Imagine if you could start investing in the stock market at your own pace, like when you learnt to swim. That would be cool, wouldn’t it?

Investing money in the stock market is the key to making your wealth grow in order to become financially independent.

We all agree on that.

Yet I regularly get readers contacting me to say that they can’t take the first step…

They’re attached to their savings account.

They veer towards robo-advisors, not daring to start investing by themselves.

Then they hesitate… longer and longer… and never take the plunge.

Christopher only reminded me of this last week:

We all come to your blog with a different level of knowledge about personal finance. And with the associated fears!

That’s when I was reminded of an article by Nathan Barry (the founder of ConvertKit), in which he explains the different levels of earning a living that are possible. It starts with being employed, then goes to running your own service business, and culminates in selling your own products.

And on rereading my notes on “how to overcome all fears”, I remembered the well-known combo of “knowledge and gradual exposure”.

This intersection of ideas led to the creation of the following mental model.

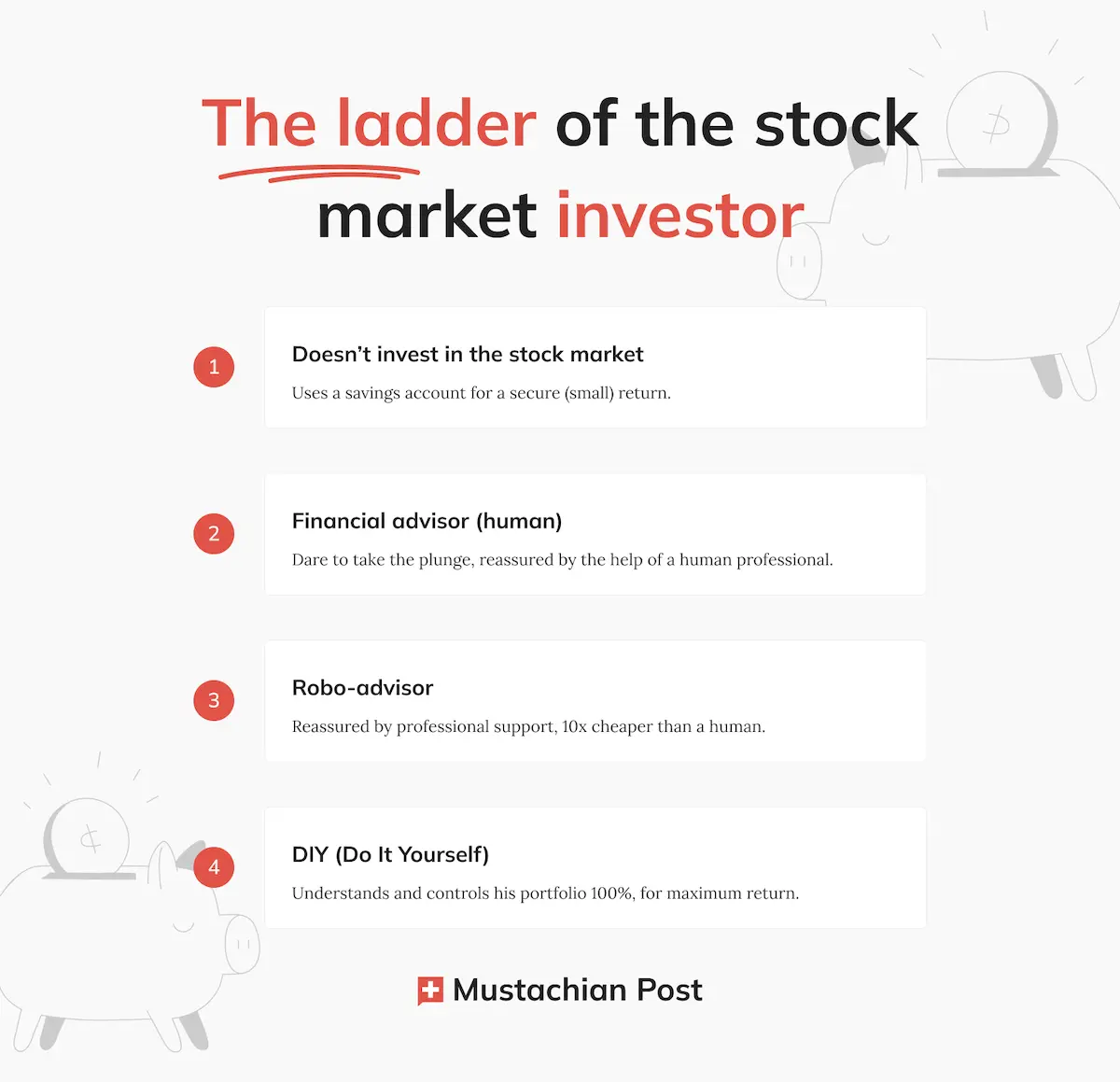

The ladder of the stock market investor

This ladder explains the stages of gradual exposure in order to overcome your fear of investing in the stock market:

Just like when I learnt to swim, I started in the paddling pool, then the pool where I could touch the bottom, until I was able to go in the big pool accompanied by an adult, and then finally jump in and swim on my own like a big boy.

On every step of the stock market investor ladder, you gain more and more confidence in yourself, which enables you to take the next step up the ladder.

In my personal experience, it can take from between a few weeks to 1-2 years maximum to reach the top step (i.e. investing in the stock market by yourself via exchange traded funds).

1. Doesn’t invest in the stock market

This stage is about keeping your savings in a savings account in Switzerland. I experienced this educational foundation myself where you celebrate the paltry interest “given” to you by your bank…

Nevertheless, you move on with more than someone who lives in debt:

Competencies:

- Spending less than you earn

- Have created a system (using a savings account) to put this money aside

- Keeping these savings without dipping into them every month

Fears:

- Fear of the stock market due to total ignorance

- Believe that it’s only for casino gamblers (aka traders)

- Fear of losing all or some of your savings

Tools:

