Each year, I fill out my pillar 3a up to the legal maximum (the maximum pillar 3a amount for 2025 is CHF 7'258), which allows me to deduct this amount from my tax bill. Concretely, I pay roughly CHF 1'000 less in taxes per year thanks to this.

This tax optimization, which is well known to the Swiss, has become even more valuable in recent years, because you can now invest this pillar 3a money 100% in shares. This is what I have been doing for several years using VIAC and finpension, and more precisely their portfolio strategy called respectively “Global 100” and “Equity 100 (Pension)".

But what is less well known is that you can save tens of thousands of CHF in taxes when you are about to withdraw this cash (because yes, you have to pay taxes when you withdraw your money from a pillar 3a…)

But to do this, you need to put a strategy in place as soon as you start contributing to your pillar 3a.

How to save even more taxes with the staggered withdrawal of the pillar 3a?

You can save tens of thousands of CHF in taxes with the staggered withdrawal of your pillar 3a money! In percentage terms, that’s Swiss tax savings of up to 70% — that’s pretty crazy!

And the most incredible thing is that it’s all legal (I’ll give you the details below, because the rules differ from canton to canton, of course)! But nobody teaches you this at school though…

The whole trick is based on two points.

The first point is that Swiss law currently says that your pillar 3a money must be withdrawn at the earliest five years before reaching normal retirement age. That is to say at 59 years old for a woman, and at 60 years old for a man.

The second point is that the tax you will pay on the withdrawal of your Swiss pillar 3a is progressive in percentage. Imagine that your 3a capital is CHF 273'040, and that you withdraw it all at once, then your tax will be 8% for example (for a single man, without children, and living in Zurich). But if, on the contrary, you withdraw this money in four installments (i.e. 4x CHF 68'260), well, the tax rate will only be around 5%.

The idea is therefore to spread the withdrawal of your pillar 3a over several years in order to benefit from this Swiss tax rebate.

