In the last article, we completed the first three parts of our Swiss tax declaration (for the canton of Vaud), which are: living expenses, earned income personal details, paid employment and business expenses.

If you took a break between them, you’ll need to import your .vaudtax declaration recovery file to restart from the place you stopped at.

Now let’s move on to the next categories — including the most important part with our stock market investments!

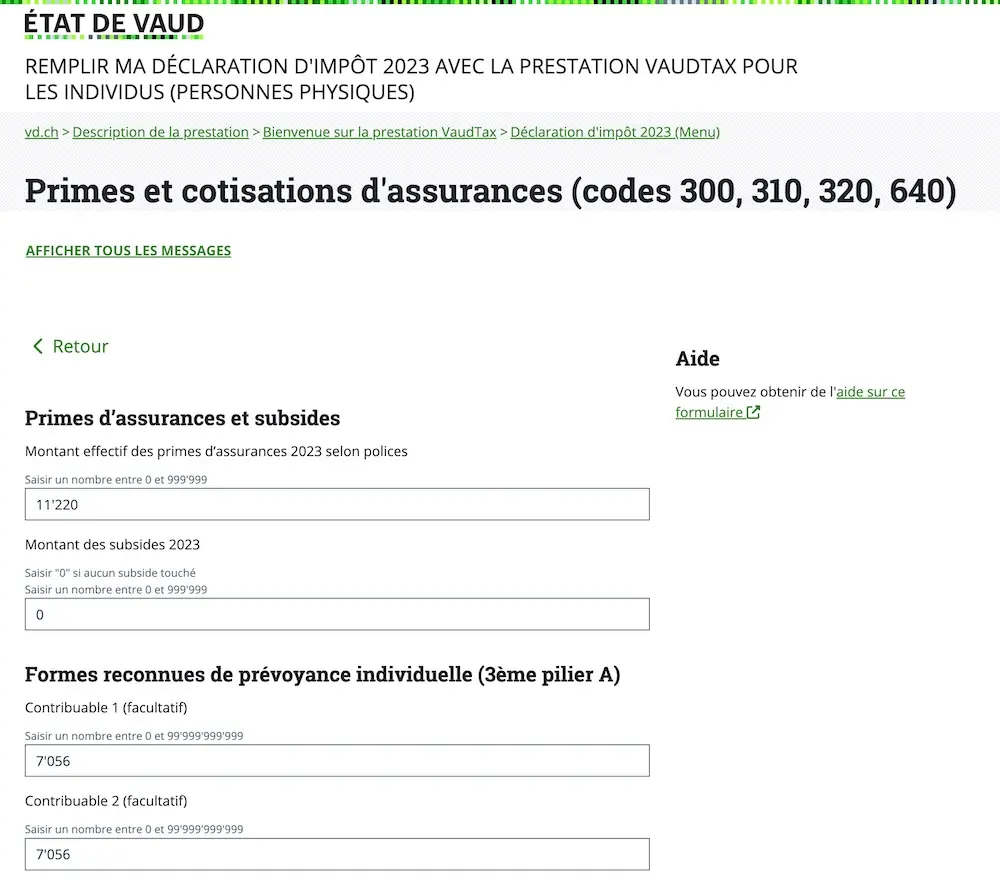

Step 1: Premiums and insurance contributions

Health insurance premiums

In the first section, you can enter the amount of the health insurance premiums that you paid.

Nowadays, all Swiss health insurance companies provide you with a tax certificate. So it’s easy to find this information.

Declaration of your health insurance premiums as well as your deposits into your 3rd pillar 3A (VIAC or finpension)

3rd pillar

In the second section of the above image, you’ll see that this is also where you need to declare any payments made into your 3rd pillar.

As you’re a Mustachian, and therefore frugal, you’ll have plenty of savings, so you’ll add the maximum 3rd pillar amount for the past year (if you’re new to the blog, I recommend you read this article to know which is the best 3rd pillar)!

Buybacks of insurance years (2nd pillar) and other contributions

Also on this page on the VaudTax service, you’ll be able to declare any 2nd pillar buybacks.