- A Swiss savings account (comparison of the best savings accounts in Switzerland here)

In order to move onto the next step, you’ll need to use a service that guides you through each stage.

Recommended length of exposure:

If you follow this blog, you should already be sufficiently exposed to the concept of a savings account, so I’d recommend that you move swiftly (today?!) onto the next level.

2. Financial advisor (human)

When we don’t know a subject, humans have a natural tendency to want to be reassured by another human.

The big problem with the world of stock market investment in Switzerland is that there are loads of crooks who’ll try to flog you their rubbish products… not all, just 9 times out of 10…

There is a very simple rule to follow in order to know which human you can trust in this area: they must provide you with independent unbiased advice. You can find this out by asking them two questions:

- What are all your income sources? (here, you want them to respond “Only what you pay me by the hour”)

- More precisely: do you receive any commission for any products or services that you recommend? (and there, you want them to respond with a clear and transparent “No”)

The second simple rule: stay away from all bankers and insurers, as they have conflicts of interest between your financial gains and theirs (because they have more interest in selling you their own products in order to get their end-of-year bonus…).

So after all that, you’ll just be left with independent financial advisers.

After several appointments, you’ll enter the stock market. And this is what you will have gained:

Competencies:

- Understanding of some basics of the stock market

- Have identified your risk profile to know what to invest in

- Have started investing in the stock market on the basis of professional advice

- Starting your path towards financial independence thanks to the magic of compound interest

Fears:

- Knowing that you are paying a lot of money for a service, and that you could save more by using an automated online platform

- Not wanting to be dependent on annual appointments with a third party in order to find out if you’re on the right path

Tools:

- The Swiss independent advice company VZ

- They are currently the only one I know of, from having used them myself for my FIRE planning in 2016

- Their rate was around 200.- or 250.-/hour

This stage, while costly, has the advantage of getting you started.

Recommended duration of exposure:

At worst, spend one or years on this step, and at best, skip it entirely by using one of the below robo-advisors and save hundreds (even thousands) of Swiss francs!

