It is possible. And that’s even my goal. Many negativists will tell you that no, it is not possible, otherwise it would be known. Or that they believed in this sweet dream in their twenties too, but after a few months they gave up.

It’s funny because that’s exactly what I was told when I started my adventure towards financial independence back in 2013.

When I'll be 40, the hike in Les Diablerets will be on Tuesday afternoons when there's no one there! What about you?

And the funniest thing about this story is that at the time I’m writing these lines (end of 2019), my motivation is even stronger than it was then. My net worth is one of the proofs of this: I have gone from about CHF 50'000 (capital of the 2nd and 3rd pillars taken into account) to CHF 400'000 (UPDATE 2021: CHF 750'000 UPDATE 2022: CHF 1'044'205 UPDATE 2024: CHF 1'204'459 UPDATE 2025: CHF 1'709'233)! We bought the apartment where we live (yes, in Switzerland). We invest all our savings in the stock market. And we even acquired a rental building.

All this to support our goal of no longer having to work for money after our 40th birthday.

So yes dear negativist friends of 2013, I will retire at 40 in Switzerland!

Cool the inspiring speech, but what do I do?

Before I explain to you how to get started step by step (including how to earn CHF 25 in 8 minutes, and CHF 6'600 over the next year), I would just like to talk to you about financial independence / early retirement.

Most new readers generally fall into one of the following 3 categories when they discover the blog:

- “I’m just looking to save a little more money per month than nowadays”

- “I want to save money for a major project that we have with my family in a few years (world tour, sabbatical year, real estate purchase)”

- “I want to achieve financial independence to early retire at 40 (or even earlier). Which will allow me to do what I want with my life. Every morning. For the rest of my life.”

What category do you fall into?

I am personnally in category 3. To make it short, that’s basically how financial independence works:

- You start from your current situation where each month you earn an amount X, and you spend an amount Y

- Your final goal is to increase your income X as much as possible and to reduce your expenses as much as possible (don’t worry I’m not going to tell you that you have to shower in less than 12 seconds, although it would help :D)

- Then, everything you save, you invest it in the stock market, in real estate, or in a new business of your own

- And on your 40th birthday, you can stop working and continue to receive passive income from your investments

Where do I start?

In order to keep your motivation at the highest level, I have prepared a list of 3 things that you can easily implement and that will save you money very quickly. The goal is for you to become aware of the potential of my strategy by living it by yourself.

And these 3 points are valid no matter what your objective is (save a little more, save for a big project, or achieve financial independence).

1. Save CHF 600/year on bank and credit card fees (all of it in 2-3 hours of work)

How? By using a 100% free Swiss bank and a 100% free credit card system that even brings you cashback.

- Savings #1: earn CHF 25 in 8 minutes after opening your new account

- Savings #2: saves an average of CHF 200 per year on fees, or CHF 2'799 in 10 years!

- Savings #3: earns an average of CHF 200 in cashback via credit card spendings, or another CHF 2'799 in 10 years

- Savings #4: save on average CHF 150 in transaction costs in foreign currency, or CHF 2'100 in 10 years

- Total savings: CHF 600 in one year, i. e. CHF 8'389 in 10 years for less than 2-3 hours of work!

To implement this, it’s easy, you can follow my two tutorials where I explain in detail how I use the best free Swiss bank and the best credit card system in Switzerland.

Come back to this page once you’re done.

2. Earn CHF 400 each month, for 10 minutes of work per day

And no, it’s not a miracle way to get rich in one night or that kind of thing. It’s very concrete and it consists in changing your meal routine when you have lunch at work.

At first I wondered if it was really worth it.

Once I’ve done my calculations, I’ve never gone back and I take my tupp’ to work every day.

Total savings: CHF 4'800 in one year, or CHF 67'068 in 10 years, and that for 10 minutes of efforts a day!!!!

I explain my strategy in detail in this article.

Ditto, let me know how much you saved after the first month!

3. Stop to over-insure yourself and save at least CHF 100 per month

Insurance is useful, but we must not succumb to their marketing of fear, at the risk of spending much more than necessary.

Two concrete and quick examples to implement this tip (only one or two letters to be sent per point):

- Find out how David will be richer by CHF 19'608 in 10 years, thanks to a simple change of health insurance

- Do you have a car? Check how I made CHF 10,000 as I investigated about what I really needed as coverage

Total savings: just by switching health insurance, you can find yourself with CHF 16'773 more in your account in 10 years

These first three steps are really simple and quick to implement. If you are looking for a source of motivation to start now, send me an email explaining what you intend to do with these CHF 92'230 of savings in 10 years!

And by implementing even more optimizations of this kind, this is what I have managed to achieve concretely:

- We set aside each month CHF 4'732.74 (our salaries are revealed in this article)

- We have gone from CHF 50'000 to

CHF 400'000CHF 750'000CHF 1'044'205CHF 1'204'459CHF 1'709'233 in5.588.51011 years (thanks YNAB!)