The same goes for if you had to make AVS, AI, APG or AC contributions; this is where to input them.

For contributions to an occupational pension (2nd pillar), the boxes are automatically ticked based on the information that you entered in the previous section “Paid employment”.

Step 2: Status of assets - Current accounts and savings accounts, precious metals accounts, cryptocurrencies

In this section, we’re going to declare all our bank accounts, savings accounts, gold, and cryptocurrency accounts (also known as “Casino” account here on the blog).

Current accounts and savings accounts

I’m going to show you an example of how I did the Vaud tax declaration on my Swiss neon bank account:

If you received interest on any of your bank accounts or savings accounts, you need to declare it in the same form as above.

Cryptocurrency accounts

It’s in this part that I declare my cryptocurrency accounts (with Coinbase):

Step 3: Status of assets - Stocks, bonds, investment funds, Swiss tax statement, claims, etc.

We finally get to the good stuff: the declaration of our stock market investments :)

Let’s take the following example of a stock market portfolio:

- Shares in Novartis held directly (not through an online broker) (i.e., acting as the - fake - company where I work, and in which I have some shares)

- Our good old equity ETFs

- My “value investing” stocks (Daubasses portfolio)

I’m not including bonds for two reasons:

- The forms are almost identical to those for stocks, so that will help us limit the number of screenshots

- At the time of writing, I’ve never bought bonds, as I consider the cash in my 2nd pillar (and Mrs. MP’s 2nd pillar) as bonds. And as we want to be as aggressive as possible in our wealth accumulation phase (i.e., when we’re working and receiving a salary), we’ve got too much money in our 2nd pillar compared to the stocks section of our portfolio

I’m also going to mention American withholding tax with its famous R-US 164 and DA-1 forms (recommendation: read my Swiss tax guide for ETF investors before going any further).

