If only it were as easy to find a bond ETF as it is to buy bread at the bakery…

As Andrea recently asked me:

“Given my age (45), I should invest 45% in bonds.

But in which bonds should I invest my money?

There are short-term bonds and long-term bonds. Bonds work differently from stocks and ETFs, right?

And government bonds are supposed to be very safe? A colleague says that US government bonds are interesting (Treasury bills). But they’re short-term, and we want to invest for the long term…

I’m lost, can you help me?

As with any subject related to the stock market, all you need to do is take it step by step.

But before we go any further, let’s get back to basics.

What’s the difference between stocks and bonds?

“Uh, MP, for me who just arrived, can you explain what a bond is please?”

When you buy a stock, you’re buying a share in a company.

And when you buy a bond, you’re making a loan to a state entity (a country such as the Swiss confederation, a region, a specific administrative department) or a company for a specific period.

And in exchange for this loan, the state or company pays you interest in lieu of remuneration.

There are still other differences between these two asset types, as well as different types of bonds with their respective risks (maturity date, interest rate, and credit ones), but there’s no need to complicate life any further at this stage.

For your financial literacy, the state or company are also known as “issuers”. And the loan they ask for is known as a “coupon”.

Simple, isn’t it?

Why invest in a bond?

On this blog, we invest in the stock market to grow our wealth.

Why?

Well, because we want to become financially independent in Switzerland. And when we stop working, it’s the returns on our stock market investments that will enable us to earn enough money to live on without having to work.

As Swiss Mustachians, we invest according to the proven Bogleheads method.

This method prescribes investing in 3 ETFs, with your age as a percentage of bonds:

- 1x ETF in global equities (for maximum yield)

- 1x ETF in Swiss equities (for yield, while ensuring you keep some of your investments in CHF)

- 1x ETF in bonds (to smooth out portfolio volatility)

With equities, you need to be prepared to see your portfolio go from +20% one day, to -12% the next, to -30% during crises, and then +2% for weeks at a time.

This is what we call volatility.

In the long term, this volatility doesn’t really matter, since ETFs ensure that your investments always go up. But in the short term, you should never sell, because that’s when you lose money.

That’s where bond ETFs come in.

What’s the point of buying bonds?

Since it’s a loan, a bond is (in theory) more stable.

You lend X Swiss francs, and have a repayment schedule with a defined interest rate. Versus a share in a company whose return depends on the company’s performance (and therefore on many different criteria, such as their sales, the status of their target market, etc.).

In your portfolio, a bond therefore serves to remove some volatility.

But why not wanting volatility?

In my opinion, you can accept a maximum of volatility when you have a guaranteed fixed income. 1.

“What kind of guaranteed fixed income, MP?” I hear you ask.

When I say “guaranteed fixed income”, I mean a salary, or a rental yield in Switzerland, or income from a side job. In short, a fairly stable income that falls due each month.

If you have that kind of income, you don’t need a bond.

But when you become FIRE, you may not be doing anything that earns you money (for example: volunteering, travel, humanitarian work, etc.).

In this case, an ETF bond can help.

Because, if the stock market is in freefall, yes, you’ll still have a few dividends to meet part of your needs. On the other hand, you won’t want to sell equity ETFs at a loss in order to buy groceries (because dividends alone aren’t usually enough, you need a mix of dividends + selling some ETF).

That’s when you look for a bond ETF with a stable interest rate.

Criteria for choosing a Swiss bonds ETF

As with our stocks, we don’t want to waste time scanning all the bonds one by one, and having to buy them one by one.

We want to harness the power of ETFs, which allow you to buy a plethora of bonds in a single basket with a single click.

As usual, we’re going to use the objective criteria you know so well to find the best bond ETF:

Cheapest TER

The TER is the fee you pay to the entity issuing the ETF. These fees eat into your returns, so they should be as low as possible.

To put it simply:

- 0-0.15% = top

- 0.16-0.30% = interesting

- 0.31-0.40% = meh

- over 0.40% = I don’t know

Highest historical yield

I look at the previous year’s performance to get an idea of how things are going. Then I look at each year since the ETF’s inception to see the trend.

Fund volume

The smaller an ETF is (in terms of the number of CHF invested by the people in it), the more likely it is to close or merge, which means you’ll have to sell at an inappropriate time, or pay higher fees (due to the merger).

I’m aiming for >1 billion in assets under management, or at worst >500 million.

Trading volume

If the above criteria aren’t enough to decide on the best bond ETF, then I’ll take the one with the highest trading volume. This ensures better liquidity, which means that supply and demand are high, so the day I click on “Sell”, it won’t be weeks before I find a buyer.

