Like the first quarter of every year, it’s time to do the tax declaration in Switzerland. Even Mustachians are bound by the same rules and timelines as any other taxpayer. Grrr…

But it has to be said that compared to a paper form (!) or even VaudTax’s previous computer app, the Vaud canton’s tax administration is getting better and better every year.

In fact, we can now access the Vaud Tax declaration service (VaudTax) 100% online. There is no longer any need to download the new version of VaudTax!). And it makes a great difference in terms of ease of use.

Particularly at the end of your tax declaration, when all you need to do is click a button to submit!

Before diving in, I’m working on the assumption that you submitted a tax declaration last tax year. This therefore means that you have a .tax or .zip Auto-Recover file that saves your personal information, like name, address, and date of birth, automatically for you.

Also, a pro tip: instead of paying a fiduciary company for your tax questions, try contacting your canton’s tax department first. Every time I’ve done this, I’ve had all my questions answered, for free!

Without further ado, here’s my VaudTax tutorial :)

Step 1: Log into the VaudTax service (tax declaration)

As I mentioned above, you no longer have to download the latest version of the software to use VaudTax.

The VaudTax service is now available online!

You just need to go onto the VaudTax website of the Vaud canton.

You will land on a page that looks like this:

At this stage, you need to log in with your federal taxs taxpayer number and verification code.

You can find both of these numbers on the letter you received from the Vaud canton’s tax administration department.

The Vaud canton has done an impressive job recently, with the addition of a clear and concise YouTube intro video which explains in detail how to log in:

Step 2: Import your VaudTax data from the previous year

Once logged in, you’ll see the following screen:

On the right-hand side, you need to click on “Import a 2022 or 2023 declaration” (“Importer une déclaration 2022 ou 2023”).

As above, I’ve added the section of the VaudTax YouTube video, which is a good way to see how to do this:

If it’s all worked out, you’ll then come to this screen:

Step 3: Personal details and dependent children

The advantage of importing the data is that it will automatically populate all your personal details, as well as those of your dependent children.

You can click on each of the links (“Taxpayer 1”, “Taxpayer 2”, “Underage children and adult children on an apprenticeship or in education, childcare costs”, etc. (“Contribuable 1”, “Contribuable 2”, “Enfants mineurs et enfants majeurs en apprentissage ou aux études, frais de garde”, etc.)) to check and amend the data so that it reflects the current status of your household for tax purposes.

N.B. everything is filled in automatically except the “Actual amount of childcare expenses paid for this child (optional)” (“Montant effectif des frais de garde versés pour cet enfant (facultatif)”). You obviously want to deduct the actual costs because this deduction makes a big difference to the final tax bill:

So, if you have dependent children, you can see how this works in this VaudTax “help” video:

Step 4: Save your data regularly!

As much as I love the new web solution for the Vaud tax declaration, it can develop issues faster than a good old software program installed on your computer. Also, if you want to take a break during your declaration, bear in mind that nothing is saved automatically.

Remember: you need to save your declaration manually!

I should point out that I had no issues while doing my tax declaration online.

But you can never be too careful.

So I recommend that you save your tax declaration every time you finish filling out the main section.

To achieve this, you need to download the save file via the button “Export the declaration” (“Exporter la déclaration”), as explained in this video section:

Step 5: Input your earned income from paid employment

From here on, I’m going to complete the form as if I had no previous taxable income from paid employment.

That will avoid me having to blur all my personal info :D

Start by clicking on the link below:

Then click on “Add paid employment” (“Ajouter une activité salariée”)and input the details stated on your salary statement into the VaudTax tax system:

Scroll down, and then you’ll be able to fill in the information regarding “Free transport” (“Transport gratuit”) and other benefits that your employer may provide you with:

Then check and continue.

Following this, you can add your partner, if you are completing a joint tax declaration.

Step 6: Business expenses (and breaks in employment)

In this section, you will be able to declare the following items:

- Transport expenses

- Lunch and evening meal expenses (for stays away from home)

- Away from home living expenses (weekly return and accommodation)

- Other business expenses and secondary employment expenses

- Breaks in employment

I’m going to show you the screens for the two most common business expenses, which are transport expenses and meal expenses.

Let’s start with transport expenses:

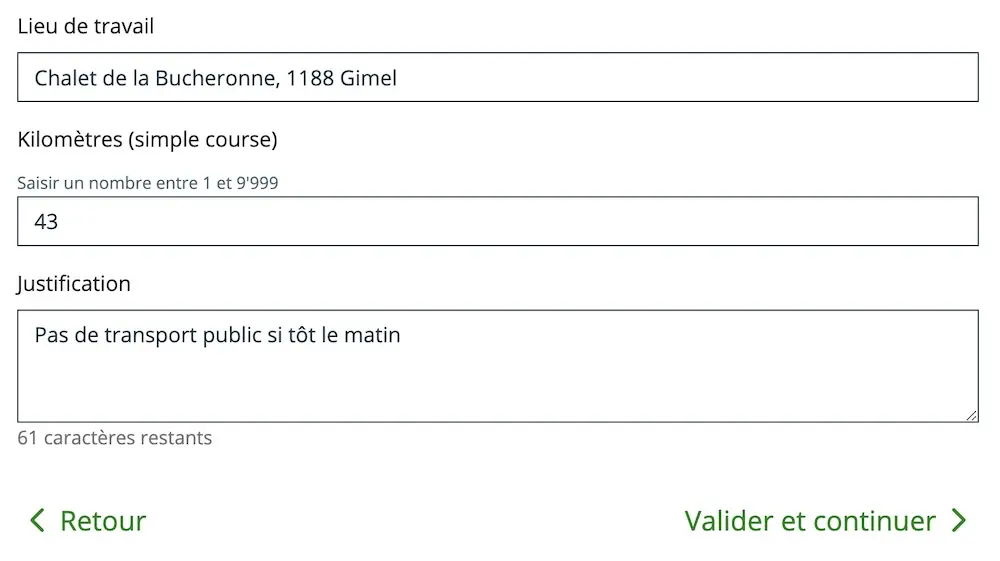

Select the taxpayer for whom you’re adding the transport expenses. Then the type of transport, the number of days in the year, the location of your home, your workplace and the number of kms (single journey) between the two:

I’ll share with you a few tips and things that I’ve learned through my experience with the tax service:

- If you work at different speeds throughout the year, make sure to mention this at the end of your tax return. Otherwise, the tax office will only consider the earnings from the longest period listed on your salary statement.

- If you use your car to get to work, for the sole reason that you don’t have any public transport available so early in the morning, then state this in the “Justification” box so that the tax office doesn’t come and ask you later.

Adding the justification for transport expenses if using a car (in any case, you'll get an error message if you leave this field blank ^^)

Oh, and also, since we’re on the subject: all self-respecting Mustachians are frugal with their money and their time. So always use public transport to get to work (see here why you too would want to do that, and you’ll never be able to go back)!

And once you’ve done all that, you’ll have a summary of your transport expenses:

Then, we continue with meal expenses using the same method:

Next step

If you’re employed like me, these first three steps of filling out your tax declaration in Switzerland are relatively straightforward.

In the next article, we’ll cover the following sections:

- Insurance Premiums and contributions

- Status of assets - Current accounts and savings accounts, precious metal accounts, cryptocurrencies

- Status of assets - Stocks, bonds, investment funds, tax statement, loans, etc.

- Status of assets - Administration costs

- Status of assets - Summary

- Other assets and income (car for example, or worse… life assurance!)

And if I’ve missed any potential tax deductions or tax savings in the screenshots above (or if you have any other questions), please let me know in the comments section below!