3. Robo-advisors

As its name implies, a robo-advisor is a virtual financial advisor (aka digital asset managers). It therefore costs a lot less at the beginning. However, in the medium to long term, it can be more expensive than a financial advisor if you have a lot of money invested through it. You pay monthly fees (that include the transaction fees) to the robo-advisor, while you only pay the independent financial adviser for the hours you’ve actually spent with them.

It doesn’t really matter for you as you’ll want to get to the last step of our ladder after one or two years at most of experimenting.

Here are the features of this step of the ladder:

Competencies:

- Understanding of some basics of the stock market

- Have identified your risk profile to know what to invest in

- Have started investing in the stock market on the basis of professional advice

- Starting your path towards financial independence thanks to the magic of compound interest

- Paying 10-15x less than a human financial advisor

Fears:

- Not being comfortable with depending on an online service when it comes to the what and why of your investments

- Fear of not knowing or finding the information for getting to the next level up

Tools (Swiss robo-advisors):

Selma

Selma is the best robo-advisor for your first venture onto the stock market and provides a good level of support. Their initial questionnaire is reassuring AND well explained. Their fees are higher than their competitors but as you’re only going to use them for 1-2 years, it’s not a big problem. Also, the minimum investment amount is low (i.e. CHF 2'000): this helps you to take the plunge quickly.

- Selma management fee:

- 0.68% up to 50'000 CHF

- 0.55% from 50'000 to 150'000 CHF

- 0.47% from 150'000 to 500'000 CHF

- 0.42% above 500'000 CHF

- Average costs (TER): 0.22%

- Minimum investment amount: CHF 2'000

(using the code mustachian when you create your Selma Finance account, you will get 5'000 CHF investments managed for free, for 12 months. That’s 34 CHF waived. 👋)

VIAC Invest

According to my Mustachian criteria, VIAC launched the best pillar 3a in 2017 AND the best mortgage in Switzerland in 2022.

And in December 2024, they launched their own robo-advisor solution (my detailed article on this here). No need to beat about the bush: this is THE best robo-advisor in Switzerland, both in terms of fees and investment strategies offered.

- VIAC Invest management fee: 0.25% max (and 0.00% until 31.12.2025)

- Average costs (TER): 0.24%

- Minimum investment amount: CHF 1

(VIAC promo code InvMust entitles you to free management of CHF 2'000 of assets in your investment account – and this is valid for life!)

finpension invest

We know finpension well on the blog, with their very advantageous pillar 3a. Well, in 2024, they launched their robo-advisor. It’s based on the same low trading costs, high-return investment strategy. Add to that US withholding tax optimizations and no margin on foreign exchange transactions, and you’ve got the Swiss robo-advisor with the best all-inclusive return (strategies and fees).

- finpension invest management fee: 0.39%

- Average costs (TER): 0.09%

- Minimum investment amount: CHF 1

(finpension promo code MUSTBC entitles you to a fee credit of CHF 25 (provided you transfer or deposit at least CHF 1'000 in the first 12 months after creating your finpension account). If you have already used the coupon code to open your 3a finpension account, you can still use it for your finpension invest account, and benefit from another CHF 25 of fee credit :))

