My Smile.Car insurance verdict

Smile.car is, in my case, the best frugal car insurance in Switzerland. It offers the usual coverages of a car insurance: accident insurance (partial and full coverage) and liability insurance. It is 100% online. And best of all: it’s the cheapest car insurance in Switzerland.

PROS:

- Cheapest offer in Switzerland

- Entirely online

- Customer service via chat(instead of waiting on a hotline for hours)

CONS:

- 100% online (problematic for some readers I know)

DISCLAIMER:

- I, luckily, have never had to file a claim with Smile. Nevertheless, as I explain below, their procedure for reporting an accident is very simple and user-friendly via their website (or by phone).

- Due to this, I cannot share any personal experiences with their support.

- If you’ve already had to declare one or more claims yourself, I’d be interested in your experience in the comment section below.

My love for insurance…

If you’ve been reading my blogs for a while, you know how much I dislike 95% of Swiss insurance companies.

Whether it’s your car insurance or your liability insurance, most insurances focus a lot of effort on selling fear and over-insuring the Swiss.

This is because of the insurers’ unfair self-benefiting commission based system.

I’m speaking from experience, because I myself was more than overinsured for my car insurance in 2013, just when I started my FIRE (Financial Independence, Retire Early) adventure in Switzerland!

And don’t even get me started on the mixed 3a pillars linked to a life insurance because otherwise I keep on ranting 🤯

Anyway, when an insurance company like Smile (formerly Smile.direct) pops up and enters the juicy market of unscrupulous insurances, it feels good.

Who is Smile (formerly Smile.direct)?

Basically, smile.direct is a Swiss insurtech startup that was created to disturb the quiet and old-fashioned business of insurers since… 1994 already! And this by selling their insurance by phone (every era has its revolution ^^).

Then they took advantage of the digital revolution and went online in 1999.

They digitalised and optimised all their processes in order to reduce their costs to a minimum and offer ultra competitive premiums.

This is the same strategy as the neo-bank neon free and the best online broker Interactive Brokers: they both make money by being the best and relying on the quantity of customers.

Unlike most other insurance companies in Switzerland that rely on dirty marketing…

With the strategy “300% customer satisfaction at all levels”, anything can work in the long term!

Proof: in 2014, Smile became part of the Helvetia group, which was starting to feel threatened that Smile would eventually steal their leading position. Luckily, from what I’ve read, Smile are still as autonomous as before, better for us!

How do you choose your car insurance as a Swiss Mustachian?

Like every year, I review my recurring expenses to optimise them as much as possible.

The goal?

To save as much as possible, to invest the difference in the stock market or in real estate, and to use the passive income created to be financially independent in Switzerland by 40 :)

So, recurring expenses include my car insurance.

Being frugal by nature, any self-respecting Mustachian will opt for a frugal and reliable car (like my beloved old Toyota!)

This allows me to opt for this car insurance strategy:

- I only choose third party insurance and partial cover insurance

- Because I don’t need full coverage because of the low market value of my car!

- In terms of the deductible for partial cover, I have opted for CHF 500 per case in terms of our history and the impact this has on the amount of the premiums

- And I tick off all the fear monger options

- No bonus protection (I prefer to save and be cautious, and self-insure)

- No bonus glass insurance for small headlights

- No compensation higher than the market value, as it is not worth much

- No insurance for personal items in the car (either you hide what you need in the boot on holiday, and generally don’t leave anything of value in there)

- No occupational accident insurance, as I am only with people resident in Switzerland who are already insured through their employer

- No assistance in case of breakdowns, as I self-insure and save every year on what I don’t pay to my insurer :)

- No legal protection (same thing, I self-insure)

- No option for severe negligence, because I am not a Fangio nor is Mrs MP

That’s it, it’s pretty quick to apply :)

Smile.direct premium comparison with the competition

Every year, I use the car insurance comparison website bonus.ch (I don’t like the Comparis.ch one, because it hides the insurers’ name in the list view).

I enter the information about my vehicle and the driver, as well as the selection criteria explained in the previous paragraph. And I run the search engine!

And in the blink of an eye I note down the 3-4 best insurance offers.

Then, to make sure that the comparison website is up to date with the data and the information displayed, I go to the website of all the insurers and do the calculation again on their own website.

Since the beginning of 2020, Smile has always been the cheapest car insurance according to my Mustachian criteria.

I checked again last year during September (because the contracts often stipulate that you can cancel with 3 months notice by the end of the year, otherwise it’s renewed for next year). Smile.car was still the cheapest.

And the same today, as you can see in the screenshot above: Smile.car is the cheapest car insurance in 2024 for Mustachians.

Smile insurance customer reviews and ratings

In addition to the price, I always try to get information about companies with a mobile app by looking at its ratings and reviews on both the Apple and Google App stores.

This is due to unhappy customers who usually use this communication channel to share their frustration.

This is what reassures me about Smile.car’s handling of claims by seeing their rating:

How much will my Smile care insurance cost in 2024?

Since we’re here to talk about money, here’s what I pay to insure my Toyota Prius with Smile.car:

Smile.car car insurance details of the MP family (you'll notice that it's in the name of Mrs MP to pay less ;))

This reminds me of the time when I was paying CHF 1'680 in 2013 before I became a Mustachian…

And now we’re down to only CHF 321.30 a year.

Over a decade, by investing this difference in the stock market each year, we are talking about savings of CHF 18'993!

Smile.car insurance claim: what to do?