Stocks and ETFs

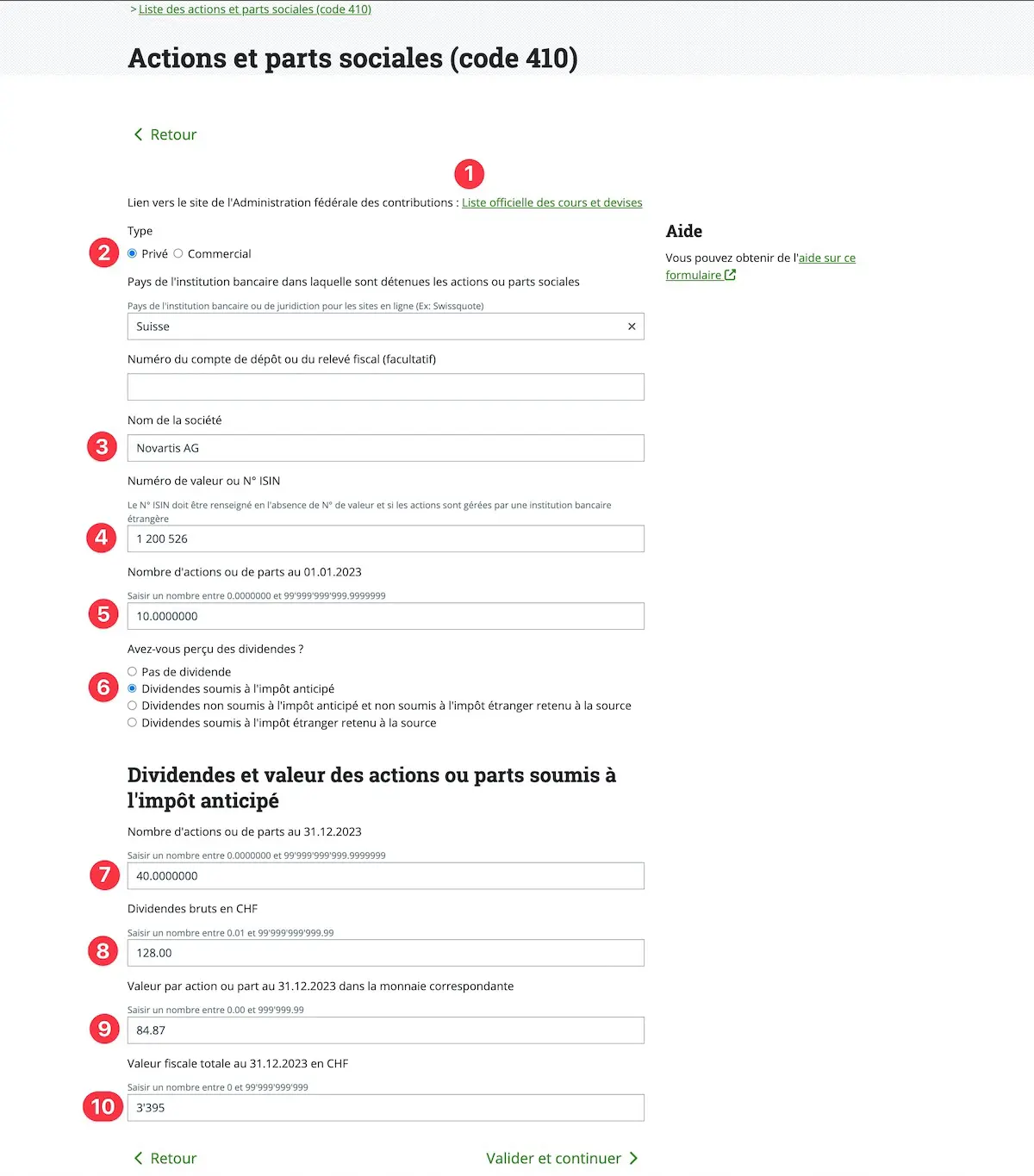

I therefore select the link “Stocks and shares” (“Actions et parts sociales”) to declare the stocks I own, from the company where I work (for the example, I’m saying that I work for Novartis).

Then, when you click on “Add a stock, a share” (“Ajouter une action, une part sociale”), you’ll come to this screen:

I hold shares in the Swiss company where I work. I'm adding them here, acting as if I work for Novartis

The numbers on the screenshot refer to:

- Link to the AFC website where you can find all the information about the stocks (cf. the “AFC-stock” screenshot below), as well as historical exchange rates

- If it is a privately held share or an operating one that you manage yourself

- Company name (see point 1 in the “AFC-stock” screenshot below)

- Security number (see point 3 in the “AFC-stock” screenshot below)

- Number of shares that you held on the first day of last year

- Is your share subject to withholding tax or not (see points 6 and 7 in the “AFC-stock” screenshot below to know how to find this information)

- Number of shares of this company that you held at the end of last year (for them to calculate if you bought or sold any during the year)

- Amount of all gross dividends (i.e., before withholding tax) that you received for this share during the last year (use the figure from point 6 or 7 of the “AFC-stock” screenshot below)

- Tax value per share at the end of last year (you can get this amount by referring to the point 5 of the “AFC-stock” screenshot below)

- To calculate the total tax value at the end of last year, you just need to multiply field 9 (84.87) by the value in the field 7 (40)