BUT, because there is a BUT!

I learned from Beat (the founder of finpension) hat you have to be careful between USD hedged bonds and CHF bonds.

What currency for a bond ETF?

We want to protect our savings against volatility with bonds.

This means that the day we resell bonds, we don’t want to suffer a loss of -10% on our purchase price. Such a loss may come from a government that can no longer pay, or because of rising interest rates (thanks dear Swiss National Bank and your monetary policy). But it can also come from the currency in which you hold your bond, which has fallen against the CHF.

“So, MP, should I restrict my choice of bond ETFs to those issued in CHF?”

Not necessarily, because there is a system for protecting against the exchange rate, also known as “hedging”. So, in theory, you could buy a USD bond ETF with no risk of loss due to the USD-CHF exchange rate.

Except that such exchange-rate protection doesn’t come free of charge in certain interest rate scenarios 2.

USD-hedged bond ETFs: not a good idea at the moment!

The return in CHF should actually correspond to the USD return minus the hedging costs. We can use the interest rate difference for the estimated hedging costs.

But beware: we should apply the after-tax view. The USD bond leads to a massively higher tax burden, and then a much lower after-tax return.

Beat from finpension illustrated this for me with this diagram:

The conclusion regarding the currency of a bond market ETF: you want to take it in Swiss francs.

Shortlisting ETF bonds for CHF investors (Swiss government bonds, corporates, etc.)

When I’m looking for an ETF, I use etf.com, because I can access the best US-based ETFs via my favorite American broker Interactive Brokers.

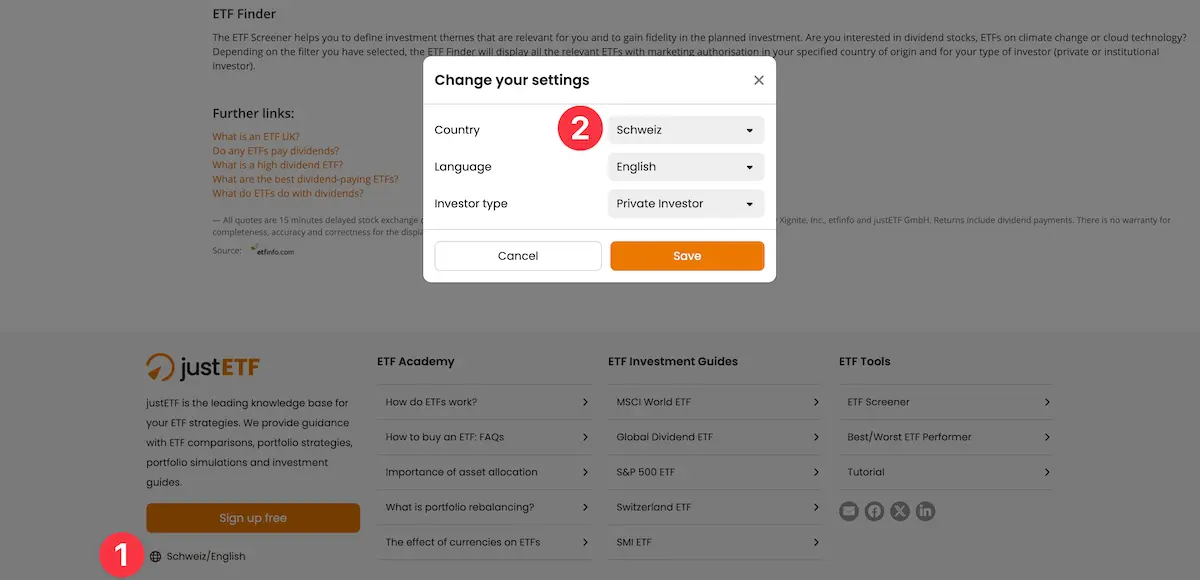

But in today’s case, we want to find the best CHF bond ETF. To do this, we’ll use justetf.com making sure to select Switzerland as the parameter in the bottom left-hand corner of their web page.