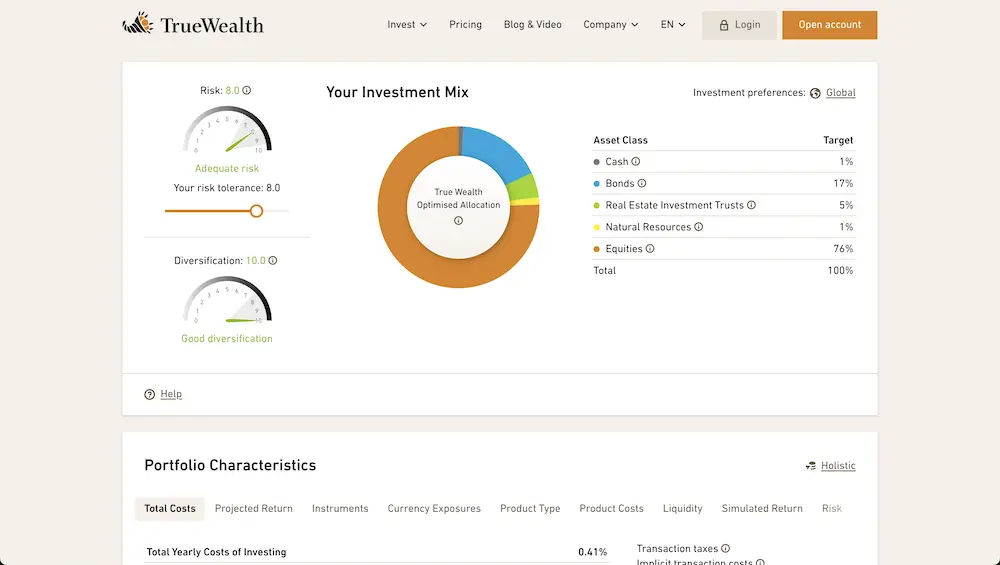

True Wealth

True Wealth is the oldest of the robo-advisors in Switzerland, and one of the best when it comes to value for money. Their fees are only 0.50% if you invest between 0 and 500'000 CHF. However, their onboarding is less user-friendly than Selma (many readers have told me that they chose Selma for that reason). On the other hand, True Wealth requires a minimum investment amount of CHF 8'500.

- True Wealth management fee: 0.50% (0.25% if >500kCHF)

- Average costs (TER): 0.13%

- Minimum investment amount: CHF 8'500

findependent

findependent is one of the latest robo-advisors to have arrived on the Swiss market. They’ve been in business since February 2021. While their fees may be even lower than True Wealth’s, their investment strategies are much too conservative for me. For example: their so-called “Risky” investment strategy only contains 30-40% exposure to the US (as opposed to what should be 60% in my opinion).

- findependent management fee:

- 0.40% up to 50'000 CHF

- 0.38% from 50'000 to 150'000 CHF

- 0.35% from 150'000 to 250'000 CHF

- 0.33% from 250'000 to 500'000 CHF

- 0.31% from 500'000 to 1'000'000 CHF

- 0.29% above 1'000'000 CHF

- Average costs (TER): 0.17%

- Minimum investment amount: CHF 500

(by using the code mustachian when you create your findependent account, you get a CHF 20 welcome bonus as soon as you deposit CHF 500, which is the minimum amount to start investing).

Why don’t I mention Swissquote Invest Easy, Inyova, Investart, Simplewealth, or neon invest in my robo-advisor comparison?

As usual, I don’t beat about the bush:

Swissquote Invest Easy: ah, the good old Swissquote… I made the rookie mistake of choosing them back then. For me, it’s too many fees (0.74-0.81%) for a user experience that’s as complicated as ever, with too many products and too much information scattered all over the site (exchange fees). So I wouldn’t recommend the Swissquote robo-advisor.

Inyova: I have a specific opinion on impact investing. Also, for a beginner, Inyova is too little diversified (only 300 companies). Add to that the high fees compared with most robo-advisors, and I don’t recommend it here.

Investart: they offer low fees (0.30% per year, including transaction fees), of course. But it’s a young startup, whose site hasn’t been updated much since 2022… no thanks, I want a serious company to invest my money in, even if it’s only for 2-3 years.

Simplewealth: same as Investart… no news on their site since 2022. And even less reassuringly, the company was bought out by private investors in 2020… all very strange. What’s more, their 0.50% fees (including transaction fees) aren’t the cheapest on the market. I’ll pass.

neon invest: because neon invest is not a robo-advisor who recommends an investment strategy based on your risk profile. neon invest simply gives you access to the stock market, so that you can buy ETFs and other equities.

If you intend to use a robo-advisor in the long term, as you don't ever see yourself doing it yourself, I recommend two options.