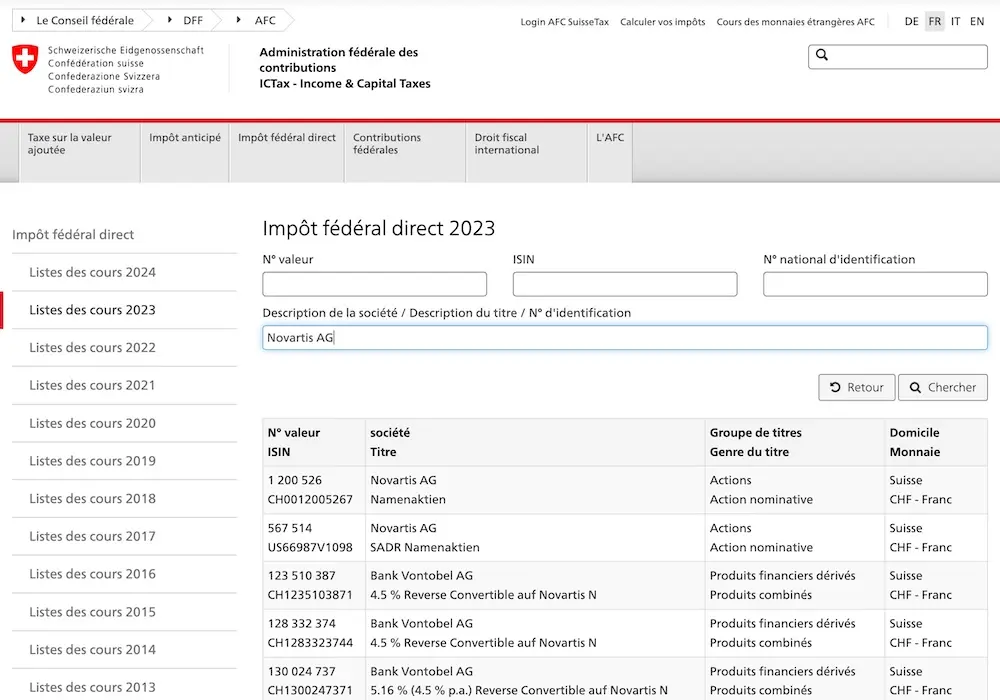

The AFC website is a gold mine of information provided by Switzerland: search for your share and select it in the list to then proceed to the next screenshot