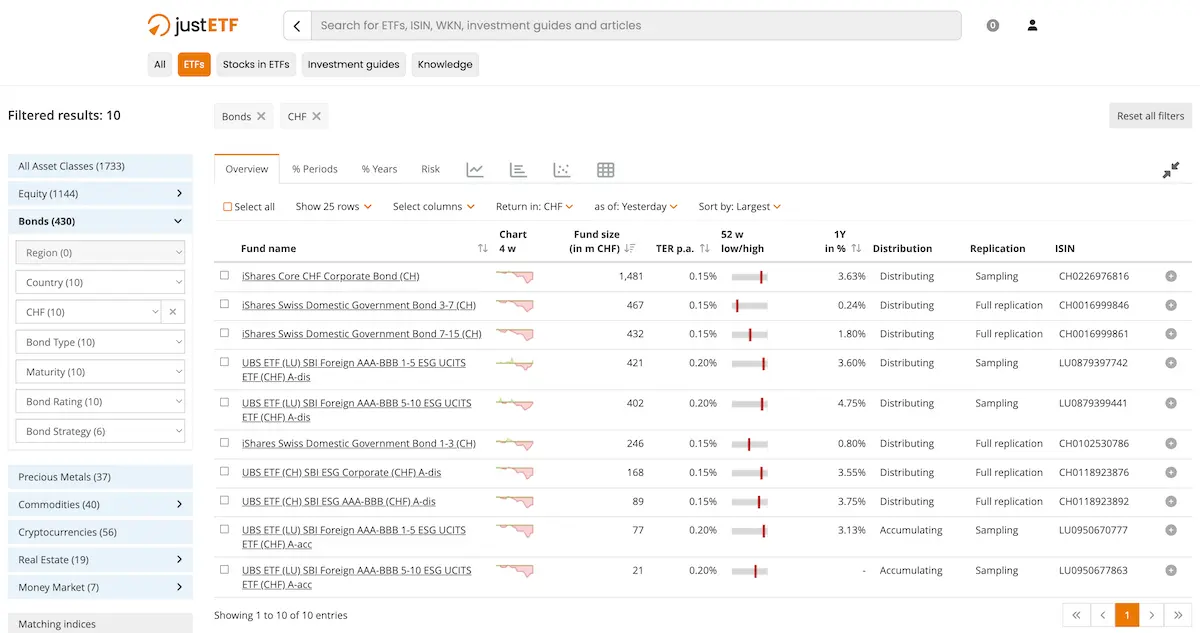

Filtering by “Bonds” as the asset class, and then by “CHF” for the currency, we already go from 1'733 ETFs to… 10!

Then we see that many of the remaining 10 are “Corporate” bonds only.

We do not want pure corporate bonds, as in the event of a sharp fall in share prices, we would also have to accept a setback for pure corporate bonds (due to defaulting companies).

Also, remember that we don’t look for yield at any price with our bonds. We use them to smooth out portfolio volatility. So if you’re tempted by a pure corporate bond ETF, forget it and allocate that part of your savings to your equity ETF.

If we remove the bond ETFs composed solely of corporate loans, we’re down to 8 ETFs.

Secondly, I don’t just want Swiss government bonds ETFs either. Ideally, I’d like a mix of different governments and other state entities from the rest of the world. So I’m removing all “Domestic Government Bonds” from my list.

I only have 5 ETFs left.

I notice that among these 5, 4 are bonds made solely out of foreign entities (i.e. outside Switzerland). I’d like to have a Swiss-foreign mix for maximum diversification, so I’m dropping them.

And I’m down to 1 ETF, with 0.15% TER (top).

This ETF is the “UBS ETF (CH) SBI ESG AAA-BBB (CHF) A-dis”.

Four comments about my choice:

- This ETF also contains corporate bonds. It’s not ideal, but the mix suits me better than the other ETFs available to us Swiss Mustachians…

- The ETF has only CHF 90 million under management (as opposed to the usual minimum of CHF 500 million I’m looking for). Ditto, you go with what you’ve got. So I prefer to go for the right ETF, with the best TER, and then look at the other criteria

- I’m not a fan of ESG investing (the reason here, and also here). Except that only this ETF version seems to be available (the “SBI AAA-BBB (CHF)” version is only available to institutional investors - such as banks or insurance companies - via index funds)

Conclusion: my choice of Swiss bonds ETF in CHF

If I were FIRE today, with no other recurring income (real estate or side business), then I would take 20-25% of the ETF “UBS ETF (CH) SBI ESG AAA-BBB (CHF) A-dis” to ease the volatility of my 80% in equity ETFs.

On the other hand, as long as I have recurring income such as rental yield in Switzerland or another side job, then I’d stay in 100% equities.

And you, which Swiss bonds ETF did you choose? And for what reason(s)?

Well, if you’re extremely risk-averse and know that you’ll sell all your shares as soon as the stock market falls, then bonds can help you sleep better. ↩︎

The costs for currency hedging result from the interest rate difference between the two currencies. If the interest rates were the same (e.g. USD and CHF both 1.5%), then you don’t have any major costs. On the other hand, you have high costs if the interest rates of the different currencies are far apart and the CHF interest rate is lower (specifically CHF interest rate 1.5%, and USD interest rate 5.5%). ↩︎