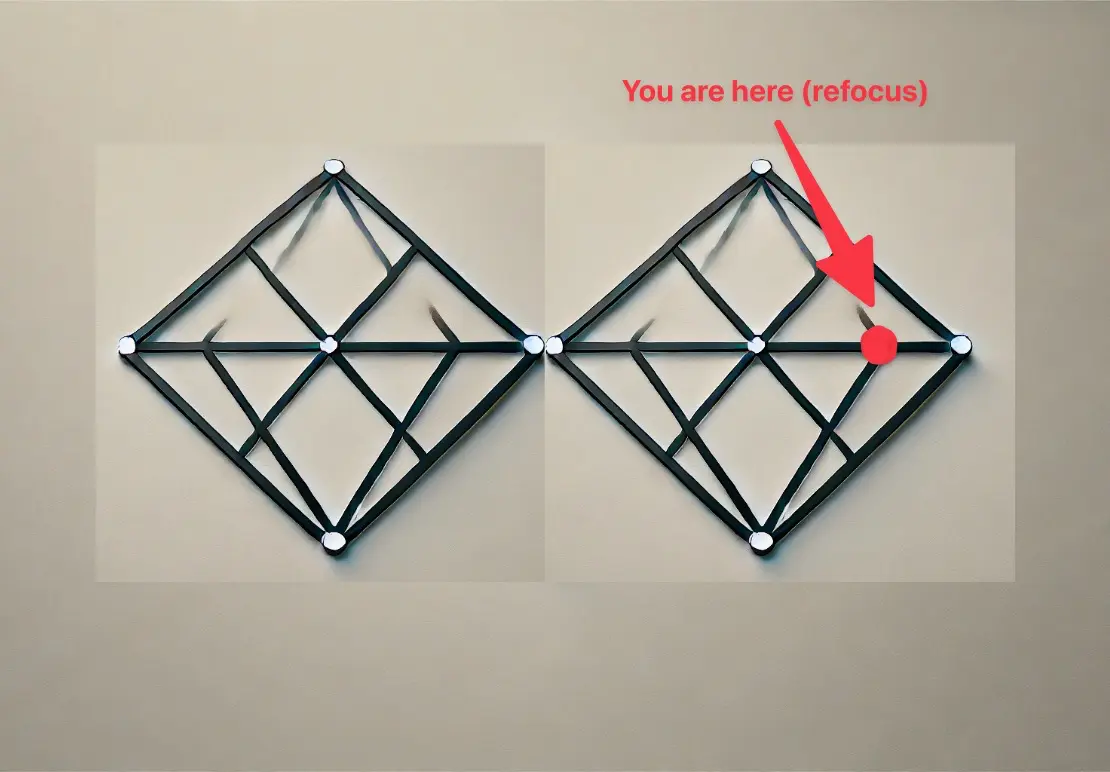

VIAC explains it so well in pictures that I put their graph here:

The tax advantage between a staggered withdrawal and a one-time withdrawal is CHF 7'823. And that, without making any effort apart from opening four accounts :)

Since we talk about a percentage tax increase, it means that the bigger your pillar 3a capital is, the more substantial the Swiss tax saving will be.

For example, if you pay 8% tax on CHF 750'000 of pillar 3a capital via a unique withdrawal, you will pay CHF 60'000 in taxes, whereas if you pay only 5% via four withdrawals, you will pay CHF 37'500. That means you will save CHF 22'500 thanks to a staggered withdrawal!

Tax optimization pillar 3a invested in the stock market

And we don’t stop there! Because as we, as a good Mustachian, we invest all our pillar 3a in the stock market, we can optimize even more on our tax bill!

As you are beginning to know, the earlier you start investing in your life, the bigger your initial capital will be thanks to the magic of compound interest.

Let’s imagine that you have an investment horizon of 40 years for your pillar 3a.

If you fill in four pillar 3a pillars (all invested in the stock market) one after the other every 10 years, your first Pillar 3a pillar will be bigger in the end because compound interest will have had more years (i.e. 40 years) to “make babies” (via dividends and the capital increase of the shares you invest in).

Your second pillar 3a opened 10 years after the first one will therefore have had less time in life (i.e. 30 years) to benefit from compound interest. And the same goes for your third and fourth pillars 3a.

In image it looks like this:

Four pillars 3a invested in the stock market at 10 year intervals each increase in a different way due to compound interest (source: VIAC)

Between a staggered withdrawal and a one-off withdrawal of the pillar 3a invested on the stock exchange, the tax optimization presented above amounts to CHF 68'433. And this, always thanks to a simple opening of four different accounts (i.e. maximum 1 hour of work, nice ROI!!!)

And as the taxation on the pillar 3a is progressive in percentage, you will therefore pay more taxes on the withdrawal of your first pillar 3a, a little less on the second, etc…

But nowadays, it has become so easy to open pillars 3a in one click in an app that nothing prevents you from optimizing even more this tax saving on your pillar 3a.

The key to maximum tax optimization of a pillar 3a invested on the stock market is therefore to divide the annual payment on your pillar 3a into five equal parts (five being the legal maximum allowed number of pillars 3a).

Result: after 40 years, you find yourself with exactly the same amount in each of your pillar 3a. And so you have optimized your taxation as much as possible as shown in this picture:

Here's how to optimize your Swiss tax situation with a pillar 3a invested on the stock market (source: VIAC)

Legal maximum number of pillars 3a

Swiss law states that you can start withdrawing your pillar 3a capital at the earliest five years before the official Swiss retirement age (65 and 64 for men and women respectively in 2021).

The other law to be respected is that you cannot withdraw your capital from a pillar 3a partially. So if you have two pillars 3a with CHF 30'000 each, you cannot withdraw CHF 15k from one of them. You must legally withdraw either 1x 30k, or 2x 30k.