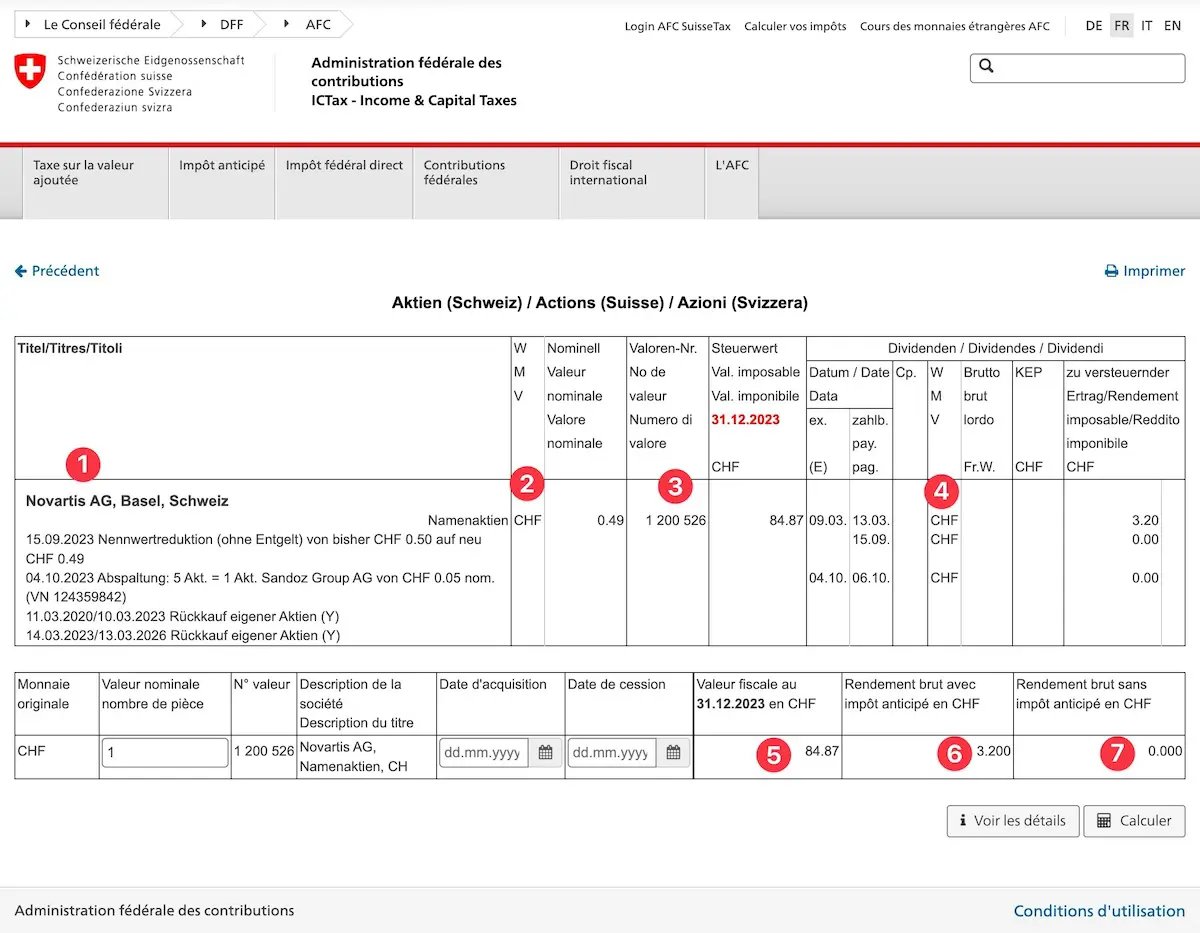

See the paragraph below this image to understand each number (I refer to this image as 'AFC-stock' screenshot)

The numbers on the screenshot above correspond to:

- Official name of the company that issued the share

- Currency of the share

- Security number (i.e., identification or taxpayer number)

- Currency of the dividends

- Tax value of one share at the end of the previous year

- Gross return with withholding tax in CHF (if 0, that means that there is no withholding tax on this asset)

- Gross return without withholding tax in CHF (if 0, that means that there is withholding tax on this asset — like on this screenshot)

And here is the result of inputting our Novartis shares and their dividends:

Bank tax statement

For me, this is the most considerable change since 2023.

I’ll explain.

In previous years, I used to enjoy inputting two things manually:

- My ETFs (VT and VWRL) with the initial number at the beginning of the year and the final number at the end of the year (just like for my Novartis shares above)

- And what took me the most time above all: all my Daubasses shares, when indicating the purchases and sales made during the year

Except that at my last tax inspection (that scares me more than anything else because at the end they asked me for additional evidence), the tax department recommended that I simplify my (and above all their!) life with all my ETFs and foreign shares:

For the next tax period, we request that you send us the bank tax statements of all your deposits and state in your declaration the number of assets and returns from the summary page, which will avoid you having to report the many lines of individual securities separately.

Hallelujah!

Therefore, as all my ETFs and Daubasses stocks are managed through my preferred online broker Interactive Brokers, I just needed to download my account statement for last year and proceed as follows:

In the image above, you can see my net assets (1) with Interactive Brokers. I’m then going to transfer this information across to VaudTax.

After making a PDF of the Interactive Brokers statement screenshot, I opened the “Dividends” section to prove to the tax office the total amount of the dividends in CHF that I received during last year (circle “1”):

Then the latest PDF is sent to the tax department along with the total amount of tax deductions in CHF by Interactive Brokers (circle “1”):

With this information, I now go to the “Bank tax statement” section (“Relevé fiscal bancaire”):

I click on “Add a bank tax statement” (“Ajouter un relevé fiscal bancaire”) and fill in the info as follows:

As you can see, I don’t hold any Swiss stocks directly (only in ETFs), so I don’t put anything in the section “Income and value of the bank tax statement subject to withholding tax” (“Revenus et valeur du relevé fiscal bancaire soumis à l’impôt anticipé”).

Likewise, I put nothing in “Income and value of the bank tax statement not subject to withholding tax and not subject to foreign tax deducted at source” (“Revenus et valeur du relevé fiscal bancaire non soumis à l’impôt anticipé et non soumis à l’impôt étranger retenu à la source”), as all my securities are subject to foreign withholding tax.

So it’s the last section that is important for me, with the data coming from my Interactive Brokers bank tax statement:

This links to my “Swiss tax guide for investors”, in particular chapter 4 - part 2:

- By filling in the section “Income and value of the bank tax statement subject to foreign tax deductions at source” (“Revenu et valeur du relevé fiscal bancaire soumis à l’impôt étranger retenu à la source”), it will automatically generate me a form called DA-1, which can be used to get all your foreign taxes deducted at source reimbursed