I’m so excited, what do I do next?!?

Glad you’re so motivated about retiring by your 40 (rather than your 65th birthday :D)!

Then I advise you the following three four things:

- Subscribe to the newsletter at the bottom of this page (100% spam-free guarantee, I hate it myself!) to receive every new article in your mailbox so you don’t miss any saving or investment advice

- Go back to the first blog post and read all posts up to the most recent using the navigation links at the end of each article. It will allow you to understand my frugal state of mind, as well as how I invest my money in order to stop working definitively when I turn 40

- In parallel, because I am aware that there is a lot to read, explore the blog via the list of all categories or the list of all articles to find the advice you need more quickly

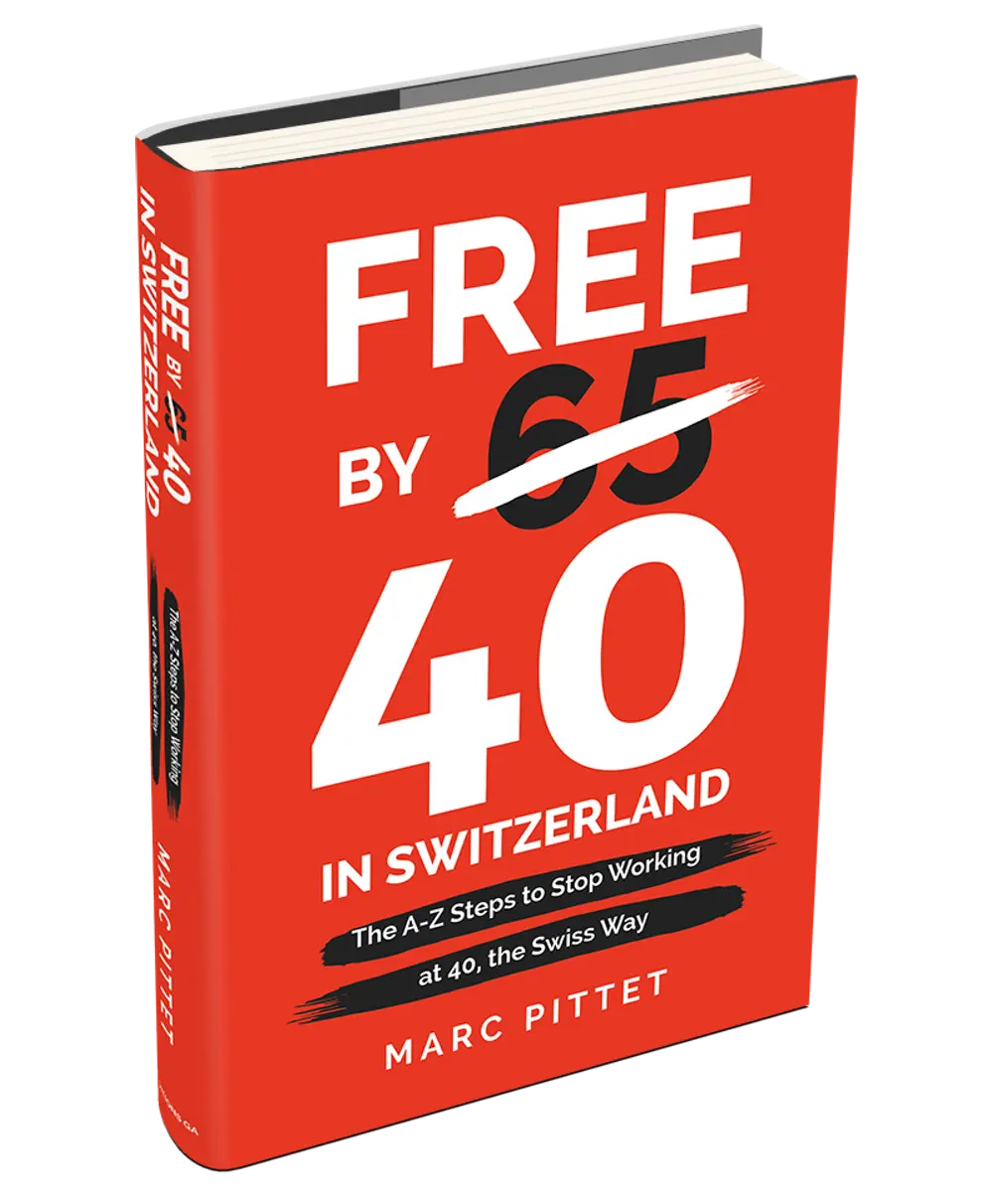

- In November 2020, I released my book explaining the steps from A to Z of how to become financially independent by 40 in Switzerland. It is the guide that I would have liked to have in 2013 when I started in the FIRE (Financial Independence, Retire Early) movement. If you are interested in having my method explained in detail in one place, you can order it on this page (or by clicking on the image below)