Option 1: start today with Selma in order to gain confidence in yourself, then in max 2-3 years, change to finpension invest, which is much more attractive when it comes to fees over the long term AND which offers better thought out investment strategy (for your return).

Option 2: choose finpension invest straight away, which is the best of the Swiss robo-advisors when it comes to fees and optimizing your return.

Don't take too long to think about it, as the most important thing is to start investing today in order to benefit from the magic of compound interest.

Recommended length of exposure:

A few months minimum, to give you enough time to get used to the ups and downs of the stock market, as well as acquire the necessary knowledge for investing by yourself. And 1-2 years maximum, otherwise you’ll lose too much money with unnecessarily high fees.

Example of Reto with the robo-advisor Selma

Reto is one of the people who inspired me to write this article. Its story speaks for itself:

Me: “What’s your biggest personal finance challenge?”

Reto: “I think my biggest challenge was getting started. Reading your articles, I started investing yesterday (I’m 28). Selma.io made it very easy for me to get started and from now on I’ll be investing every month.”

Me: “You know I’m a big fan of DIY for my finances. So I’m wondering, why did you choose Selma?”

Reto: “Since I don’t want to spend a lot of time cutting costs to the bare minimum at first, and prefer to start investing as soon as possible, I thought I’d get started and not think too much about costs. Selma was very easy to get started with. I really like the robo-advisor they’ve developed.”

Me: “Interesting… I’ll have to do an article about your story ;) But how much have you invested so far with Selma out of curiosity?”

Reto: “I’ll start with CHF 2'000 and invest about CHF 300 a month. Looking forward to the article!”

I won’t draw you a picture… just get started!

4. DIY (Do It Yourself)

The last step for a stock market investor is to invest your money yourself in something that you understand.

That gives you total control over the costs and, above all, the returns which are maximized by choosing the best products and services.

The features of this last step of the ladder are:

Competencies:

- Broad understanding of the principles of the stock market, stocks, bonds and ETFs

- Knowledge of your risk tolerance that will enable you to sleep soundly

- Have chosen your online broker

- Have defined your investment portfolio (very simple, with maximum three ETFs in total, but often one or two will suffice)

- Ensuring you will reach financial independence with much greater wealth than you could achieve with your pension income at age 65

Fears:

- No more fears, only confidence and certainty with your choices and investments

Tools:

Here is the list of the best online brokers for a Swiss investor:

- Interactive Brokers (IBKR) is the best online broker (based in the USA)

- DEGIRO if you want an online broker based in Europe

- Saxo Bank if you want a Swiss online broker

You can find my comparison of trading platforms in Switzerland here, in order to understand how I arrived at my rankings (and why Swissquote and other brokers spending too much on advertising don’t feature).

How do I move from one level up to the next?

Knowledge and gradual exposure are the two scientifically proven ways to understand a new topic or area.

When talking about starting to invest in the stock market, I recommend that you read as much as possible about the subject:

- How would I invest CHF 10'000 in the stock market if I started today? (free)

- Bogleheads investment strategy (free)

- “Free by 40 in Switzerland” (especially part 3) (book available to buy)

- “The Simple Path to Wealth” (book available to buy)

- “How to start investing in Switzerland” (program available to buy)

And in parallel, create a free account for yourself on one of the tools described in the different levels above.

Conclusion

I want you to dive into the stock market as soon as possible (read: TODAY). It’s the best way to become rich over a lifetime, thanks to the power of compound interest.

I repeat: the best way to build your wealth was to start investing in the stock market yesterday. The second best way is to start today.

I wish my parents had explained that to me when I was 10 years old… I’d already be FIRE with several million Swiss francs invested in the stock market today!

And you, where are you on the stock market investor ladder? And above all, are you FINALLY going to take the plunge?

This article contains affiliate links. If you click on any of them, you will see no difference compared to a standard link — but the blog will receive affiliate commission. Thank you for that. As usual, I only write about and review things that I use in my everyday life, or in which I have confidence.

Photos credit: pexels.com