- I haven’t checked the box “Income and value of the bank tax statement subject to additional USA withholding” (“Revenu et valeur du relevé fiscal bancaire soumis à la retenue supplémentaire USA”), as I use Interactive Brokers which is a foreign broker (i.e., non Swiss) with the status of “qualified intermediary” (DEGIRO also has the same status, for info). That means that IBKR or DEGIRO will complete Form W8-BEN for you so that you’re only taxed at source on your US share dividends at a rate of 15% (instead of 30%). If this was not the case (if, for example, I used Saxo Bank), then I would have checked the box in VaudTax

So, needless to say, the message from the Vaud tax office was very welcome in 2023! Because instead of filling out the same form for my ETFs and Daubasses stocks, I don’t know how many times, I’ve only filled it in once:

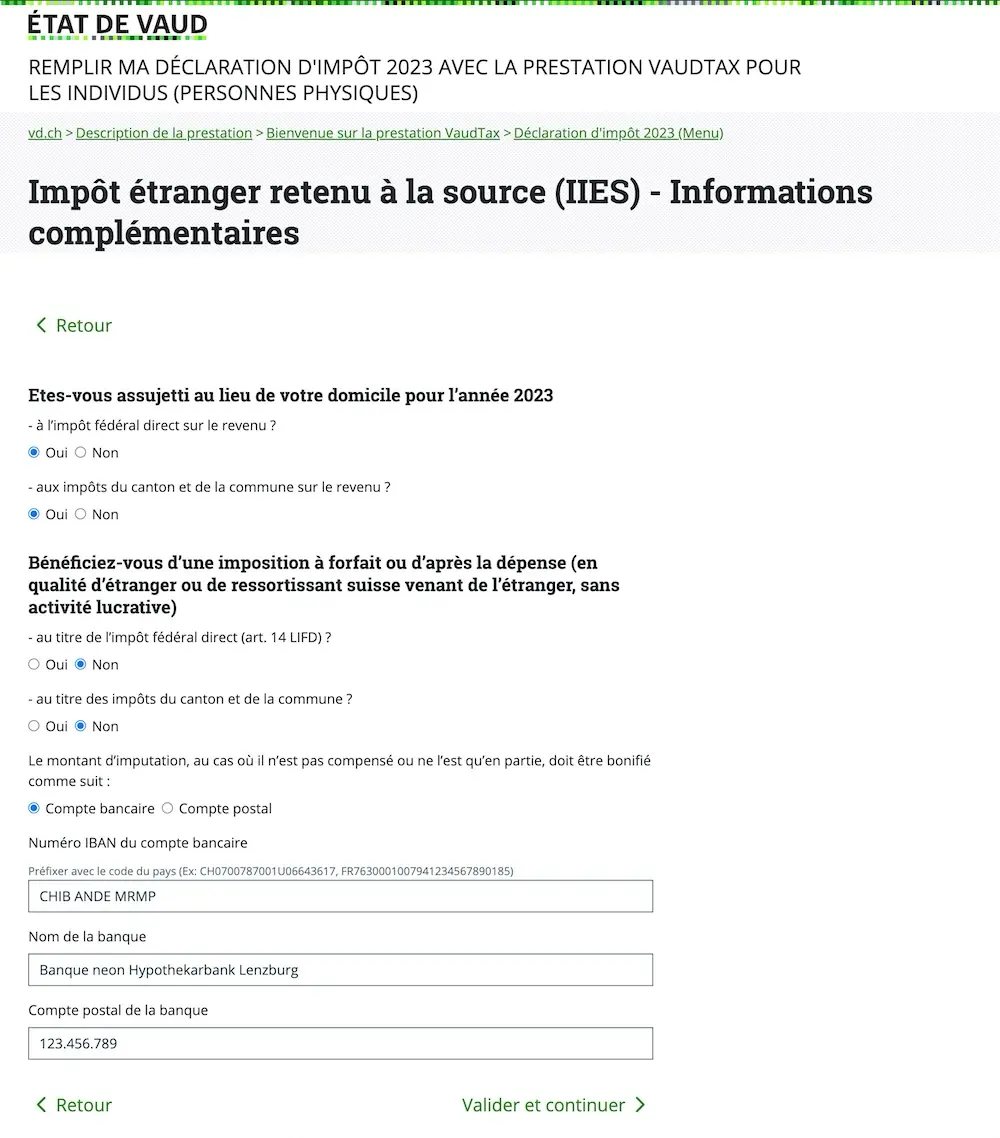

Foreign tax deducted at source (IIES) - Additional information

This part is the last stage to complete regarding our stock market investments:

Please reimburse my Swiss francs that I’m owed, dear tax department:

Yes, I do pay tax in Switzerland, and no, I'm not so rich that I'm eligible for lump-sum taxation...give me my money back! :)

Step 4: Status of assets - Administration costs

Since we’re talking about getting money back, you’ll know that your administration costs for securities are tax deductible :)

As a Mustachian, I’ve obviously chosen the most efficient and cheapest broker.

This means that I pay almost nothing in securities administration fees.

BUT, the cantonal tax administration automatically awards us a flat-rate deduction on the final tax bill for this line, which we’ll willingly accept, as it’s more advantageous than declaring these fees as actual costs:

Step 5: Status of assets - Summary

You can see a recap of the status of assets in the section summarizing this:

No questions? OK, let’s move to the next stage of filling out our tax declaration in Switzerland :)

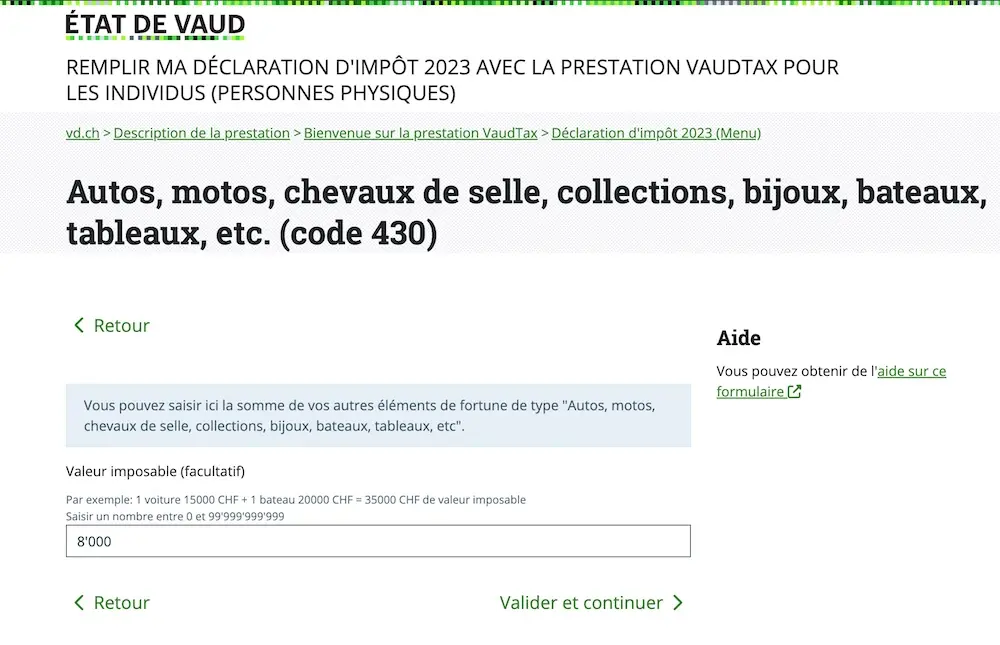

Step 6: Other assets and income

I was adding my good old reliable Toyota Prius in this section until about two years ago.

But since then, I’ve stopped, as its market value is “worth nothing”.

If you want to add your vehicle, which has a market value, here is what the screen looks like:

One car max, and obviously no boat, hey (at the very least, rent one if you need one, as long as it's YOUR passion)!

Next step

You see, this shows that doing your tax declaration in Switzerland when you’re a stock market investor is really not that complicated!

In the next article, we’ll tackle the following sections:

- Buildings, land and forests (as both a tenant AND owner)

- Interest and debts

- Special income deductions

- Additional information

- Payments on account

As ever, if I’ve missed any potential tax savings or tax deductions in the screenshots above (or if you have any other questions), please let me know in the comments section below!