This is why you often hear that you should create a maximum of five Swiss pillars 3a to maximize your tax liability when withdrawing from them.

The question I asked myself after I realized that I needed at least five pillar 3a contracts was:

But I think I read somewhere that the canton of Vaud is stricter in terms of tax evasion, and limits the number of withdrawals of the pillar 3a to only two in the five years preceding retirement, is that true?

Apart from bank and insurance documents, I could not find a single legal source confirming these statements on the site of the canton of Vaud.

Hence, I wrote to the Cantonal Tax Administration of Vaud :)

Their answer surprised me — yet another proof that one should not believe what people say on the Internet :D

First of all, they told me that they would not be able to pronounce on the pillar 3a legislation in several decades because it will surely change between now and then.

Then, they literally told me that “for the moment there is no limit set by the Canton of Vaud on the number of pillar 3a accounts”, but that one should not play too much with this kind of accounts, at the risk of it being considered as tax evasion.

Knowing that other cantons are cooler with regard to this rule, and that we don’t know in which canton we will live with Mrs. MP when we pass the legal Swiss retirement age, we will therefore create a minimum of 5 pillar 3a accounts. And at worst, if we stay in Vaud, we will withdraw 2 pillars in one year, and the other 3 in another year, and it will be considered as 2 withdrawals as it seems to be the implicit rule that is authorized and applied by the Vaud tax authorities.

“But I already have a pillar 3a VIAC with several thousand CHF, what do I do?!”

I “discovered” this Swiss tax trick during my research for my book. I had heard about it before, but I had never taken the time to understand it in detail, and above all to act on it.

Except that when I wanted to put it into practice last week, I found myself facing another problem…

Mrs. MP’s VIAC pillar 3a has only one portfolio (i.e. 1 portfolio = 1 pillar 3a account at VIAC), which amounts to already 41kCHF at the time I am writing these lines…

So I asked VIAC if I could divide my pillar 3a into five, by any chance? But no, it’s not possible.

My solution will therefore be to create four new portfolios on my VIAC account, which I will fill in equal parts each year until my four new portfolios have the same amount as my current pillar 3a.

Additional question: can I test a 6th pillar 3a at Finpension then?

The competition between 3a pillar companies increases (good for us, the consumers!), and finpension is now ex-aequo with VIAC. So I decided to open a new Finpension account (same as VIAC: a pillar 3a invested in the stock market).

But is this possible if I already have five Pillar 3a contracts in progress at VIAC?

The answer is yes!

As mentioned above, there is no legal maximum number of how many pillar 3a contracts you have in Switzerland. You can open as many as you want. Even if you only put CHF 5 into it to test a service.

Where the law comes into play is when you want to withdraw this money when you officially retire. At that point, you will simply have to close more than one pillar 3a in a year, and the total of these closures will form the basis for calculating your tax on your pillar 3a capital in that year.

It’s as simple as that :)

Summary staggered withdrawal pillar 3a invested in the stock market

This is what we just learned:

- Pillar 3a taxation is progressive as a percentage: the bigger the amount you withdraw, the higher your tax percentage will be

- The best pillar 3a strategy is to open five pillars 3a from the start to optimize your Swiss tax bill when you’ll withdraw each of them 1x per year, five years before the legal retirement age

- Each year, fill each of your pillars 3a in equal parts to optimize your tax system as much as possible

- If you already have a well-filled pillar 3a, stop putting money into it and open four more pillar 3a contracts and fill them out equally each year until they have the same amount as your first pillar 3a

Bonus: tutorial tax optimization pillar 3a with VIAC

As usual, I took screenshots of each step when I implemented this Swiss pillar 3a tax optimization strategy with VIAC (via several Global 100 portfolios). And I made a tutorial out of it :)

finpension promo code

VIAC promo code

===> 3aMust <===

And you, do you already apply this method of tax savings via pillar 3a to stagger the withdrawal of these 3a assets?