I still looked into the issue of claims with Smile, in case I need to use it one day😅

Let’s imagine I had an accident with someone who hit me on one of the hills in Lausanne because of the ice…

We would have parked in a car park in Lausanne to make an official report… on the roof of my Prius, in 3 degrees, with frozen hands…

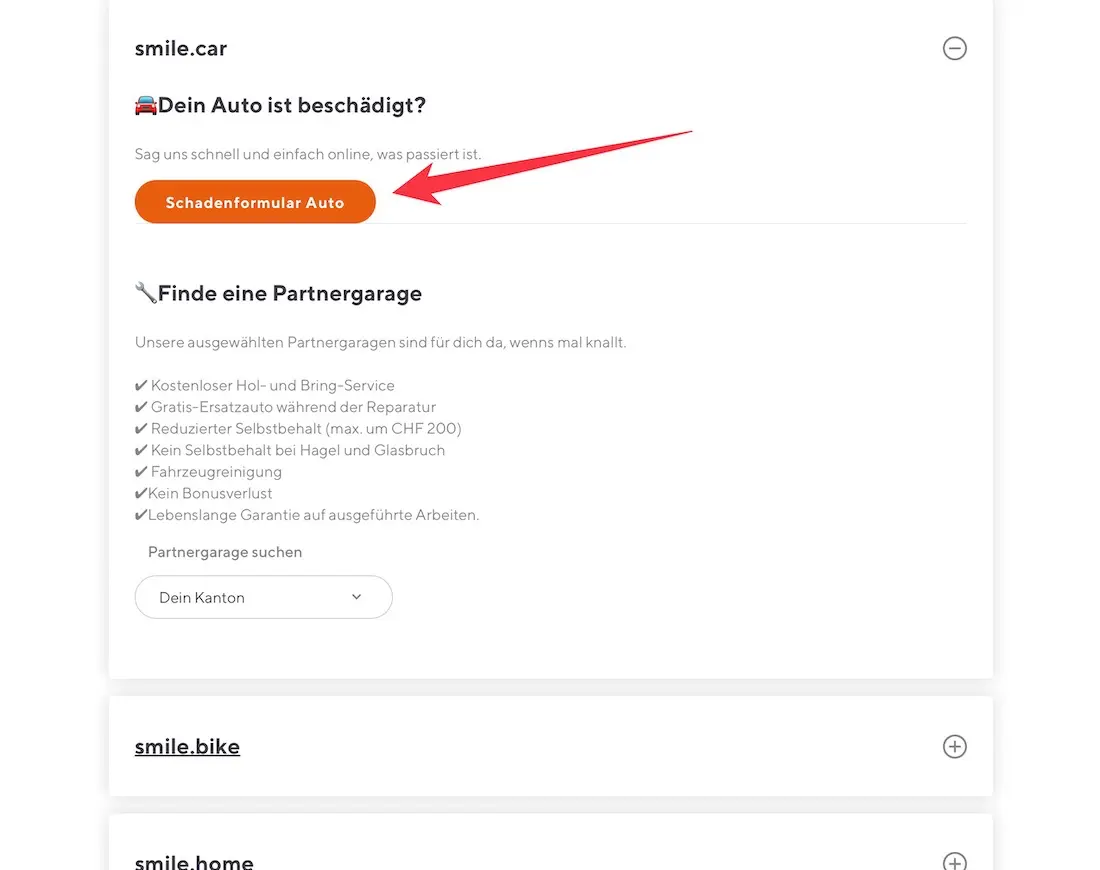

Then, when I got home, I would go to the Smile website - in the warmth!

And here is the procedure I would follow:

- Online declaration if it’s just a simple car scratch, and if it’s clear that the other driver is at fault:

As you can see, it’s really quite simple and straightforward.

For accidents more complex:

- I would have contacted Smile.direct via phone instead (available on their website), in order to ask one of their representatives for any additional information needed

I really hope to hear about your experience if you ever had to deal with a claim with Smile.car.

Short FAQ for newcomers

I’m putting down below a short FAQ for the 2-3 questions I receive the most from my readers. Hopefully it will help you too :)

How long does it take to change your car insurance in Switzerland?

The deadline for cancelling a car insurance policy is usually 3 months. Many insurers also add a contractual clause of annual renewal of the contract. So if you don’t cancel your policy before September 30th, you are bound to the end of the following year.

What is partial cover?

Partial cover car insurance in Switzerland covers damage to your vehicle caused by events such as theft, fire, hail and collisions with animals. However, it does not cover damage caused by road accidents for which you are responsible.

What is full coverage insurance?

Full coverage insurance is the car insurance that covers you for all damage to your car, even damage you cause yourself in an accident. It also includes partial coverage for damage caused by events such as theft, fire, hail, etc…

Conclusion

Since 2020, I have been a satisfied customer with my Smile.car insurance. It is cheap and covers all my needs as a Mustachian driver.

If you are also a Smile customer, let me know if you have ever had to deal with a claim, and how satisfied (or not!) you were with their services. I will adapt my conclusion depending on the feedback I receive.

In the meantime, if you want to switch to Smile to save on your car insurance, you can follow this link to get CHF 50 cashback (*):

PS: If you are a neon or VIAC customer, then go through their marketplace instead because their partner offers are even better than mine ;)

(*) This symbol indicates where my article contains affilite links. If you follow one or more of them, you won’t see any difference compared to a standard link - but the blog will receive an affiliate commission. Thank you for this. As usual, I only write about and review things I use in my daily life, or trust.