE 12.12.2024: you will find my comprehensive comparison of joint accounts in Switzerland on this link.

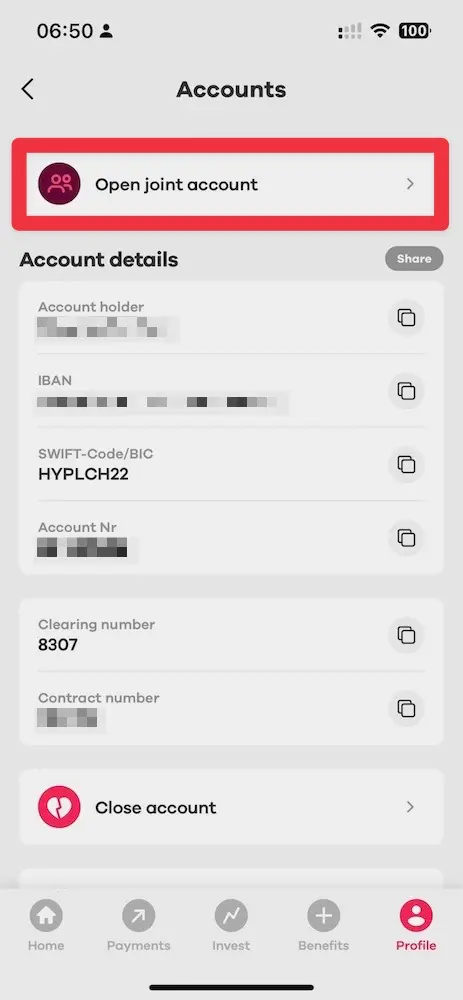

Opening a neon duo joint account (in 6 minutes!)

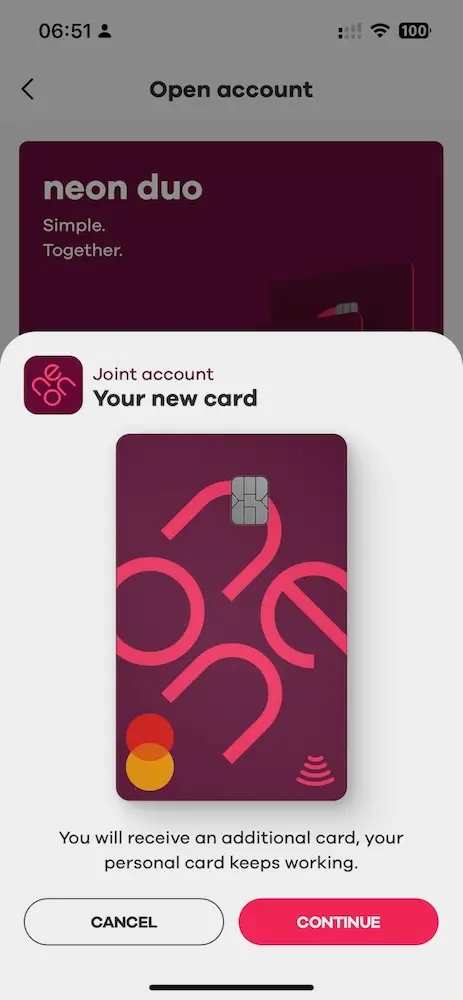

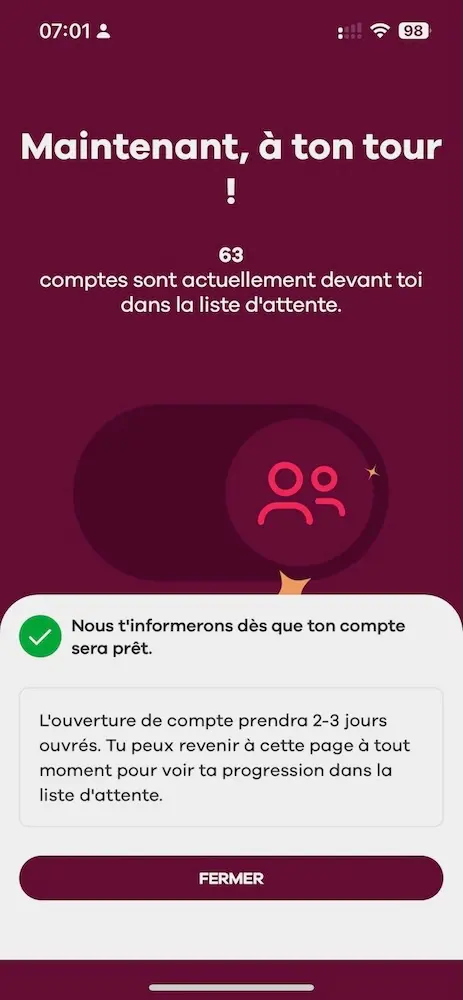

As always, I’ve captured a few screenshots to show you the process of setting up our shared banking account with neon duo.

While the user experience isn’t normally the most important thing for me, given my financial tools, it was a joy to be able to open my Swiss joint account, neon duo, from my sofa in less than… 6 minutes!!

Then you just need to:

- Check your personal details

- Confirm your address (it must be the same as your partner, if you’re a couple, or the other person with whom you live)

- Generate an invitation code for your partner

- Select the option why you’re opening an account for couples (personal use such as paying your joint rent or credit cards, owning and managing assets for a third-party account like a charity, business payments, or payments for the third-party account)

- Accept the various general conditions

- And… that’s it! Then all you need to do is wait 2-3 days for each of the two people to receive their respective credit cards

Don’t forget to transfer standing orders and eBills

We plan to use neon duo as our sole bank account, so we had to transfer all our standing orders and eBills from one of our personal accounts.

I therefore got out my old change of bank checklist which works well for making sure I don’t forget anything.

FAQ

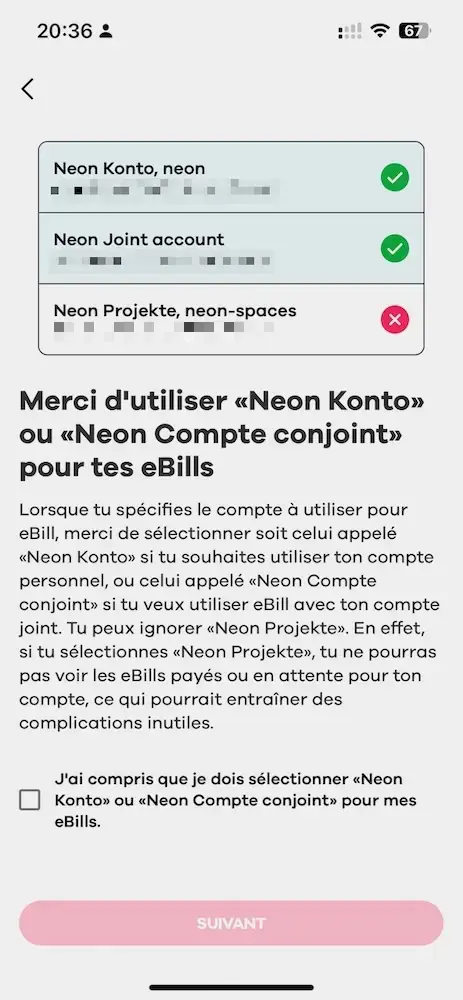

neon eBill (with neon duo)

I wondered how I was going to be able to transfer my current and future eBill payments between my private neon bank account and our joint neon duo account.

In fact, the process is relatively simple:

- Cancel all your future eBill payments on your private bank account

- That makes them reappear as “to be paid” in the eBill section

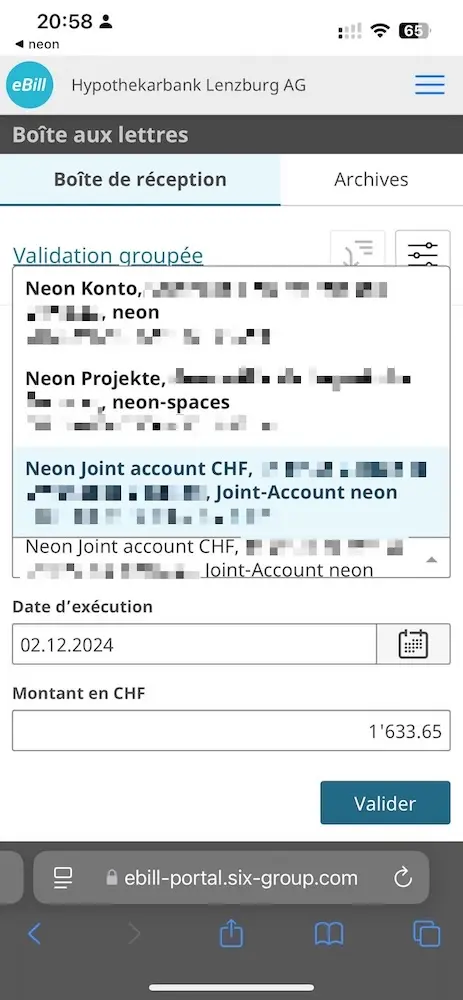

- Once your neon duo account has been created, go back into eBill (via the link in the neon app), and go to pay a bill

- At the payment stage, you just need to select “Neon joint account”, and, that’s it!

Bank neon, neon, or neon bank?

I’m often asked if bank neon or neon bank are different entities. Well, no, they’re just the different marketing names, but they all refer to the online bank neon, which you’ll find through this URL.

Conclusion about the neon duo bank account for couples

After two weeks of using the neon duo joint account, I must say I’m really quite won over by bank neon’s solution. The way you can move quickly between private and joint accounts is really well-thought-out in their ebanking, as are money transfers between these two accounts.

Extracting all my joint account transactions into CSV format works as it should (so that I can do my tracking in YNAB).

Likewise, the eBill system in e-Banking allows me to choose between a private account and a joint account to decide which funds I want to use for my eBill payments.

The only downside is the CHF 3 cost per partner, totaling CHF 6/month. If it’s not free, I was thinking more like 3-4 Swiss francs maximum.

So we’re going to try out neon duo for the next twelve months, and then we’ll review things again.

(N.B. the app may not reflect the bonus directly, but it'll be taken into account, I checked with their support)

How about you, what joint account have you chosen to manage your couple’s personal finances in Switzerland?

Calculate your financial independence accurately! …

Interactive Brokers Switzerland SIPC protection...